Introduction

Mobile Banking Statistics: Mobile banking has become the main way people handle their money today. Using banking apps or mobile websites, users can make quick payments, send and receive money, check their account balance, and get personalised alerts from anywhere at any time. This makes banking easier for customers and smoother for banks.

This article will examine several key segments with effective understanding, drawing on diverse insights, including growth rates, usage patterns, the age groups and regions that adopt it most, the features, and the factors that influence their choices regarding safety and trust. Overall, the data shows more than just rising popularity; it explains why banks and fintech companies are focusing on faster, simpler, and 24/7 banking experiences.

Editor’s Choice

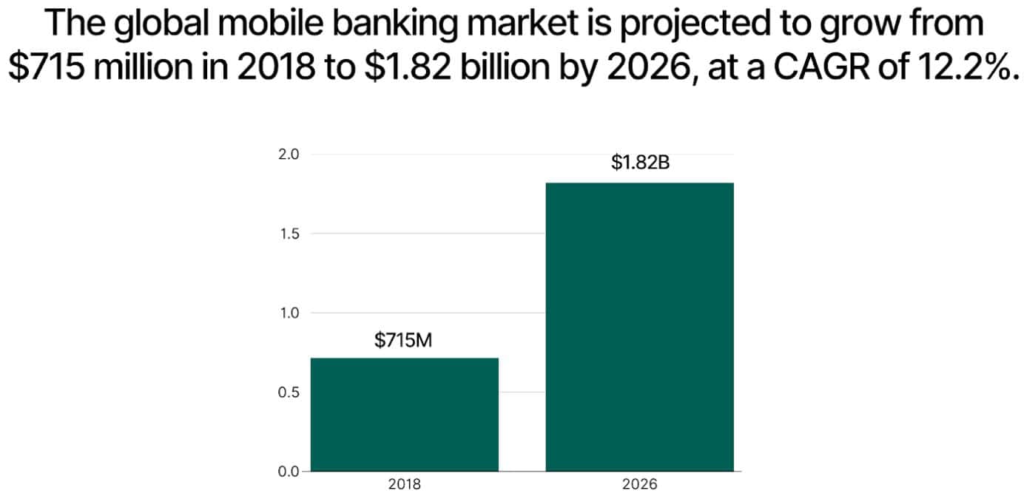

- In 2018, the global mobile banking market was valued at USD 715.3 million and is projected to reach USD 1,824.7 million by 2026, growing at an average annual rate of 12.2% from 2019 to 2026.

- 61% of the population in North America has adopted mobile banking.

