Introduction

Savings Account Ownership and Usage Statistics: Savings accounts have played a key role in helping billions of people to manage their finances and participate in the formal banking system. Also provides a secure place to store money while earning interest; they help individuals and families build emergency savings and prepare for short-term financial needs. Ownership and use depend on income stability, financial literacy, trust in banks, and the availability of banking services.

This article on Savings Account Ownership and Usage Statistics presents several statistical analyses from different studies that elaborate on how the use of these bank accounts across age groups, occupations, and locations may be shaped by mobile banking, minimum balance requirements, and withdrawal limits.

Editor’s Choice

- According to Coinlaw, approximately 76% of global adults had a bank or mobile money account in 2025.

- Globally, 79% of people now have a savings account, with around 75% in low- and middle-income countries.

- Across the world, around 97% of high-income individuals have bank accounts.

- In the U.S., 99% of high-income households have accounts, compared with 74% of low-income households.

- Savings account interest rates reached their highest level of 0.72% in the fourth quarter of 2024.

- According to the WalletHub Savings Interest Index, community banks offer about 0.20%, small banks 0.57%, regional banks 0.38%, and national banks 0.49%.

- Average savings interest rates vary by category, ranging from 0.75% for personal branch, followed by 3.27% (personal online), 1.01% (business branch), and 1.33% (student branch).

- As of February 2025, the average savings account balance in the United States was USD 14,323.20.

- Savings accounts are held by 72% of consumers and are mainly used to set aside money for future needs.

- In developing economies, account ownership is projected to reach approximately 66% by 2025.

- In the 2025 direct banking study using a 1,000-point satisfaction index, Charles Schwab Bank ranked first with 748, followed by American Express at 737 and Marcus by Goldman Sachs at 735.

- Savings accounts are the most common U.S. financial products, with 48% of people owning or using them.

Savings Account Ownership Statistics

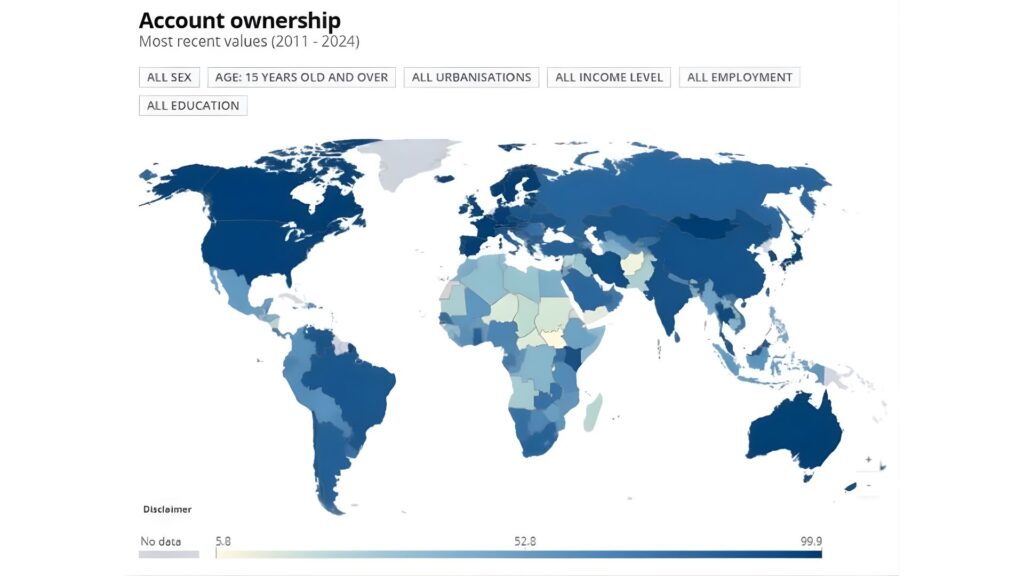

- According to Coinlaw, approximately 76% of global adults had a bank or mobile money account in 2025.

- Digital expansion and steady progress lifted account ownership to 85% in East Asia-Pacific.

- Followed by South Asia (74%), Europe and Central Asia (92%), Sub-Saharan Africa (58%), Latin America (77%), and the Middle East (57%).

- Meanwhile, high-income countries exceed 95%, and low-income countries are at 49%.

- The highest rates are in Norway (99%), South Korea (98%), and Canada (97%).

(Source: findevgateway.org)

- Globally, 79% of people now have a savings account, with around 75% in low- and middle-income countries.

