Introduction

Mobile Banking App Engagement Statistics: In 2025, mobile banking is not just a thing of the future — it is a base for all financial transactions worldwide. With billions of smartphone users, mobile banking applications have become a means of communication between people and money. Users are not only involved in activities such as checking their balances, making instant payments, or using AI-assisted planning tools. Additionally, they are at the center of financial interaction. Statistics are proving to be a strong narrating factor of growth, opportunity, and changing user behavior.

This article examines mobile banking app engagement among customers and the current market trends.

Editor’s Choice

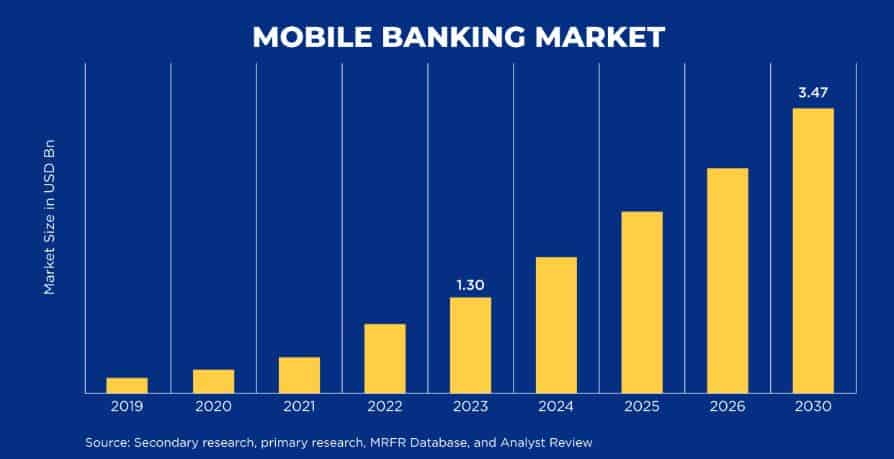

- Global mobile banking revenue is projected to increase from USD 1.3 billion in 2023 to USD 3.47 billion by 2030, reflecting a CAGR of 15.06%.

- The world’s leading banks, like Citibank, Bank of America, JPMorgan Chase, HSBC, and Ajman Bank, are leveraging mobile applications loaded with features to facilitate engagement, customer loyalty, and access to a large customer base.

- The process of creating a secure mobile banking application typically requires between US$200,000 and US$500,000, depending on complexity, feature set, and the extent to which regulatory requirements are adhered to.

- By 2025, two-thirds of the world’s population will be able to use mobile banking services, with the largest increase happening in developing countries such as India, Nigeria, and Bangladesh.

- Almost half of digital banking transactions worldwide (49%) are conducted via mobile payments, indicating a clear trend toward mobile-first access to financial services.

- Mobile banking usage in North America reached 61%, and penetration was aided by 5G deployment, AI capabilities, and the integration of finance into non-bank platforms.

- 72% of Gen Z consider mobile applications as their primary banking channel.

Mobile Banking Market

(Source: openxcell.com)

- The mobile banking market is projected to experience a significant and rapid expansion in the near future.

- Market Research Future predicts that mobile banking revenue will more than double, increasing from USD 1.3 billion in 2023 to USD 3.47 billion by 2030.

- This growth represents a remarkable compound annual growth rate of 15.06%, indicating that adoption is accelerating while remaining sustained.

- The mobile banking market is expanding due to factors such as the widespread use of smartphones, customer preference for digital financial services, improved mobile apps, and banks’ heavy investment in secure, user-friendly, and attractive platforms.

Best Mobile Banking Applications

Citibank

- Citibank is a financial services provider that prioritises consumer needs and operates globally with its headquarters in New York City, USA.

- Citibank’s mobile banking app is primarily designed for personal clients and provides broad access to the bank’s services.

- Users of the app can access their accounts, send and receive money, settle bills, and keep track of their spending in real-time.

- The bank prides itself on offering convenience, personalization, and security, thus displaying its mobile platform as a strong case of how even the large banks could engage customers through digital channels close to them.

Bank of America

- Bank of America is the second largest bank in the U.S. after JPMorgan Chase, and together they account for 16% of the U.S. banks’ total deposits.

- This is why the bank has developed an app that enables customers to perform all necessary banking activities, such as checking balances, transferring money, viewing transaction history, and managing cards, so that customers can complete these tasks on their mobile phones.

- Thus, it can be said that an easy-to-use interface combined with extensive features is the factor behind the large customer base.

JPMorgan Chase

- JPMorgan Chase & Co., the largest bank in the U.S. and the fourth-largest in the world, has been a close competitor to other major banks, including Citigroup and Wells Fargo.

