Introduction

Digital Identity and KYC Verification Statistics: Digital identity facilitates online verification of a person’s identity as more services, such as banking, payments, shopping, healthcare, and government portals, shift to digital environments. Because of this, companies must make sure a real person is creating an account and using the service. This is where KYC (Know Your Customer) verification is useful, as it helps businesses prevent fraud, comply with regulations, and make sign-up safer and easier.

A digital identity includes details such as your name, date of birth, ID documents, facial recognition, device information, and online activity. KYC checks these details using procedures such as ID verification, selfie verification, and database verification.

This article presents several statistical analyses from multiple perspectives that examine digital identity, the importance of KYC, and the challenges of balancing security and privacy.

Editor’s Choice

- According to a report shared by Coherent Market Insights, the digital identity verification market was valued at USD 13.78 billion in 2025.

- Meanwhile, North America accounted for the largest share (38.4%), and Asia-Pacific (23.7%) was the fastest-growing.

- As of 2025, the digital identity solution market accounted for USD 45.9 billion in revenue.

- The Digital Identity Solutions Market generated USD 27.9 billion in solutions revenue and USD 18 billion in services revenue.

- As of 2024, banks remain the top choice for a single digital identity service, trusted by 49% of respondents.

- Biometric-based digital identity solutions account for 68% of the global market.

- Demand for digital identity verification is increasing as online crime becomes more costly, with the FBI’s Internet Crime Complaint Centre (IC3) reporting USD 16.6 billion in losses in 2024.

- Polaris Market Research estimates the e-KYC market at USD 1.33 billion in 2025.

- Digital identity services (KYC/AML share): Identity verification & KYC/AML are projected to account for 35.7% of the market value in 2025.

Global Digital Identity Verification Market Size

- According to a report shared by Coherent Market Insights, the digital identity verification market was valued at USD 13.78 billion in 2025.

- By the end of 2032, the market will reach USD 39.66 billion, with a 16.3% CAGR from 2025 to 2032.

- As of 2025, the single-factor authentication segment accounted for the largest market share (68.5%), and the Banking, Financial Services, and Insurance sector also secured the largest share (31.8%).

- Meanwhile, North America accounted for 38.4%, and Asia-Pacific (23.7%) was the fastest-growing.

- From 2025 to 2030, the market rises from USD 28,504.4 million to USD 49,667.0 million, an increase of USD 21,162.6 million, representing about 36% of the decade’s total growth, according to Future Market Insights.

- Here, identity verification with KYC/AML accounts for over 35% of high-accuracy, compliance-intensive cases.

- From 2030 to 2035, the market increases from USD 49,667.0 million to USD 86,541.2 million, representing a 64% increase in total value.

- By then, cloud and hybrid exceed 70%, and service models exceed 65%.

- From 2020 to 2024, the market grew from under USD 20,000 million to over USD 26,000 million, with verification providers accounting for nearly 70%, and recurring models accounting for less than 20%.

- In 2025, it reached around USD 28,504.4 million.