- Approximately 1.3 billion adults remain unbanked, of whom 50% live in eight countries.

- Women’s ownership reached 77%, with a 4% gender gap.

- The savings account also increased by 40% in accounts and by 15% elsewhere, for a total of 55%.

By Income level

- Across the world, around 97% of high-income individuals have bank accounts.

- Account ownership among middle-income adults increased to 81%, while only 47% of low-income adults are banked.

- In the U.S., 99% of high-income households have accounts, compared with 74% of low-income households.

- Urban low-income ownership is 51%, higher than the rural rate of 43%.

- In Sub-Saharan Africa, people in the poorest 40% use mobile money the most.

- Due to increased government transfers, women’s ownership of savings accounts has also increased by 7% over two years.

- In India, direct benefit programs raised usage by 12% among the lowest earners.

- Although digital KYC improves access, about 40% of unbanked adults still belong to the poorest group.

Savings Account Interest Rate Statistics

(Source: wallethub.com)

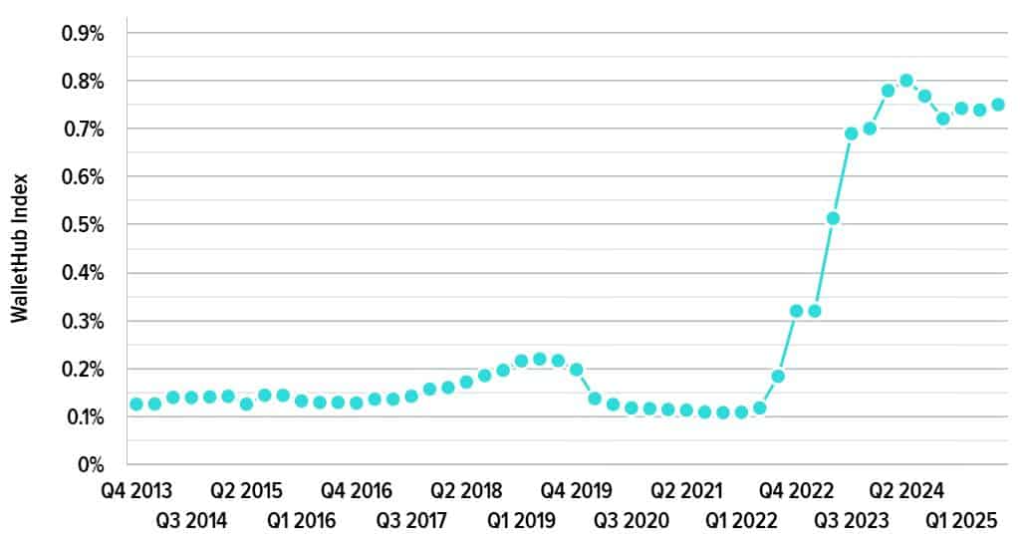

- Savings account interest rates reached their highest level of 0.72% in the fourth quarter of 2024.

- Meanwhile, in 2025, the quarterly interest rates of savings accounts are followed by Q1 (0.74%), Q2 (0.74%), and Q3 (0.75%).

By Category

(Reference: wallethub.com)