- The company provides its mobile app to customers as a primary channel for customer engagement and service.

- The application is highly capable of covering the entire customer life cycle and handling transactions for hundreds of millions of customers, including management, payments, investments, and credit monitoring.

- The example of JPMorgan Chase shows that the large-volume and various user banks need to have only the best and the powerful mobile banking solution.

HSBC Bank

- HSBC Bank is a major financial services group based in the UK, with activities spanning banking, investment, and insurance across multiple geographic regions.

- The bank’s app allows customers to securely manage their personal accounts on their phones, with transfers, payments, and account monitoring among the supported services.

- In addition to consumer banking, HSBC offers a special corporate banking app designed for business users.

- The company’s emphasis on the digital needs of both corporate and retail customers is communicated through its dual-app strategy.

Ajman Bank

- Ajman Bank is a prominent Islamic financial institution established in 2009, with its main office in Ajman, UAE.

- It is listed on the Dubai Financial Market and has been recognized for its mobile banking app, which is one of the best-performing apps in the market.

- One of the most important features of Ajman Bank’s app is the reward-planning system, designed to increase cardholder engagement and loyalty.

- By offering users rewards and benefits, the bank not only increased user activity but also strengthened customer relationships that endure over time.

- Thus, Ajman Bank can rightfully take the credit for being the pioneer of innovation-powered mobile banking.

Mobile Banking App Development Cost

- When planning a mobile banking application, cost is by far the most important factor to consider.

- In addition to the developer’s significant investment in developing a secure, scalable, and user-friendly banking app, the requirements for the app include regulatory compliance, data security, backend integration, and ongoing maintenance.

- Mobile banking app overall development cost usually varies, depending on the app’s scope, technology stack, and degree of customization, between US$200,000 and US$500,000, according to Clutch.

- Organizations that are going to set up a mobile banking solution must consider the different cost tiers to help them in budgeting and scheduling realistically.

- A very basic app with only the most important functions as logging in, checking account balance, viewing transaction history, and making simple transfers of money.

- The entire development process costs approximately US$20,000 to US$50,000 and takes approximately 3 to 5 months. Such apps can be seen along with the MVPs or smaller banks that are just starting their digital journey.

- An application that is rich in features and has a medium-to-high complexity level will include functions such as bill payments, customer support via chat, notifications within the app, and layered security.

- The cost of developing such applications typically ranges from US$50,000 to US$120,000, and the development timeline can range from 5 to 7 months.

- These applications are primarily used by growing banks and, in particular, by fintech companies targeting a larger user base.

- Cutting-edge mobile banking applications integrate modern technologies through features such as biometric authentication, AI-powered financial insights, 3rd-party API integration, multilingual support, and advanced analytics.

- The budget for such applications can range from US$120,000 to US$300,000, depending on the programming duration of more than 7 months.

- Large banks and global financial institutions are the ones that typically invest at this level to provide the best available digital experience.

Worldwide Mobile Banking Usage Data

- In 2025, mobile banking i.,e. The use of mobile phones for financial activities has been the leading channel, with two-thirds of the world population already having mobile banking services.

- In North America, the usage of mobile banking reached 61% in 2025 compared to 58% in 2023.

- The advancement of 5G connectivity, the inclusion of AI-powered features such as smart budgeting and fraud alerts, and the adoption of embedded finance, where consumers receive banking services directly within non-bank platforms such as e-commerce and ride-hailing apps, are the main factors that contributed to the growth.

- A global trend is evident: customers are increasingly turning away from traditional banking and favouring mobile applications for their banking transactions.

- Recently, it was reported that mobile payments account for 49% of global digital banking transactions, indicating that users now consider smartphones the most convenient and preferred channel for daily transactions, transfers, and account management.

- So far, the main factors that help this mobile banking trend move forward are convenience, quickness, and real-time access to customers’ accounts.

- Latin America presents a markedly different picture in banking, with mobile banking users increasing by 46% between 2021 and 2025.

- Brazil, Mexico, and Colombia are credited with this regional boom, as their consumers are rapidly adopting digital wallets and instant payment systems, which have also led to reduced cash use and reliance on traditional banking infrastructure.

- The Middle East and Africa (MEA) region was among the regions that embraced the global banking trend most rapidly, with an astonishing 74% annual increase from 2023 to 2025.

- Financial inclusion, collaboration between banks and technology companies, and increased smartphone adoption have contributed to the situation in which millions of people who previously could not use bank services can now access digital financial services with ease.

- In Germany, the UK, and France, more than 69% of the population uses mobile banking to make payments, save money, or take out loans.

- The reason for this is that people place considerable trust in digital infrastructures, which are also protected by stringent regulations that have made it difficult for individuals to lose their money due to the bankruptcy of banks or other financial institutions.

