Introduction

Digital Transformation In Banking Statistics: Digital transformation in banking entails moving from paper-based processes and branch-only service to faster digital services. Banks have adapted their operations to better serve customers by offering mobile apps, online banking, digital payments, and e-wallets. In the background, banks enhanced their core systems and adopted cloud technologies, APIs, and data analytics to deliver services more smoothly and more personalised.

Tools such as artificial intelligence help banks detect fraud, automate routine checks, and provide customer support via chatbots at any time. Banks also collaborated with fintech companies to introduce new products more quickly and align with evolving customer needs. As more banking occurred online, keeping customer information secure and improving cybersecurity became as important as speed and ease of use.

Editor’s Choice

- According to coinlaw.io, the global digital banking platform market is projected to reach USD 12.94 billion by 2025, growing at a 13.23% CAGR from 2024 to 2032.

- Global banks will invest around USD 1.5 trillion in digital transformation, up 15% from 2024.

- In 2025, about 3.6 billion people worldwide use digital banking, continuing the rise seen in 2024.

- Meanwhile, the global digital banks are projected to generate a net interest income of USD 956.3 billion.

- Approximately 1.75 billion people use digital banking accounts, and together they handle about USD 1.4 trillion annually, roughly USD 2.7 million every minute.

- Banks are achieving more than 5% improvement from digital transformation efforts.

- Nine out of ten banks plan to increase their digital transformation budgets, with 92% reporting overall budget increases.

- In 2025, the banking AI market is expected to reach USD 34.58 billion and grow at a 30.63% CAGR through 2034.

- Today, banking favours APIs, with 71% of near- or fully-transformed banking institutions already deploying them strategically.

- Placing investment banking on digital platforms enables banks to reach clients more quickly and operate more effectively.

- Finextra reports that Europe’s open banking market may grow at an annual rate of 25.3%, reaching USD 44.9 billion by 2030.

General Statistics On Digital Transformation In Banking

- Approximately 1.75 billion people use digital banking accounts, and together they handle about USD 1.4 trillion annually, roughly USD 2.7 million every minute.

(Source: sdk.finance)

- More than 76% of US customers use mobile banking apps.

- Banks that adopt digital technologies reduce operating costs by 20% to 40% through automation, process improvements, and fewer branches.

- lvivity.com further reported that 77% of Canadians, 71% of Americans, and 69% of Spaniards use online banking monthly.

Types of Digital Banks

| Type | Numeric Information |

| Fully licensed digital-only banks (Full banking licence; app-led, no branches) | Nubank: More than 100 million customers (May 2024); Revolut: 52.5 million customers in 2024 (+38% YoY) |

| Challenger banks (Newer rivals to big banks; mostly app-first) | Monzo: 13 million customers (2025) |

| Digital brands by big banks (Traditional banks launching separate digital brands) | Chase UK: Approximately 2 million customers; Nearly USD 20 billion in deposits (as of November 2023). |

| Neobanks: fintech-led (Often use a partner bank’s licence) | Around 376.9M neobank users projected by 2027; USD 2.60 trillion transaction value forecast by 2027. |

| Payments Banks: India (Often use a partner bank’s licence) | 6 Payments Banks in India: Airtel, India Post, FINO, Paytm, Jio, NSDL. |

Recent Banking Trends of Digital Transformation

- Banks are achieving more than 5% improvement from digital transformation efforts.

- Comparing institutions with 50% or more of their strategy completed with those with less than 50% completed.

| Areas | Metrics | First Value | Comparison value |

| Growth in volumes | Deposit account volumes | 31% | 9% |

| Loan volumes | 29% | 13% | |

| Efficiency and capability | Loan productivity | 27% | 175 |

| IT agility | 25% | 20% | |

| Customer outcomes | Customer retention | 22% | 8% |

| Risk and cost impacts | Fraud losses improvement | 18% | 4% |

| Operational expenses improvement | 12% | 8% | |

| Revenue mix and selling effectiveness | Up-sell/Cross-sell effectiveness | 12% | 8% |

| Non-interest income | 6% | 4% |

The table below covers the key drivers behind digital transformation in banking:

| Metrics | Banks Share |

| Lower customer acquisition cost | 71% |

| Improve customer banking experience | 68% |

| Achieve top-line growth | 68% |

| Increase operational efficiency | 56% |

| Reach more banked customers | 41% |

Digital Banking Market Size

- According to ElectroIQ, the global digital banking platform market is projected to reach USD 12.94 billion by 2025, growing at a 13.23% CAGR from 2024 to 2032.

