Introduction

Embedded Finance in Banking Statistics: Think of reserving a plane ticket, getting household necessities delivered to your door, getting a prescription filled, and getting a loan or an insurance policy all through a single app without even going to the bank. Simply sound financial services right at the place where they are required, no redirects, no separate banking portals – just easy and fast. This amazing technology, called embedded finance, makes it possible, which refers to blending financial services into e-commerce, marketplaces, retail, delivery, and even gig-worker platforms that had been considered non-financial ones.

In 2025, the scenario where banks have to bear huge costs due to less adoption of digitally-savvy customers will no longer exist. This article will present the important and trending Embedded Finance in Banking statistics.

Editor’s Choice

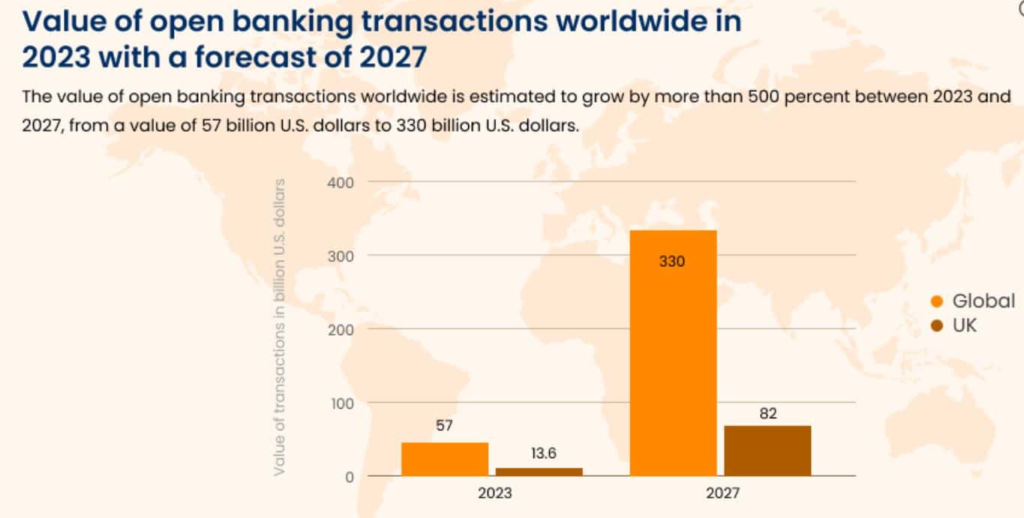

- The value of open banking transactions is expected to skyrocket from USD 57 billion in 2023 to USD 330 billion by 2027, providing a very promising 500%+ growth rate for the global market and mainly based on APIs, favourable regulations, and consumer trust.

