Introduction

SME Lending and Credit Access Statistics: In many countries, SMEs (businesses with fewer than 250 employees) are regarded as the backbone of the economy. They constitute the largest number of companies and play a significant role in employment and trade. Across the world, MSMEs account for more than 90% of businesses. They account for approximately 60-70% of employment and produce nearly half of the total GDP. Besides, many SMEs still cannot obtain the credit they need.

The World Bank estimated a financing shortfall of approximately USD 5.7 trillion across 119 emerging economies, and the gap may reach nearly USD 8 trillion when informal firms are included. All the above analyses also show that many small firms see finance as a major barrier.

Editor’s Choice

- According to gdslink.com, in 2025, 42% of SME brokers expect higher demand for loans exceeding £100,000 (approximately USD 134,649).

- The share of small firms using external funding declined from 50% in Q3 2023 to 43% in Q2 2024 and remained at 43% in Q3.

- As of 2025, around 68% of SMEs worldwide reported having access to formal credit.

- SBA 7(a) loans typically range from 11.5% to 15% (variable) and 13.5% to 16.5% (fixed).

- A World Bank report found that across 119 EMDEs, MSMEs faced a financing shortfall of approximately USD 5.7 trillion.

- Biz2X reported that SMEs account for approximately 90% of all businesses and provide approximately 50% of global employment.

- Many SMEs are denied funding due to cash-flow constraints, with 40% rejected for low sales and weak cash flow.

- In Q2 2025, only 23% of European firms applied for bank loans, 18% of SMEs, and 31% of large companies.

- A recent EY report found that India’s MSME sector faces a significant credit gap of USD 530 billion.

General SME Lending And Credit Access Statistics

- According to coinlaw.io, in 2025, around 68% of SMEs worldwide reported having access to formal credit.

- SME loan approvals averaged 71% globally, whereas in developed markets they were approximately 79%.

- Loans were disbursed more quickly, taking approximately 2.6 business days.

- In North America and Asia, Digital lenders accounted for 36% of SME loans.

- Women-owned SMEs had approval rates 12% higher, supported by inclusive lending programs.

- In the US, community banks accounted for 38% of SME credit, down from 41% the previous year.

- More than 50% of mid-sized financial institutions employ AI-based credit scoring.

- Peer-to-peer platforms issued more than USD 28 billion in SME credit.

- SME default rates fell to 4.7%. In 18 countries, expanded guarantee schemes supported over $95 billion in SME loans.

SMEs Move Into Growth

- According to gdslink.com, in 2025, 42% of SME brokers expect higher demand for loans exceeding £100,000 (approximately USD 134,649).

- In Q1 2025, these large loans were the most requested type by 36% of brokers.

- Concern about the downturn is declining, with 46% reporting concerned clients, down 5 points from last quarter.

- Borrowers primarily seek to expand or relocate premises (26%) or purchase stock and equipment (13%).

Loan Applications And Approvals Statistics

(Source: nitrocdn.com)

- 59% of small employer firms applied for funding through online lenders, the SBA, merchant cash advance (MCA) providers, and banks.

- Most applications were for a business loan, a line of credit, or an MCA, while credit cards and trade credit were the next common options.

- Among applicants, 43% sought a line of credit, 36% sought a loan, and 20% sought SBA financing.

- Full approvals were 73% for auto/equipment loans, 54% for mortgage/real estate loans, and 46% for lines of credit.

- Full approval rates were highest at small banks (52%), credit unions (51%), and finance companies (51%).

Recent Trends In SME Finance

- A report published by british-business-bank.co.uk stated that the share of small firms using external funding declined from 50% in Q3 2023 to 43% in Q2 2024 and remained at 43% in Q3.

- Even so, the total value of funding flows stayed steady in nominal terms.

- As of 2024, gross bank lending reached £62 billion (USD 83.7 billion), up 4.5% from the previous year.

- Challenger banks accounted for 60% of all bank lending.

- Equity funding volumes in 2024 were similar to those in 2019 to 2020.

- Deal values rose 7% across the first three quarters (helped by a strong Q2), but activity fell sharply in Q3.