- In the same period, 80% of millennials prefer digital banking, and 48% say they would change banks if the digital service is not seamless.

- In the U.S., 80% of bank transactions are expected to happen on digital platforms.

- Digital-only banks could serve 50 million U.S. customers by the end of 2025.

- Approximately 94 million U.S. consumer accounts are expected to share data via open banking APIs.

- Digital banks spend almost 60% less to acquire customers than traditional banks.

- Meanwhile, 68% of global banks plan to increase cloud investment by 2026.

(Reference: sdk.finance)

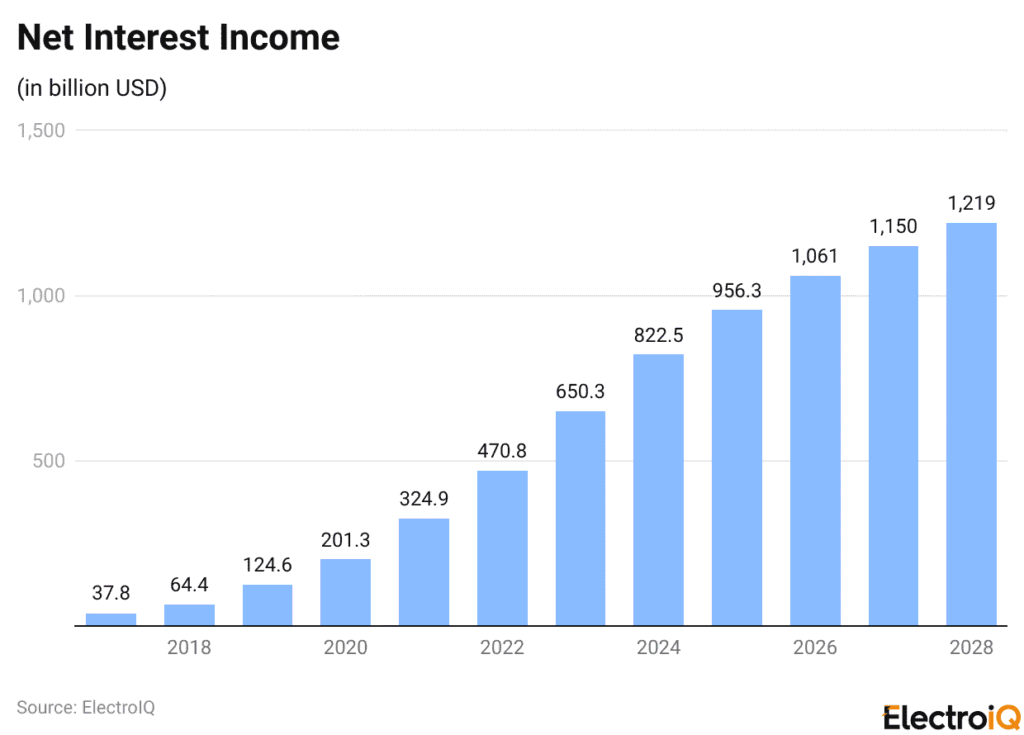

- By 2025, the global digital banks are projected to generate a net interest income of USD 956.3 billion, up from USD 822.5 billion in 2024.

- Furthermore, net interest income is projected to reach USD 1,061 billion in 2026, USD 1,150 billion in 2027, and USD 1,219 billion in 2028.

By Usage

- In 2025, about 3.6 billion people will use digital banking globally.

- In the United States, approximately 76% of adults use mobile banking apps, and 73% regularly use online banking.

- Digital banking revenue is expected to reach USD 1.61 trillion in 2025.

- The global neobanking market is forecast to reach USD 262.36 billion by this year as more customers choose fully digital services.

- Now, over 90% of banking interactions happen online.

- Digital banks achieved an 81% customer satisfaction rate.

- Voice banking is also expanding via Alexa and Google Assistant.