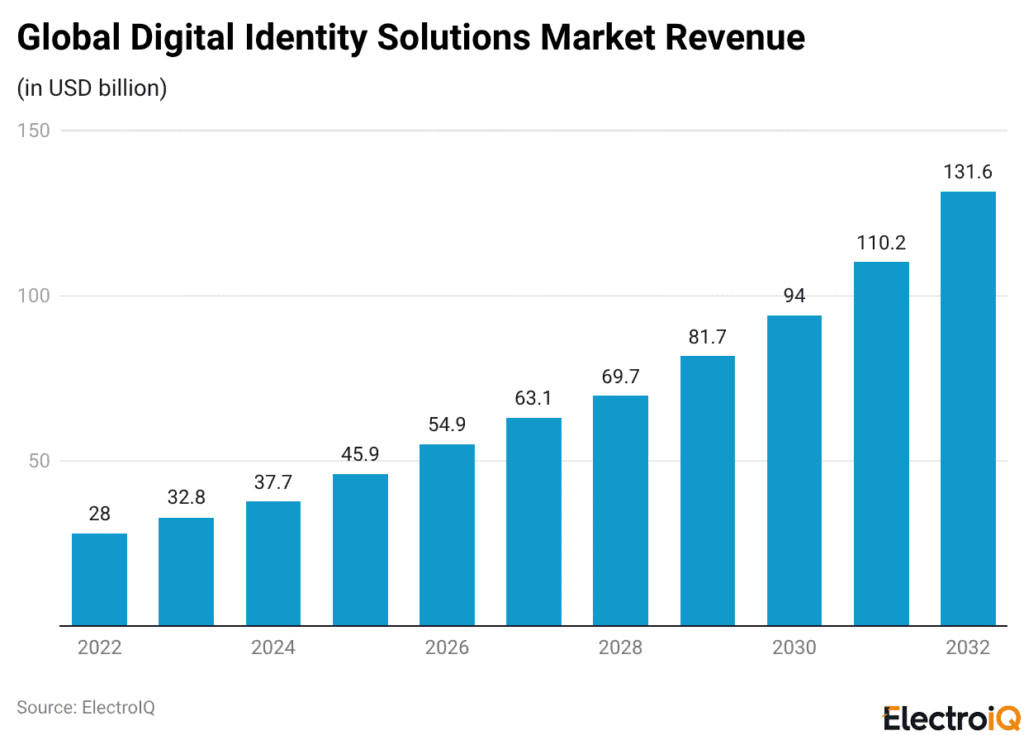

Digital Identity Solutions Market Revenue

(Reference: Market.us Scoop)

- As of 2025, the digital identity solution market accounted for USD 45.9 billion in revenue.

- By the end of 2026, the market size is expected to reach around USD 54.9 billion.

- Followed by USD 63.1 billion in 2027, USD 69.7 billion in 2028, USD 81.7 billion in 2029, USD 94 billion in 2030, USD 110.2 billion in 2031 and USD 131.6 billion in 2032.

- A global survey found that only 58% of respondents reported understanding the term “digital identity.”

- Italy had the highest awareness at 83%, whereas the United States had the lowest, with only 45% reporting confidence.

- Almost 42% of respondents said digital identity refers to any personal information available online, and Germans agreed most (52%).

- In comparison, 14% linked it to their e-signature, while only 5% chose their email address.

By Components

- In 2025, the Digital Identity Solutions Market generated USD 27.9 billion in solutions revenue and USD 18 billion in services revenue.