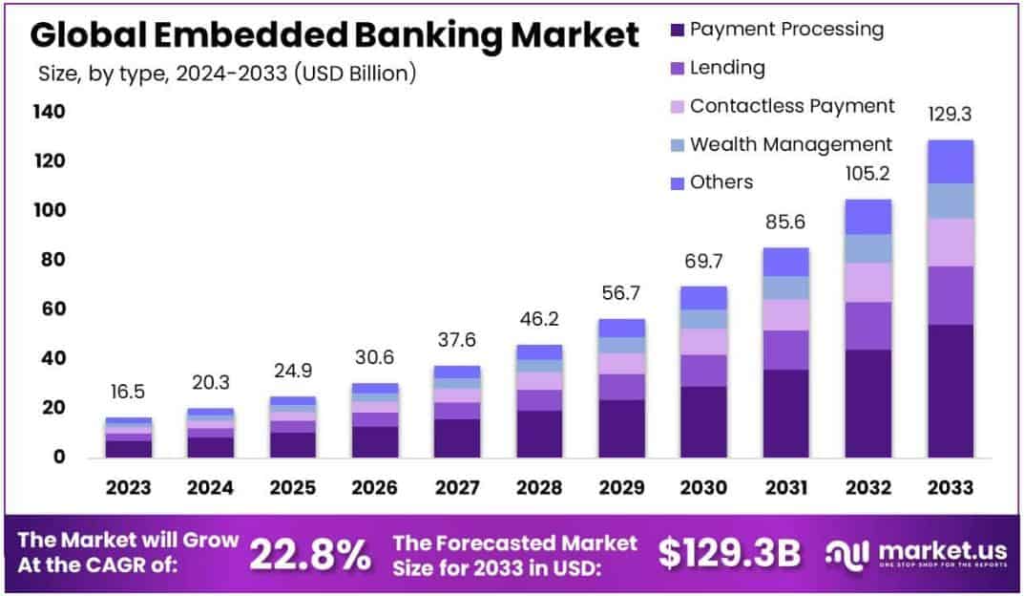

- The global embedded banking market is projected to grow from a market value of USD 16.51 billion in 2023 to USD 129.3 billion in 2033, which translates into a very strong CAGR of 22.85%.

- North America is the biggest player in the embedded banking market with about 37% revenue share in 2023, which equals USD 6.1 billion income, owing to the mature fintech ecosystems and the excellent digital infrastructure.

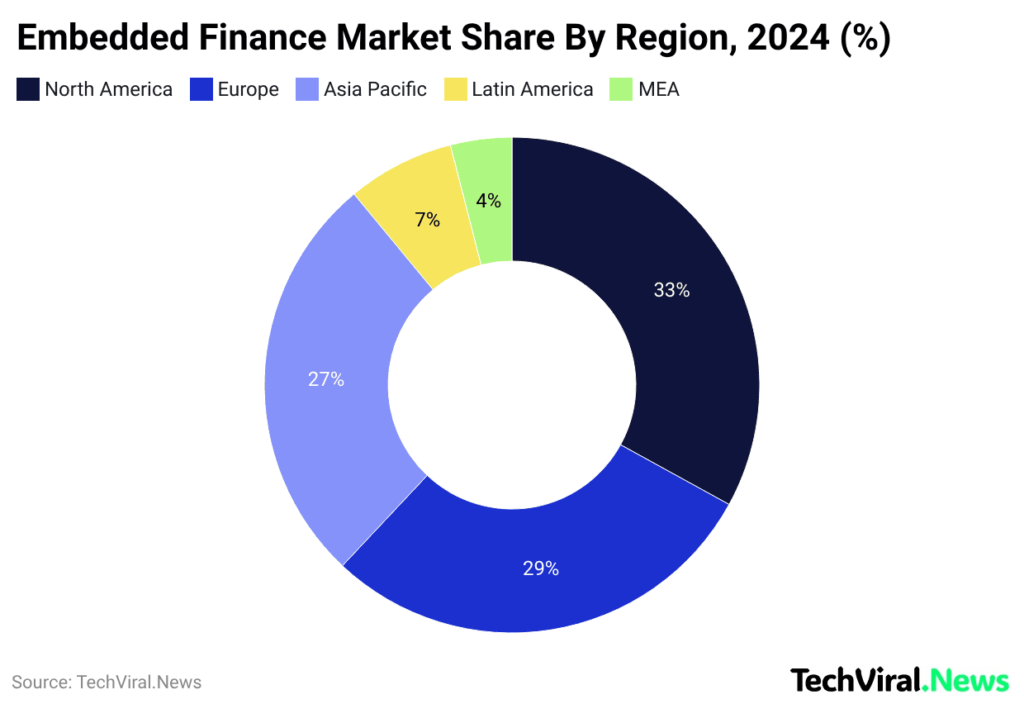

- By the end of 2024, North America (33%) was the leader in the embedded finance market share, followed by Europe (29%) and Asia Pacific (27%), thus reflecting a global but geographically diverse market.