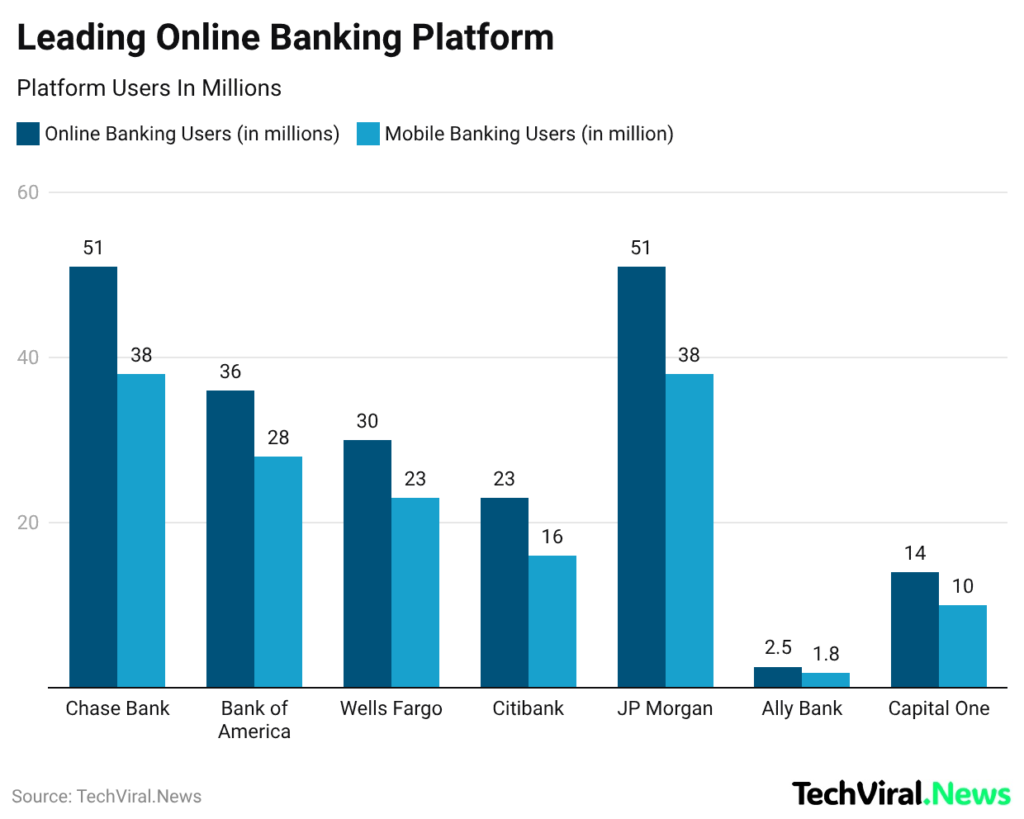

- Chase Bank is a leading online banking platform, with 51 million online users and 38 million mobile users.

- As of 2025, SQ Magazine reported that global banking had reached 2.17 billion mobile users.

- During the same period, approximately 68% of millennials rely primarily on mobile apps for banking.

- A report published by coinlaw.io stated that mobile banking use is strongest among younger people, with 74.1% of those aged 15-24.

- The highest use is among people identifying as two or more races (52.3%) and Native American or Alaska Native users (50.6%).

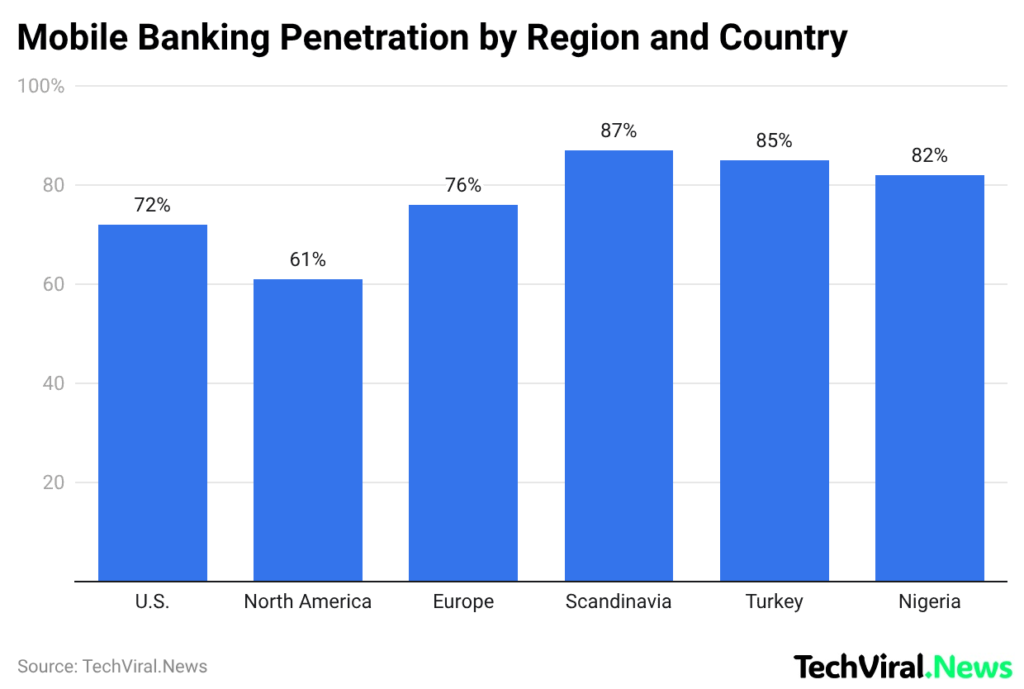

- Mobile banking penetration was approximately 72% in the United States, 61% in North America, and 76% in Europe.