Investment Budgets For Digital Transformation In Banking

(Source: lvivity.com)

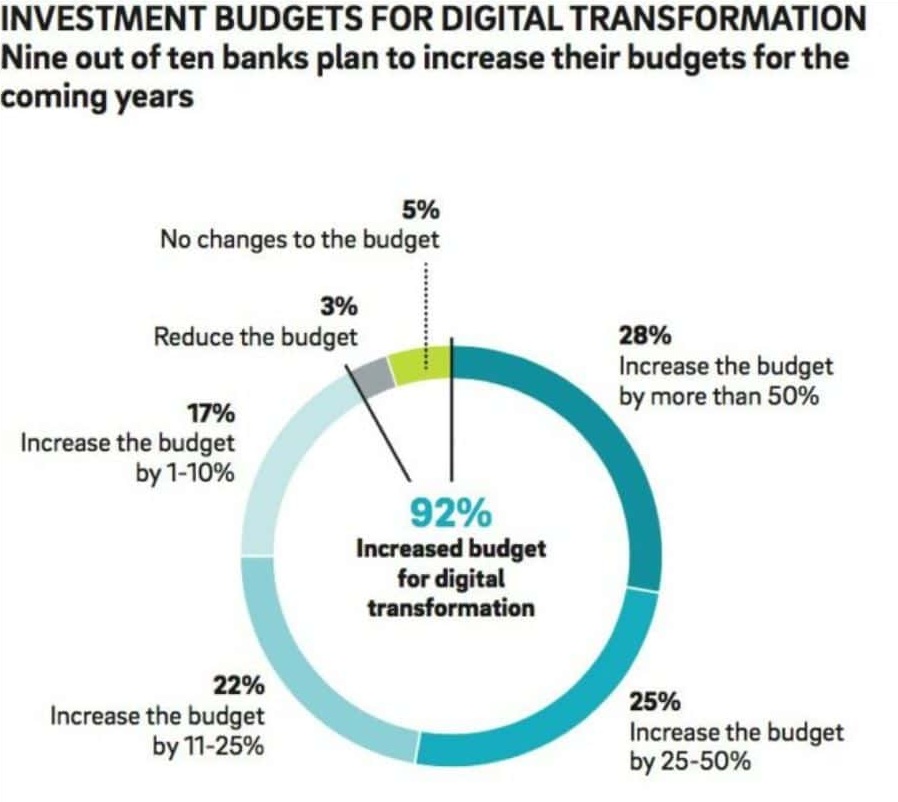

- Nine out of ten banks (approximately 92%) planned to increase their digital transformation budgets.

- Meanwhile, 28% increased their budget by more than 50%.

- Followed by 25% (increase the budget by 25-50%), 22% (increase the budget by 11-25%), and 17% (increase the budget by 1-10%).

- Meanwhile, 5% expect no changes to the budget, and only 3% plan to reduce the budget.

Digital Bank’s Spending Statistics

- In 2025, banks worldwide may invest USD 1.5 trillion in digital transformation, up 15% from 2024, according to a report shared by CoinLaw.

- A typical U.S. bank now allocates 35% of its total budget to digital work.

- Approximately 82% of financial firms intend to migrate at least half of their core systems to the cloud by 2025 to operate more efficiently and scale more effectively.

- Global bank cybersecurity budgets could reach USD 212 billion, representing another 15% annual increase.

- AI funding is increasing by approximately 25% per year, with USD 180 billion expected for 2025 projects.

- Almost 90% of banks plan to release improved or new mobile apps.

- Meanwhile, blockchain spending will reach USD 10 billion by the end of this year.

Mobile Banking Growth Analyses, 2025

| Updates | Key Numbers |

| More people use mobile banking | 3.8 billion users are expected by the end of 2025, with a 10% annual growth rate. |

| Gen Z uses apps often (U.S.) | 86% use mobile banking apps every month. |

| Time saved vs. branch visits | Saves about 1.8 hours monthly, over 21 hours yearly. |

| Payments shifting to phones | Mobile devices may account for 60% of global transactions. |

| Digital-only accounts growing (U.S.) | Digital-only account users may number 53 million. |

| Wallet payments are getting bigger | Digital wallets could hit USD 11.55 trillion globally. |

| Stronger login security | Biometric use may increase by 520%, thereby improving trust. |

Digital Transformation In Banking Statistics By Artificial Intelligence

- In 2025, the banking AI market is expected to reach USD 34.58 billion and grow at a 30.63% CAGR through 2034.

(Source: coinlaw.io)

- In 2024, chatbots handled 80% of banking operations without human intervention and completed complex tasks more easily.

- Around 90% of financial firms use AI for fraud detection, customer support, and improving operational efficiency.

- Banks that used predictive machine-learning models reported a 30% drop in default rates.