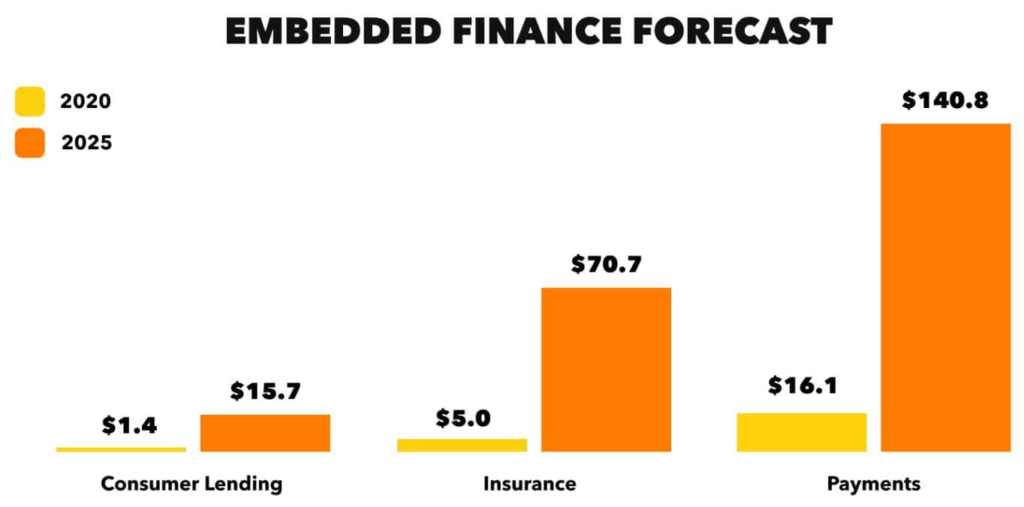

- Embedded payments dominate the sector, growing from USD 16.1 billion in 2020 to USD 140.8 billion by 2025, making payments the largest embedded finance use case.

- Embedded insurance is rapidly increasing; it is predicted to rise from USD 5.0 billion in 2020 to USD 70.7 billion in 2025 due to the checkout and on-demand insurance models.

- Regulatory uncertainty still poses a great challenge, especially for 48% of financial services firms that mentioned it as their biggest hindrance to blockchain adoption in the case of embedded finance.

Value of Open Banking Transactions Worldwide

(Source: credible.in)

- The global transition to open banking is illustrated through the sharp increase in the number of transactions.

- In 2023, the total worldwide value of open banking transactions was around USD 57 billion, with the UK contributing about USD 13.6 billion to that amount.

- The prediction indicates a tremendous growth in the market by 2027, when the worldwide transaction value is expected to be USD 330 billion, and the UK alone is anticipated to be approximately USD 82 billion.

- Thus, the growth globally would be more than 500% over a period of four years, which already indicates the speedy acceptance of open banking.

- The increase can be attributed to stronger regulatory backing, more banks adopting APIs, rising consumer confidence, and customers using third-party financial apps of third parties for payments, sharing data, and managing finances.

- Overall, the visual underlines that the transformation of open banking from being a mere concept to becoming a key ecosystem of the global digital finance sector is taking place.

Global Embedded Banking Market

(Source: market.us)

- The globally embedded banking market will experience a rapid expansion during the coming decade. Back in the year 2023, it was worth around USD 16.51 billion, and the forecast is that this amount will go up to nearly USD 129.3 billion by the year 2033.

- The market growth, which is amplified by the adoption of embedded banking win solutions across industries, is estimated by a compound annual growth rate of 22.85% for the years 2024 to 2033.

- It can be concluded that the steepest rise in the acceptance of embedded banking methods, i.e., through non-financial firms such as e-commerce, fintech, and SaaS providers, is encouraged by banking’s main selling point, which is consumer convenience and service areas revamping through the bringing of the banks and customers closer.

- North America was the major player in the market in 2023, with over 37% of the total market share and revenues amounting to USD 6.1 billion, owing to infrastructure, the high standard of living, and a friendly regulatory environment.

Embedded Finance Market By Region

(Reference: precedenceresearch.com)

- The worldwide distribution of the embedded finance market in 2024 depicts the division of the market share among the major regions of the globe.

- North America occupies the top position with a share of 33%, which is indicative of its robust fintech ecosystem, high digital adoption, and extensive financial services incorporated into non-banking platforms.

- Europe stands next with 29% of the market stemming from regulatory support, open banking initiatives, and strong consumer uptake.