- Global mobile payments transaction volume reached USD 13 trillion in 2025.

Key Takeaway

(Source: website-files.com)

- In 2018, the global mobile banking market was valued at USD 715.3 million and is projected to reach USD 1,824.7 million by 2026, growing at an average annual rate of 12.2% from 2019 to 2026.

- The ABSRBD report further states that approximately 2.17 billion people worldwide used mobile banking in 2025.

- 61% of the population in North America has adopted mobile banking.

- The Asia-Pacific region recorded the highest mobile banking revenue, at approximately USD 740 billion.

- Juniper Research predicted that by 2026, almost 53% of the global population will use digital banking, totalling nearly 4.2 billion users.

- Market Research Future also expects the mobile banking app market to grow from USD 26.28 billion in 2025 to USD 76.8 billion by 2035, at an average annual growth rate of 11.32% during 2025-2035.

Leading Online Banking Platform Statistics

(Reference: sqmagazine.co.uk)

- Chase Bank has the biggest mobile audience with 38 million users, followed by Bank of America with 28 million and Wells Fargo with 23 million.

- Citibank has 16 million mobile users, Capital One has 10 million, and Ally Bank reaches about 1.8 million.

Market Trends

- In 2025, Market Mind Partners reported that more than 72% of banking customers worldwide used mobile apps regularly.

- The Asia-Pacific region leads the mobile banking market, with a 35% of the global share in 2025.

- Android remains the leading platform, with a 60% share in mobile banking.

- Users fall into two categories: individuals and businesses, with individuals accounting for approximately 75% of app users.

- Additionally, 80% or more of people globally had internet access, therebyboosting adoption.

Mobile Banking Users Statistics

- The SQ Magazine further reported that global mobile banking users reached 2.17 billion as of 2025.

- The adoption rate in the United States was 72%, and app downloads increased by 22% as demand for payments, budgeting, and investing tools grew.

- Around 89% of banks had launched mobile apps.

- Asia-Pacific transaction volumeincreased by 34% (e-commerce, QR codes, and real-time clearing).

- In June 2025, consumer banking apps passed 2 billion downloads, up 5.1% YoY, and they now top 500 million downloads each quarter.

- Leading mobile apps handled almost 80% routine bank requests fully in-app.

- 90% of banking mobile users checked balances, and 79% reviewed recent transactions.

- Adoption is highest among Millennials (97%) compared with 89% overall.

- On average, people use 30 apps/month, and 51% open apps 1-10 times daily.

By Demographics

- According to sqmagazine.co.uk, in 2025, around 68% of millennials rely primarily on mobile banking apps.

- In the U.S., mobile banking usage has risen to 80%, whereas only 30% of baby boomers use mobile banking as their primary channel.

- 72% of users of these apps are Gen Z (18-24), who experienced the fastest growth.

- Baby boomer adoption has doubled, moving from 15% in 2018 to 30% in 2025.

- People aged 15-24 use mobile banking 3.9 times as often as those aged 65 years and above.

- Mobile banking adoption remains higher among college graduates (54%) than among people without a high school diploma.

- 74% of mobile banking users earned between USD 15k and 30k.

- 58% of households identified as two or more races had the highest mobile banking usage, approximately 25% higher than that of White individuals.

Age Group Analyses

- A report published by coinlaw.io stated that mobile banking use is strongest among younger people, with 74.1% of those aged 15-24, 69.4% of 25-34, and 60.5% of 35-44 using it.

- It has been observed that mobile banking use declines with age, dropping to 49.1% for ages 45-54, 33.2% for 55-64, and 15.3% for 65+.