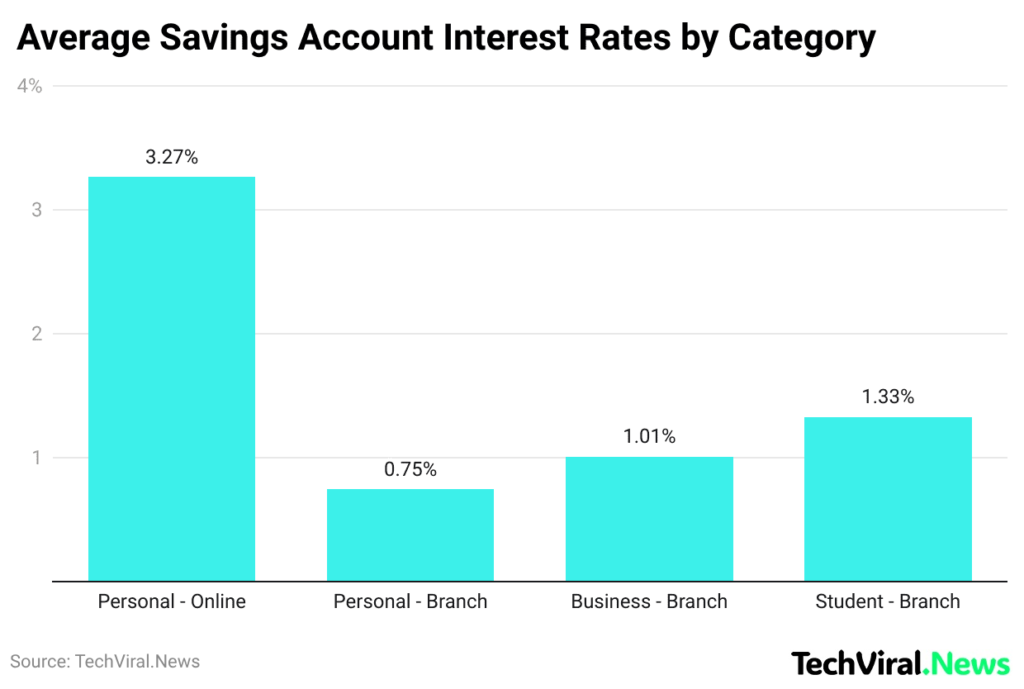

- Average savings interest rates vary by category, ranging from 0.75% for personal branch, followed by 3.27% (personal online), 1.01% (business branch), and 1.33% (student branch).

| Balance Amount (USD) | Personal-Online | Student-Branch | Business-Branch | Personal-Branch |

| 50,000 | 3.57% | 0.70% | 1.41% | 3.57% |

| 25,000 | 3.57% | 0.69% | 1.32% | 3.57% |

| 10,000 | 3.34% | 0.98% | 1.11% | 3.34% |

| 3,000 | 3.24% | 1.18% | 0.96% | 3.24% |

| 1,000 | 3.18% | 2.15% | 0.93% | 3.18% |

By Institution Type

- According to the WalletHub Savings Interest Index, community banks offer about 0.20%, small banks 0.57%, regional banks 0.38%, and national banks 0.49%.

- Meanwhile, credit unions have the highest average rate at 1.24%.

| Balance Amount (USD) | Credit Union | Small | National | Regional | Community |

| 50,000 | 1.32% | 0.87% | 0.88% | 0.71% | 0.23% |

| 25,000 | 1.27% | 0.71% | 0.90% | 0.66% | 0.24% |

| 10,000 | 1.26% | 0.63% | 0.54% | 0.44% | 0.22% |

| 3,000 | 1.23% | 0.56% | 0.43% | 0.34% | 0.20% |

| 1,000 | 1.21% | 0.50% | 0.43% | 0.33% | 0.19% |

By Regional Analyses

| Balance Amount (USD) | Southeast | West | Midwest | Northeast | Southeast |

| 50,000 | 1.24% | 1.03% | 0.96% | 0.77% | 0.76% |

| 25,000 | 1.16% | 1% | 0.93% | 0.60% | 0.67% |

| 10,000 | 1.06% | 0.99% | 0.71% | 0.60% | 0.58% |

| 3,000 | 0.80% | 0.82% | 0.68% | 0.57% | 0.58% |

| 1,000 | 0.98% | 0.66% | 0.73% | 0.55% | 0.51% |

United States Savings Accounts Statistics

(Source: upgradedpoints.com)

- As of February 2025, the average savings account balance in the United States was USD 14,323.20.

Furthermore, other countries’ saving account balances are stated in the table below:

| Category | State | Average Savings Account Balance (USD) |

| Highest Balances | New Jersey | 33,448.26 |

| Idaho | 26,376.97 | |

| Hawaii | 25,349.74 | |

| Lowest Balances | North Carolina | 2,943.33 |

| Alabama | 4,847.97 | |

| Colorado | 5,536.83 |

Types of Financial Accounts Owned Statistics By Consumers

- According to Drive Research, consumers use various types of financial accounts to manage daily spending, saving, and long-term goals.

- Approximately 9 in 10 people have a checking account or debit card.

- Savings accounts are held by 72% of consumers and are mainly used to set aside money for future needs.

- Credit cards are used by 71% of people for purchases and credit building.

- Nearly 29% own insurance products through financial institutions, and around 25% have retirement accounts or IRAs.

- Mortgages are reported by 24%, and investment or brokerage accounts are used by 23% of consumers.

- Auto loans and certificates of deposit are each held by 18%.

- Personal loans account for 13%, while 12% use money market accounts.