- Asia Pacific’s share is 27%, reflecting the rapid development brought by the large population, the mobile-first economy, and the growth of digital payment infrastructure.

- Latin America accounts for 7% of the market, signifying the increasing but still emergent use of embedded finance solutions.

- The Middle East and Africa have a meagre share of 4%, marking their initial development stage but also their long-term potential, given the digital financial inclusion trend.

Embedded Finance Technology

(Source: media.dashdevs.com)

- The chart of embedded finance evolution through major financial services from 2020 to 2025 very well indicates the extent to which financial products are being incorporated into non-financial platforms.

- At the same time, Consumer lending is an area that shows a steady increase, moving up from a rather low USD 1.4 billion in 2020 to USD 15.7 billion in 2025, a figure that not only mirrors the growing acceptance of buy-now-pay-later services but also reflects the instant credit available in e-commerce and digital platforms.

- Insurance, on the other hand, is an area with even stronger growth; it would be the case of the latter, USD 5.0 billion going to USD 70.7 billion during the same period, all thanks to the role of embedded insurance like checkout protection, travel coverage, or on-demand policies actively selling each day.

- The most powerful blast of growth is noticeable in payments, going up from USD 16.1 billion in 2020 all the way to USD 140.8 billion by 2025.

- Payments being the major force in embedded finance is not surprising considering the ubiquity of the digital transactions, mobile wallets, and the smooth in-app payment experiences that come with it.

The Challenges of Embedded Finance

- The uptake of blockchain technology in embedded finance and other parts of the financial sector is steady; however, it encounters several difficulties that are both structural and operational, and these are the reasons for the delay in the technology’s full-scale adoption.

- One of those barriers, which is indeed the largest, is the uncertainty surrounding the regulations.

- The lack of regulations that are clear and consistent regulations around blockchain technology and cryptocurrencies makes financial institutions reluctant to get involved.

- As per PwC, 48% of firms in the financial services sector see regulatory uncertainty as the biggest impediment to blockchain adoption.

- This problem becomes particularly pronounced in countries like China, where tight controls and vague regulatory frameworks restrict the use of blockchain in finance, an area where stability, compliance, and trust are paramount.

- Privacy and security-related issues are among the most important factors that slow down the adoption.

- Banks and other financial institutions store very sensitive information about their customers and transactions, and that is why privacy preservation is a must.

- Research by the World Economic Forum showed that privacy is a major problem for 35% of the financial services managers in the blockchain solutions adoption process.

- Although the blockchain provides transparency and makes the data unchangeable, these same features may clash with the data protection requirements, unless privacy-preserving technologies are used.

- It is only then that the widespread adoption will become possible when the strong privacy safeguards are already in place and effectively used in the blockchain systems.

- The traditional financial network can complete transactions in no time; for instance, Visa processes over 24,000 transactions per second, whereas Bitcoin only does about 7 transactions per second.

- Scalability remains an issue for the financial industry, which is in need of real-time high-volume transaction processing.

- Thus, until blockchain networks can guarantee the same or better performance as the existing traditional systems, the large-scale financial deployment will continue to be a challenge.

- PwC has indicated that one-third of the financial companies have cited the deficiency of blockchain talent in their organizations as a reason for not adopting the technology.

Embedded Finance Key Players

- Stripe, Inc. is probably the most important company in this regard. It has a wide-ranging package of APIs and tools that make it possible for vendors and marketplaces to neatly incorporate payments, billing, and payouts, along with other financial services, into their software.

- Another big name is Payrix, which has built a reputation particularly for its Payfac-as-a-Service (PFaaS) model. It means that software companies do not have to cover the whole extent of tax and operational requirements when they want to acquire the status of payment facilitators through Payrix.

- Cybrid Technology Inc. is mainly concerned with giving developers priority while providing embedded finance solutions, the company’s main products, which are APIs and SDKs, support the integration of payments, cryptocurrency trading and lending into applications, among others.