- The number of equity deals also dropped 24% year-on-year.

Small Businesses Statistics By High Lending Costs And Lower-Cost

- Many small businesses avoid borrowing because fees and interest rates are too high.

- According to canopyservicing.com, SBA 7(a) loans typically range from 11.5% to 15% (variable) and 13.5% to 16.5% (fixed).

- Whereas traditional bank loans are approximately 6.25% to 9%.

- Business lines of credit typically range from 3% to 39.90%.

- Business lines of credit accounted for 3% to 60.90%, while online loans secured 3% to 60.90%.

- Merchant cash advances are priced at a factor rate of 1.1% to 1.5%.

- Invoice factoring typically employs a factor rate of 1% to 6%.

SME Finance Gap Analyses

- A World Bank report found that across 119 EMDEs, MSMEs faced a financing shortfall of approximately USD 5.7 trillion, equivalent to about 19% of GDP and 20% of private-sector credit.

- Moreover, 40% of formal MSMEs could not obtain sufficient credit (19% fully, 21% partly).

- Women-owned MSMEs accounted for USD 1.9 trillion of this gap, or 34%.

- Informal businesses account for USD 2.1 trillion in unmet funding needs, representing nearly 8% of GDP in developing economies.

- From 2015 to 2019, the gap grew by more than 6% per year, even as credit supply rose by 7%.

Difficulties In Credit Accessing Statistics

- Biz2X reported that SMEs account for approximately 90% of all businesses and provide approximately 50% of global employment.

- 53% of small business owners said today’s interest rates made loans unaffordable for them.

- Almost 88% of respondents also felt lower rates would help their businesses.

- Over the past year, 35% applied for a new loan or a line of credit.

- Nevertheless, 80% reported that they still struggled to obtain affordable capital.

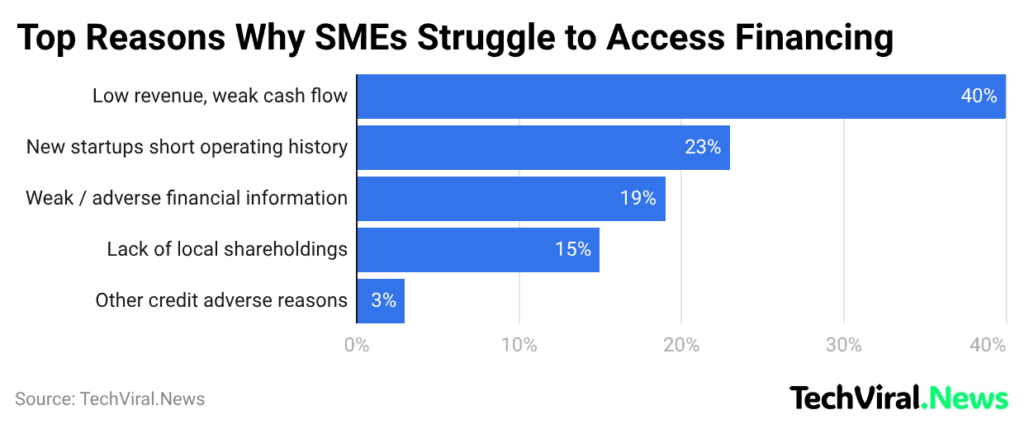

Reasons SMEs Don’t Get Loans Statistics

(Reference: coinlaw.io)

- Many SMEs are denied funding due to cash-flow constraints, with 40% rejected for low sales and weak cash flow.

- Approximately 19% fail due to poor or negative financial information.

- Only 15% struggled as they lack local shareholders, raising concerns about ownership.

- The remaining 3% are declined for other credit issues.

Small Firms’ Credit Usage Statistics In The U.S.

- The Fed’s 2024 report further showed that small businesses most often relied on credit cards (58%), followed by loans (50%) and lines of credit (34%).

- Meanwhile, smaller shares used trade credit (14%), leasing (13%), merchant cash advances (6%), and factoring (2%), while 12% used no outside finances to take loans.