- Cryptocurrency ownership stands at 11%, including assets like Bitcoin.

- Health savings accounts are held by 10%. Student loans affect 7% of people, and 6% use home equity loans or HELOCs.

- College savings or 529 plans are the least common, owned by only 4%.

Savings Account Ownership and Usage Statistics by Developed vs. Developing Economies

- As of 2024, high-income nations had very strong bank access, with over 95% of adults holding bank accounts.

- In developing economies, account ownership is projected to reach approximately 66% by 2025.

| Country | Account Ownership Share | Key Drivers |

| China | 92% | Alipay and WeBank are supporting access in semi-urban areas. |

| Brazil | 82% | Digital public banks and government welfare programs. |

| Kenya | 84% | Widespread use of M-Pesa mobile money services. |

- Still, rural areas trail cities by roughly 15% to 20%.

- Limited internet access, fewer bank branches, and weak infrastructure impede progress in fragile states.

- Support from international aid and World Bank programs has funded financial access projects in more than 35 countries.

Savings Account Customer Satisfaction

(Reference: coinlaw.io)

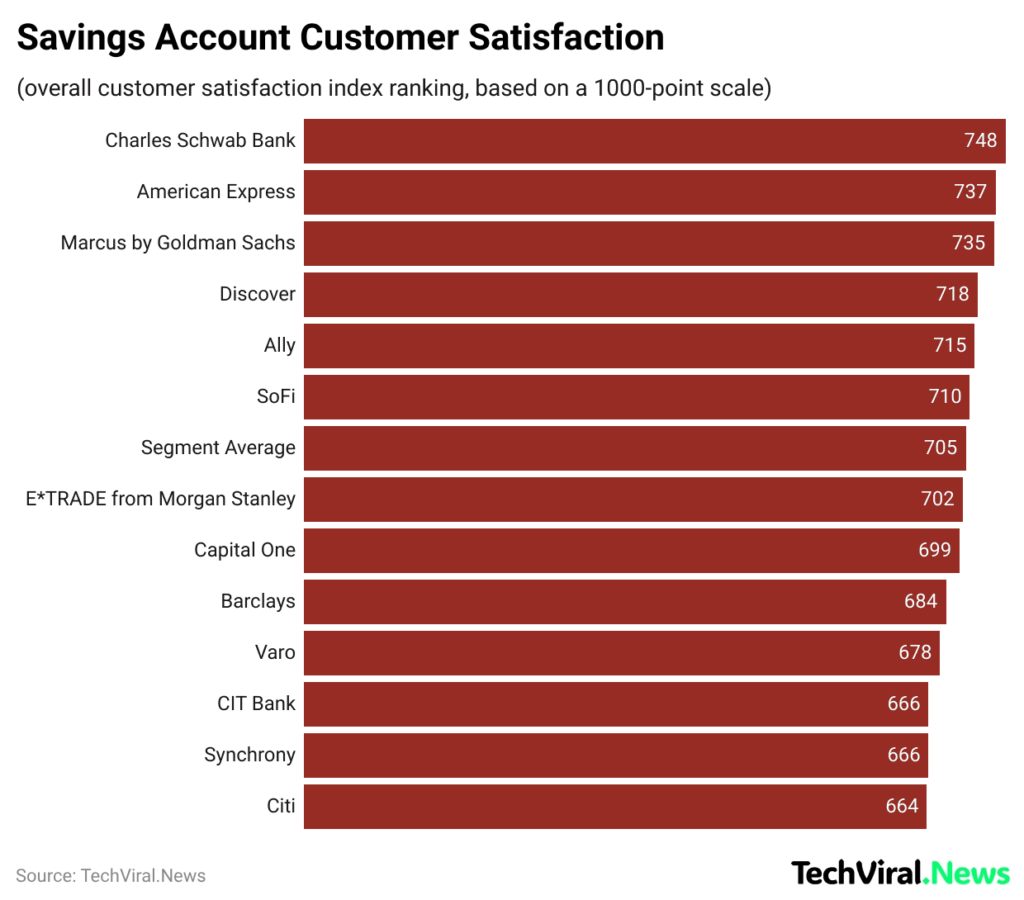

- In the 2025 direct banking study using a 1,000-point satisfaction index, Charles Schwab Bank ranked first with 748, followed by American Express at 737 and Marcus by Goldman Sachs at 735.