- Walnut Insurance Inc. is one of the companies that is deeply involved in the embedded insurance segment. It has taken the role of a licensed insurance broker that takes care of all the complex backend operations that the insurance industry needs, and the rest of the platforms have their own operations through which they can carry out insurance deliveries to the customers.

- Lendflow deals with the infrastructure of embedded lending and thus helps organizations that need to integrate credit products into their systems. The company does different things, such as going the distribution partners route, embedding credit decision models for faster conversion, and using AI-driven industry mapping to pair borrowers with lenders that fit them best.

Recent Developments

- The last twelve months have been fantastic for the embedded finance industry. This was demonstrated by the unrolling of new platforms, partnerships, and initiatives among the major global players through which they aimed at spreading access to financial services.

- In March 2025, Ant International, in collaboration with AliExpress and local partners, launched a new embedded finance solution geared for e-commerce SMEs in Brazil. This move is mainly directed at the shortage of funding suffered by small and medium enterprises (SMEs), as it opens up a way for them to get fast and low-friction access to working capital.

- The financing being embedded into e-commerce workflows directly is the solution that gives SME growth a push and also prepares them for involvement in Brazil’s rapidly growing digital commerce ecosystem.

- In October 2024, HSBC introduced SemFi, a B2B embedded finance technology provider that is the result of the bank’s partnership with fintech company Tradeshift.

- SemFi enables e-commerce sites and marketplaces to include HSBC’s payment, trade, and financing services in their ecosystems, thus making it easier for business users to do cross-border trade and get better liquidity.

- At the same time, Green Dot Corporation rolled out its Arc by Green Dot, a platform that seamlessly integrates the banking-as-a-service and money movement functionalities into a secure, cloud-based solution. The main target of Arc is to make the users’ business engagement, customer retention, and scalable growth.

- The month of June 2024 saw the appointment of Marcin Glogowski as the Senior Vice President and Managing Director for Europe and CEO for the UK at Marqeta, which made the regional strategy for issuing embedded cards even stronger.

- The previous month, in February 2024, Alloy had already introduced a new embedded finance product that would enable banks and fintechs to manage identity risk and stay compliant with the ever-changing regulations.

Conclusion

Embedded Finance in Banking Statistics: Embedded finance is a major change factor in the global banking sector that has transformed the whole picture of consumer and business access to financial services. It is like the ingredients of the cake, where payment, lending, insurance, and banking capabilities are mixed up, and then the cake is flourished with customers’ convenience, engagement, and revenue opportunities. Market growth is strong, adoption of open banking is rapid, and participation from different regions is expanding; all these indicate the momentum of the technology.

Even though there are some challenges like regulatory uncertainty, scalability, and a shortage of skilled professionals, the ongoing innovation and investment are gradually overcoming these barriers. The new solutions that will be developed by the major players in this field will just make the digital financial ecosystem even more reliant on embedded finance.

FAQ

Embedded finance is the incorporation of non-financial digital platforms, such as e-commerce apps, marketplaces, SaaS tools, and even gig platforms, into the financial services ecosystem. The latter includes payments, lending, insurance, and banking.

The pace of growth is incredible and very large. The open banking transaction value is going to increase from USD 57 billion in 2023 to USD 330 billion in 2027, which is more than 500% growth globally. At the same time, the global market for embedded banking is expected to grow from USD 16.51 billion in 2023 to USD 129.3 billion by 2033, attaining a CAGR of 22.85%.

North America has a major share of the global market, which is approximately one-third, and it leads the embedded finance market mainly due to the presence of a robust fintech ecosystem, good digital infrastructure, and the acceptance of digital finance as a norm by people in general.

Payments dominate embedded finance growth, expanding from USD 16.1 billion in 2020 to USD 140.8 billion by 2025, driven by mobile wallets and in-app transactions. Embedded insurance also shows substantial growth, rising from USD 5.0 billion to USD 70.7 billion, fueled by on-demand and checkout-based insurance offerings.

Despite strong growth, embedded finance faces several challenges, like Privacy and security concerns, scalability limitations, a lack of interoperability standards, and a shortage of skilled blockchain professionals, which also slow adoption.