Gender Differences

- The highest use of mobile banking is among people identifying as two or more races (52.3%) and Native American or Alaska Native users (50.6%), followed by Hispanic users (49.6%) and Asian users (48.6%).

- Meanwhile, the usage remained lower among Black users (45.4%) and lowest among White users (41.1%).

By Geography

(Reference: sqmagazine.co.uk)

- The chart above shows that mobile banking penetration in 2025 was approximately 72% in the United States, 61% in North America, and 76% in Europe.

- Europe records 76% mobile banking usage, followed by Scandinavia (87%), Turkey (85%), and Nigeria (82%).

- Meanwhile, China had the largest mobile banking user base, with over 860 million users.

- In India, Nigeria, and Bangladesh, approximately 66% of the population has access to mobile banking.

- India’s UPI handles 20 billion transactions per month, worth USD 293 billion, and 640 million per day, slightly above Visa’s 639 million per day.

Mobile Banking Transaction Volume

- Global mobile payments transaction volume reached USD 13 trillion in 2025.

- QR-code payments are expected to grow from USD 5.4 trillion to over USD 8 trillion in 2025 (a 48% annual increase).

- Digital wallet transactions will reach USD 17 trillion by 2029.

- In e-commerce, mobile banking revenue reached USD 2.5 trillion in 2025, accounting for 63% or more of total retail e-commerce revenue.

- 70% of e-commerce mobile wallets volume comes from the Asia-Pacific region, and India is forecast to exceed USD 1.5 trillion by 2026.

Impact of Mobile Banking On Financial Inclusion

- Access to formal financial services has risen to 79% of adults in 2025, up from 51% in 2011.

- Approximately 900 million unbanked adults still own mobile phones, including 530 million with smartphones.

- In developing regions, more than 50% of women in Zimbabwe, the Ivory Coast, and Gabon can now use mobile money accounts.

- Following India’s pandemic response, 25 million new mobile financial accounts were opened, most of them held by women.

- Women entrepreneurs face a USD 300 billion yearly funding gap, and mobile banking can help close it.

- However, inclusion remains uneven 31% of unbanked adults do not even have a mobile phone.