- In the study, Discover scored 718, followed by Ally (715), SoFi (710), the segment average (705), E*TRADE from Morgan Stanley (702), Capital One (699), Barclays (684), Varo (678), CIT Bank (666), Synchrony (666), and Citi (664).

Digital Bank Account Adoption Statistics

- By 2025, digital-only banks will make up 22% of newly opened accounts worldwide.

- In the United States, neobanks such as Chime, Varo, and SoFi increased their user base by 37%.

- Europe has more than 100 million active digital-only accounts.

- In Latin America, Brazil’s Nubank passed 90 million customers.

- In the Philippines, Tonik Bank recorded a 150% increase in deposits from last year.

- Blockchain identity tools were being tested in Kenya and Estonia, while global trust is projected to reach approximately 68% by 2025.

Americans’ Trust in Savings Accounts

(Source: statista.com)

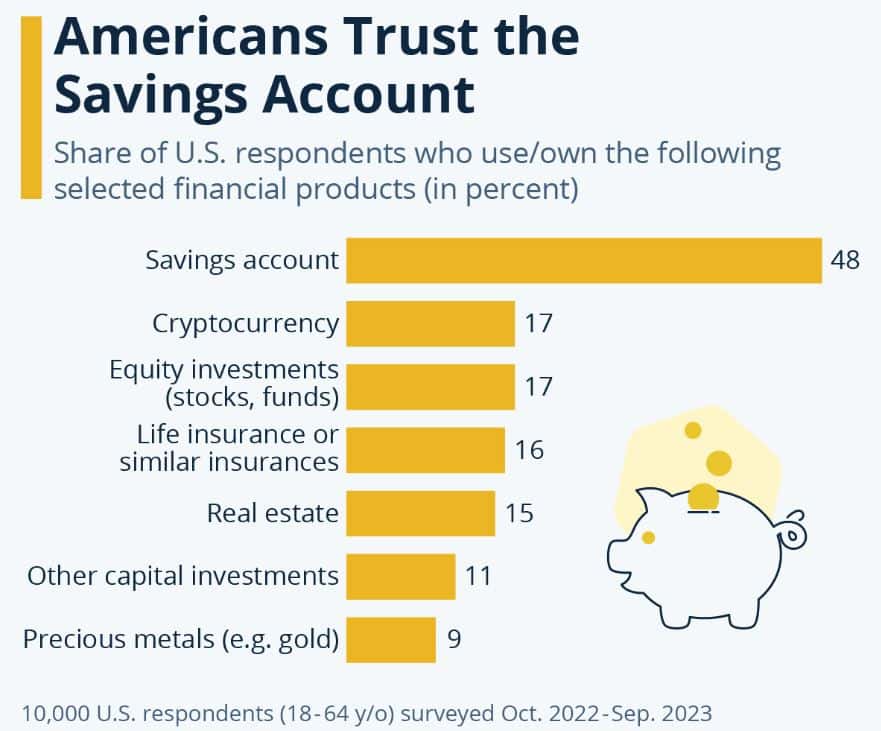

- Savings accounts are the most common U.S. financial products, with 48% of people owning or using them.

- In comparison, only 17% reported using cryptocurrency, and the same 17% reported investing in equities such as stocks or mutual funds.

- Life insurance or similar insurance products were used by 16% of respondents, while 15% owned real estate.

- Other capital investments attracted 11% of users, whereas precious metals such as gold were the least common, with only 9% participation.

Conclusion

Savings account ownership and use indicate the extent to which individuals and families are included in the financial system and their preparedness for the future. A savings account allows people to keep their money safe, earn some interest, and handle emergencies or short-term needs.

This article examines account ownership in relation to the frequency of account creation, income stability, access to banking services, basic financial literacy, and trust in financial institutions. The account usage also varies by age, occupation, and location; minimum digital payments and withdrawal limits influence everyday money habits and household stability.

FAQ

Savings accounts are commonly held by individuals or families seeking a safe place to keep their money and earn a small amount of interest.

People use savings accounts to keep their money secure, earn some interest, and set aside funds for future needs.

The way people use savings accounts depends on many factors, such as interest rates, steady income, inflation, financial literacy, access to banking services, trust in the system, rules, the need for quick cash, personal goals, and spending habits.

Younger workers often save less because they earn less, whereas older, more experienced workers typically save regularly and maintain higher savings balances.

Savings account usage reflects a person’s financial stability, planning behaviour, income level, risk tolerance, and confidence in the future.