- Firms primarily worked with large banks (45%), small banks (35%), credit unions (9%), non-bank finance companies (7%), or none (3%).

- 59% applied for financing; loan/line/MCA applications were most often sent to large banks (39%), small banks (29%), and online lenders (24%).

In Europe and the UK

- A report presented by ECB SAFE in Q2 2025 stated that 23% of European firms applied for bank loans, 18% of SMEs, and 31% of large companies.

- About 3% did not apply because they felt discouraged, and 5% reported barriers in getting a loan.

- The primary reason for not applying was that 49% reported having sufficient internal funds.

- In the UK, 45% of small businesses used external finance, primarily credit cards (15%), overdrafts (11%), and leasing/hire purchase/vehicle finance (10%).

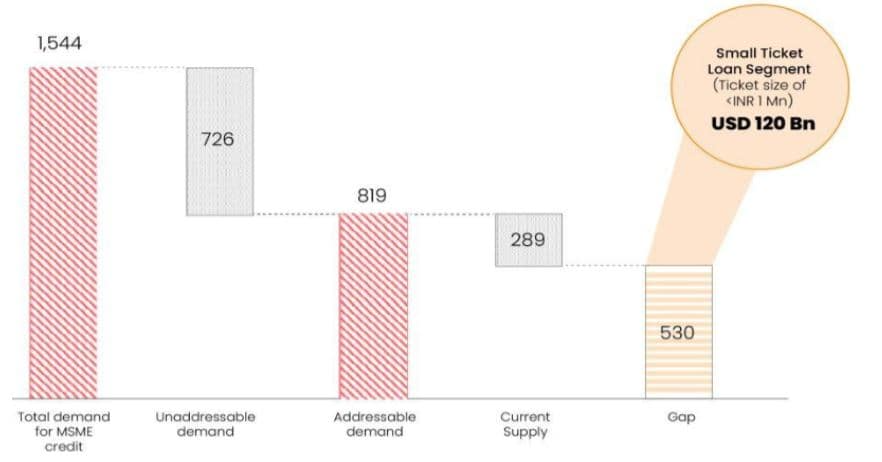

MSME Credit Situation In India

(Source: credable.in.com)

- A recent EY report found that India’s MSME sector faces a significant credit gap of USD 530 billion.

- Of the approximately 64 million MSMEs, only 14% currently have access to formal credit.

- Total financing demand in the MSME market is approximately USD 1,955 billion, with a 3.8x debt-to-equity ratio, and debt financing demand is estimated at USD 1,544 billion.

- Nearly 47% of this debt demand was seen as unaddressable.

- That leaves about USD 819 billion as addressable debt demand. Still, only USD 289 billion is currently met by formal lenders (such as private banks), leaving an unmet USD 530 billion opportunity for players like FinTechs and NBFCs.

Conclusion

SME loans support fair economic growth. When credit is available on time and at a reasonable cost, small businesses can buy inventory, pay staff, expand operations, and boost sales. Still, many SMEs struggle because they lack records, collateral, and stable income, and loan checks can be costly.

Their focus should not be on increasing loan volume, but on providing suitable loans that align with a business’s cash flow and actual needs. With digital tools, lenders can assess risk more quickly and with greater reliability. When rules are clear and lending is responsible, more SMEs can access credit, thereby narrowing the financing gap.

FAQ

SMEs borrow to buy stock, pay expenses, purchase equipment, expand, and handle late customer payments.

Credit access refers to the ease with which a small business obtains loans, as determined by eligibility, required documentation, costs, processing time, and the likelihood of approval.

Many SMEs struggle to secure loans because their records are weak, creditworthiness is limited, collateral is scarce, income is volatile, and perceived risk is high.

Usually, lenders request business registration, PAN, GST filings, bank statements, ITRs/financial reports, owner KYC, and invoices or purchase orders.

Maintain accurate bank records, file GST/taxes on time, maintain proper accounts, repay outstanding loans, and build a good credit score.

Working capital loans, term loans, overdraft/cash credit, invoice financing, equipment loans, and business credit lines.