- By 2025, Southeast Asia is projected to experience a 56% increase in mobile banking usage.

- The mobile online banking scenario is nothing but a super app, a digital-only bank, and QR-based payments in daily life.

Mobile Banking Acceptance Transcends Age Groups

- Mobile banking adoption varies across age groups, with younger individuals more likely to be leaders.

- Only 30% of baby boomers in the USA report using mobile banking for financial management, whereas millennials lead at 80%.

- It shows that users who are highly digitally comfortable prefer app-based financial tools.

- After years, Gen Z is becoming the largest user segment. Active users of mobile banking apps account for approximately 72% of 24-year-olds. Their use of smartphones, P2P payments, and digital wallets has driven their usage.

- When people in this age group start working, they will greatly influence the design and user experience of banking products.

- The older user segment is adopting it more slowly, but their adoption rate is steadily increasing.

- Mobile banking usage among baby boomers has increased from 15% in 2018 to 30%, indicating that the older generation is increasingly trusting online services and that banking apps are becoming more user-friendly and secure.

- Trends based on gender also have noticeable changes. In many parts of the world, female customers outnumber male customers in mobile banking usage.

- 55% of Asian women and 45% of African women use it actively.

- In this case, the use of thele banking provides significant support for women’s empowerment, as it improves their financial access and increases their independence, particularly in developing countries.

- Nowadays, 60% of the world’s urban populations use mobile banking, with major cities in China and India experiencing some of the fastest growth. The combination of high smartphone penetration, digital ecosystems, and dense urban living is the most significant factor.

- In the US, 40% of mobile banking users are aged 25-34 years; thus, older millennials make the largest group that is actively using these services.

- Their financial needs continue to prompt banks to develop mobile platforms; they want their needs met for payments, savings, investments, and loans.

How Users Prefer To Bank – Online, Mobile Apps, Or Traditional?

(Reference: coinlaw.io)

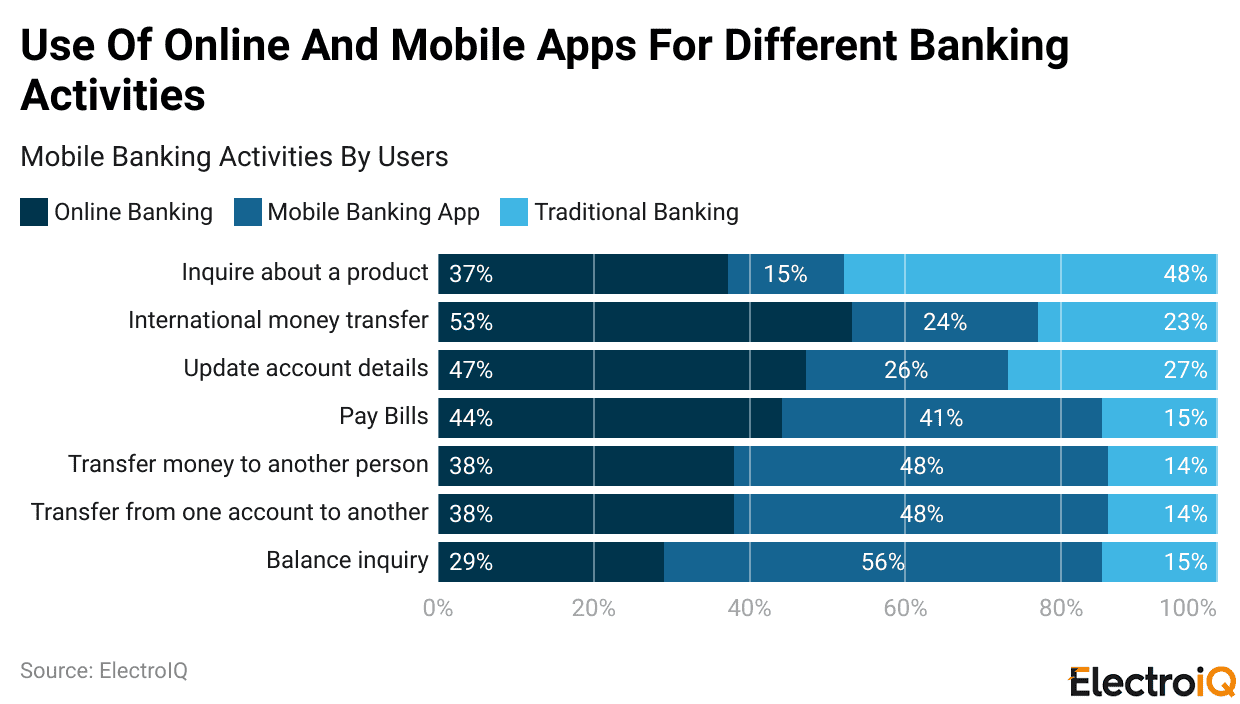

- Online banking is still the most popular medium for international money transfers, with 53% of users opting for it for cross-border transactions.