- AI fraud systems are estimated to have saved USD 217 billion worldwide in 2025, and these savings continue to grow.

By Technologies

(Source: luxoft.com)

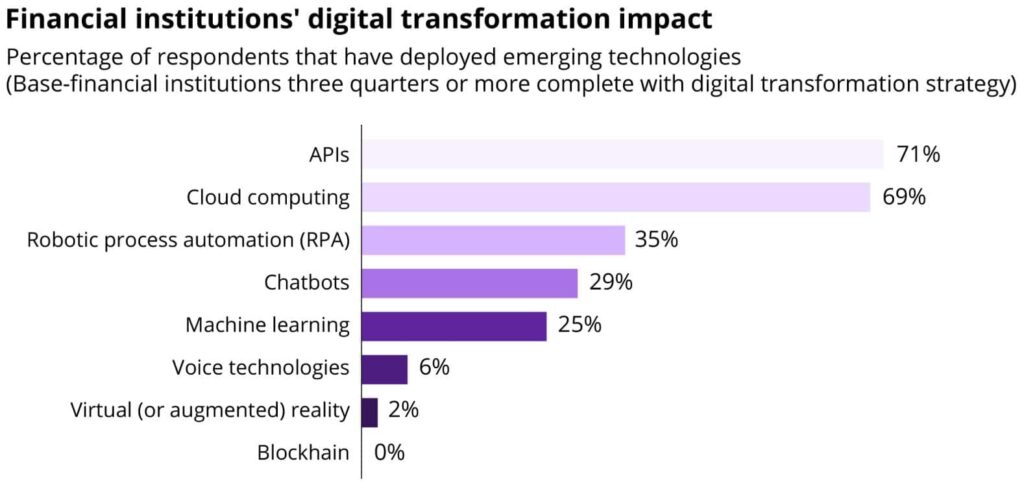

- Today, banking favours APIs, with 71% of near- or fully-transformed banking institutions already deploying them strategically.

- The digital transformation impact data also shows strong adoption of cloud computing (69%), followed by robotic process automation (RPA) (35%), chatbots (29%), and machine learning (25%).

- Meanwhile, other shares report using voice technologies (6%), virtual (or augmented) reality (2%), and blockchain (0%).

Digital Transaction Management Market Size

(Source: market.us)

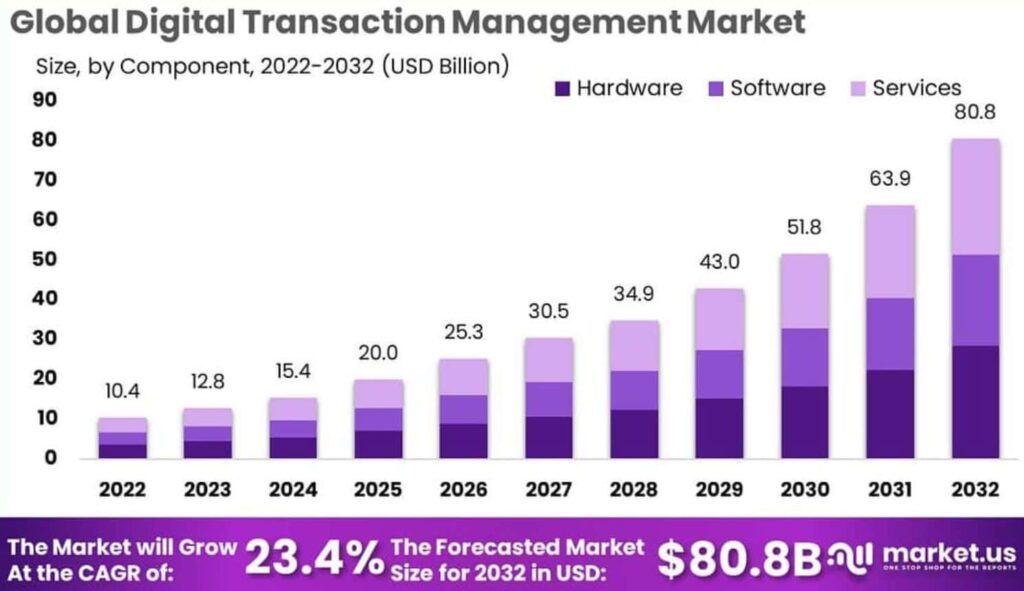

- The Global Digital Transaction Management market is expected to grow from USD 12.8 billion in 2023 to around USD 80.8 billion by 2032, reflecting a projected 23.4% CAGR over 2023–2032.