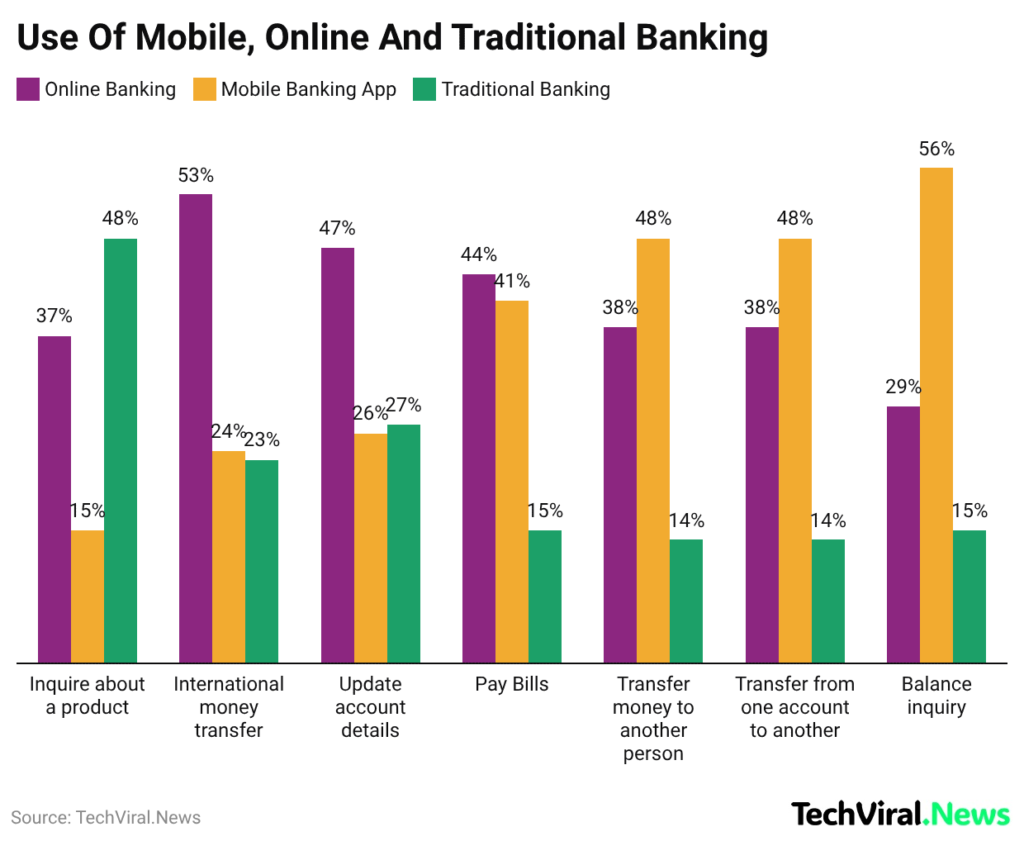

Usage Comparison Statistics of Mobile, Online, and Traditional Banking

(Reference: sqmagazine.co.uk)

| Banking activity | Mobile Banking App Share | Online Banking Share | Traditional Banking Share |

| Balance inquiry | 56% | 29% | 15% |

| Transfer from one account to another | 48% | 38% | 14% |

| Transfer money to another person | 48% | 38% | 14% |

| Pay Bills | 41% | 44% | 15% |

| Update account details | 26% | 47% | 27% |

| International money transfer | 24% | 53% | 23% |

| Inquire about a product | 15% | 37% | 48% |

Benefits of Using Mobile Banking In Companies And For Users

- Convenience enables users to bank at any time and from any location, while companies can operate with fewer or no physical branches.

- Time-saving features enable quick transactions and rapid access to information, thereby allowing firms to process customer requests more efficiently.

- Security improves through biometrics and real-time alerts, and stronger controls help businesses reduce fraud risk.

- Financial management tools like budgets and spending trackers help users, and analytics help companies make better decisions.

- Payments become easier with instant transfers and mobile payment links, and streamlining payment operations.

- Cost savings arise from fewer paper statements, lower user fees, and lower staffing and operating costs for firms.

- Personalisation provides tailored offers and AI-guided support, enabling targeted marketing and custom services.

- Engagement increases through improved app interaction, thereby improving satisfaction for both parties.

Recent Developments of Mobile Banking

- As of 2025, Bankrate reports that more than one-third of U.S. consumers experienced attempted financial fraud, and nearly 40% of those targeted lost money.

- 60% of banks report increased fraud, and nearly 70% of enterprise banks are most affected.

- In the U.S., smishing scams exposed up to 115 million payment cards in one year, with many used to break into digital wallets.

- Generative AI is also fueling deepfake fraud; one bank lost USD 25 million to a voice scam, and U.S. fraud losses may reach USD 40 billion by 2027.

Conclusion

After completing the article, it is important to note that Mobile banking is no longer merely an additional feature but has become a basic necessity for everyday financial transactions. In recent years, thousands of users have become accustomed to it and are seeking services that are quick, simple, and secure on any device.

Banks and fintech companies are now focusing on user-friendly apps, robust security systems, and 24/7 support. The overall statistical analysis across different insights will clarify all doubts about mobile banking, because when users feel protected and can bank at any time, trust grows, and that trust will determine who succeeds.

FAQ

Internet banking is accessed via a web browser on a laptop or desktop, whereas mobile banking is accessed via a smartphone, offering instant alerts and fingerprint/Face ID authentication.

Mobile banking is safe with encryption, OTPs, and biometrics; never share PINs/passwords or use public Wi-Fi.

You can transfer money, pay bills, recharge mobile plans, scan QR codes, view statements, open deposits, and set alerts for spending or low balance.

Most features require an internet connection; in some regions, basic banking is supported via SMS or USSD in offline mode.

Most apps are free, but some banks may charge for certain transfers or SMS alerts, and mobile data costs may apply.