- The preference is due to a larger-screen interface, greater visibility into transactions, and a sense of control when transferring high-value or complex assets.

- Online platforms are also widely used to update account details (47%) and pay bills (44%), during which users must review or change multiple fields at once.

- Mobile banking apps handle routine, quick-access activities. Balance inquiries are mainly done through mobile apps (56%), showing the need for instant and on-the-go access.

- Also, money transfers to others and account-to-account transfers are another factor where mobile apps are preferred by 48% of users, signalling tech platforms’ strength in speed, simplicity, and real-time notifications.

- Despite the digital transformation, traditional banking is still relevant, especially for more consultative interactions.

- Most product-related questions are still asked through traditional banking channels (48%), indicating that customers still prefer face-to-face conversations to gain clarity on loans, investments, or new financial products.

- When it comes to bill payments, customer choices are almost equal between online banking (44%) and mobile applications (41%).

- This ratio suggests that while many consumers enjoy the convenience of mobile payment, others are still loyal to the control and visibility that line portals provide.

- The decision is often dependent on the customer’s habits, complexity, and billing frequency.

- Online banking is the most popular option, chosen by 47%, whereas mobile apps and traditional banking have significant shares of 26% and 27%, respectively.

- This indicates that digital channels are gaining significant trust among users; nevertheless, a considerable portion still prefer the security of a branch visit or the convenience of a mobile app when making changes to their personal data.

- Most surprising is that 23% of customers prefer traditional banking for global transfers, even when digital use is very high.

- This situation reveals much about the security, compliance, and error fixing during international money transfers, which are still the major concerns.

Technology Innovations In Mobile Banking

- The mobile banking of 2025 is largely shaped by rapid technological developments that have transformed how customers access financial services and how banks operate behind the scenes.

- AI is at the heart of digital banking and has been implemented by 68% of banks globally for chatbot development, automated customer support, and smart financial planning tools.

- With these capabilities, the banks’ response times improve, costs are reduced, and the customers receive personalized insights that would otherwise be available via an advisor.

- Voice banking has been recognized as a major interface an,d its adoption has reached 43% in 2025, where generations Z and Millennials are huge users of it.

- Blockchain is another technologically advanced method that is increasingly widely adopted, with 28% of mobile banking platforms incorporating it.

- Banks are mostly using blockchain for secure customer authentication, automatic contract enforcement, and fraud reduction; thus, they minimize the use of traditional systems while boosting trust and transparency.

- 5G technology deployment has also contributed a lot to the mobile banking being performed at a very high level, since the transaction speed is 46% faster in 2025, as well as the overall user experience.

- The universal adoption of cloud technology is almost complete, with 78% of the banks and other financial institutions already using the cloud-based banking infrastructure.

Security Challenges And Fraud Detection In Mobile Banking

- Rapid technological development has not eliminated security concerns, as they remain major concerns for users and financial institutions.

- In 2025, more than half of the US mobile banking consumers (53%) still pointed out security as an important mobile banking issue, thus emphasizing the still-existing technological advancement and user confidence gap.

- On the other hand, mobile banking fraud has increased in number, with the global occurrence of such crimes escalating by a whopping 28% by 2025.

- The fraudulent activities have become so complex that they are increasingly difficult to detect, as cybercriminals increasingly exploit real-time payment systems and employ advanced methods such as deepfakes and AI-assisted social engineering.

- Banks have responded by detecting the fraud and implementing robust measures to address it.

- Biometric authentication has been responsible for reducing mobile banking fraud by 31%, and more than 80% of users worldwide already authenticate in their banking apps using fingerprint or facial recognition.

- These authentication methods provide stronger security and greater convenience than traditional passwords.

- The development of multi-factor authentication (MFA) has made it a must-have defense, with 85% of the world’s mobile banking applications now utilizing it.

Conclusion

Mobile Banking App Engagement Statistics: By the year 2025, mobile banking will become a prominent factor in the world’s financial system that will greatly change the ways of money transactions of both people and organizations. To a great extent that the mobile-first banking experience is huge, the strong growth of the market, the regional uptake of mobile banking, and the high-level engagement of the young customers are the main indicators of a trend.

The mobile banking applications can no longer be treated as auxiliary tools but rather as indispensable platforms. They offer a blend of convenience, innovation, and trust. Thus, they can satisfy the ever-evolving needs of people living in a digitally connected world.