- A Lone Wolf Technologies survey indicates that 84% of real estate agents consider transaction management software important or essential, suggesting that digital workflow tools are being prioritised in daily operations.

- Despite recognising its value, 20% of agents reported that the software is not currently in use, suggesting adoption gaps remain in the market.

- eSignature capability was reported as the most used feature, with 36% of agents relying on it more than any other function for faster approvals and reduced paperwork.

- Document management was the next most relied upon capability, with 28% of agents using it as their primary feature to organise transaction files and reduce administrative errors.

- Access through industry support channels remains significant, as 68% of agents reported that transaction management software is provided as a benefit through their MLS or real estate association.

- Forms integration was identified as the most vital feature by 11% of agents, indicating that smoother access to standardized forms is being viewed as a practical requirement for closing speed and accuracy.

- In 2022, the Hardware segment held the leading position with over 40.3% share, indicating that enabling infrastructure is a core requirement for secure digital transactions.

- In 2022, Electronic signatures led solution adoption with more than 35.6% share, reflecting strong demand for secure digital documentation and approvals.

- In 2022, Large Enterprises represented the dominant user group, with over 52.3% share, driven by higher compliance needs and greater transaction volumes.

- In 2022, BFSI remained the leading industry segment with more than 28.2% share, driven by regulated workflows and higher requirements for identity assurance and auditability.

- In 2022, North America held the leading regional position with over 32.6% share, supported by advanced digital infrastructure and strong enterprise adoption.

Benefits of Digital Banking

- Placing investment banking on digital platforms enables banks to reach clients more quickly and operate more effectively.

- Using digital tools also makes compliance simpler because records are easier to track.

- Digital onboarding helps bring in new customers.

- Banks can innovate more quickly and adapt to market changes more readily.

- Strong digital controls enhance the security of data and transactions.

- Digital transformations enable banks to offer more personalised services.

Why Digital Transformation Matters In Banking?

- Banks must go digital because the way people bank has changed.

- Many customers now prefer fast, simple services on their phones, so banks need better apps and online tools to keep them happy.

- FinTech companies are offering smart, digital services and pulling customers away from traditional banks.

- Digital banking enhances security through stronger authentication, improved fraud detection, and enhanced data protection.

- Digital Transformation enabled banks to comply with new open banking regulations.

- Automation accelerates routine tasks, reduces errors, and lowers costs.

- Digital transformation connects mobile devices, websites, and branches, providing customers with a consistent experience across channels.

Recent Developments of Digital Transformation In Banking

- Finextra reports that Europe’s open banking market may grow at an annual rate of 25.3%, reaching USD 44.9 billion by 2030.

- According to LinkedIn, an industry roundup notes that by 2025, digital ID verification will be mandatory in 30% of countries, thereby improving online banking security.

- CBDCs are also being explored or piloted in 134 countries, which together account for about 98% of global GDP.

- Harvard’s corporate governance forum reports 83% of major banks tie sustainability metrics to executive pay.

- 5G boosts banking with real-time processing and stronger mobile experiences, supporting AI and IoT services.

- AR banking is early but growing, with AR services projected to reach USD 274.54 billion in 2025 (up 43.6%).

Conclusion

After completing the article, the digital transformation enabled banks to better support customers, providing higher-quality service more quickly. Banks no longer rely solely on branches and paperwork. Such advanced technology is now providing services through mobile apps, websites, and digital payments. Cloud technology, APIs, and data tools have enhanced daily banking operations and enabled banks to operate more effectively.

In recent years, the overall system has provided faster services that better meet customer needs. AI helps detect fraud, accelerates rule checks, and provides support via chatbots at any time. This article presents several statistical analyses based on different insights. However, increased online banking also introduces additional security risks; maintaining data security and protecting systems is essential.

To serve customers more quickly, reduce costs, improve efficiency, and remain competitive.

Cloud computing, APIs, data analytics, AI, cybersecurity tools, and blockchain.

AI fraud detection automates compliance checks, improves risk decisions, and provides 24/7 customer support via chatbots.

Enable faster transactions, 24/7 customer access, easy payments, quicker loans, safer banking, and personalised offers.

Cybersecurity protects customer data and money by preventing hacking, fraud, identity theft, and service attacks.