| Year | Solutions Revenue | Services Revenue |

| USD billion | ||

| 2026 | 33.4 | 21.5 |

| 2027 | 38.3 | 24.7 |

| 2028 | 42.4 | 27.3 |

| 2029 | 49.7 | 32 |

| 2030 | 57.1 | 36.8 |

| 2031 | 67 | 43.2 |

| 2032 | 80 | 51.6 |

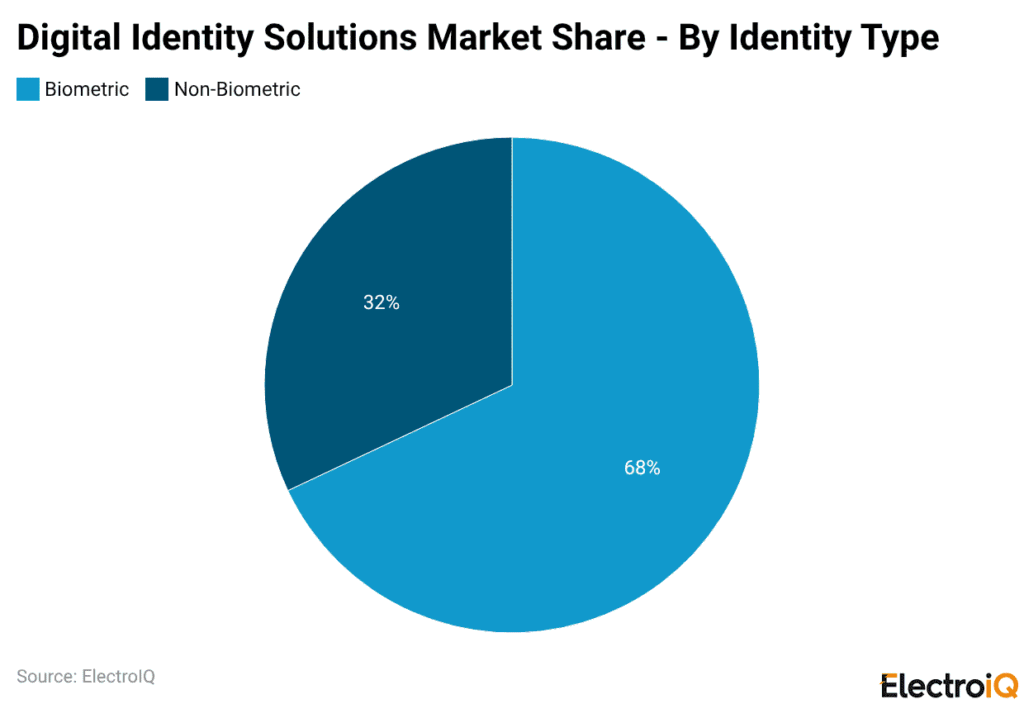

By Identity Type

(Reference: Market.us Scoop)

- Biometric-based digital identity solutions account for 68% of the global market.

- Meanwhile, non-biometric options account for the remaining 32%.

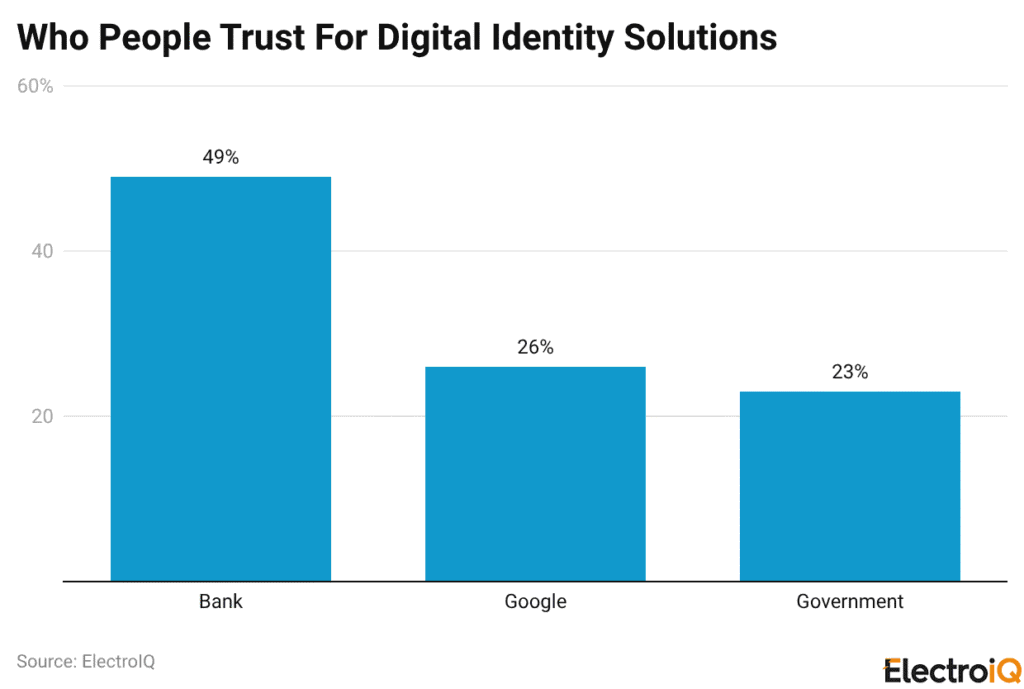

People’s Trust For Digital Identity Solutions

(Reference: Market.us Scoop)

- As of 2024, banks remained the top preferred choice for a single digital identity service, trusted by 49% of respondents.

- Meanwhile, Google drew 26% trust, while government agencies at 23%.

Reasons Driving The Demand For Digital Identity Verification

- Online crime is getting costly, with the FBI’s Internet Crime Complaint Centre (IC3) reporting USD 16.6 billion in losses in 2024.

- Consumer fraud losses reached USD 12.5 billion in 2024, and the share of fraud reporters who lost money rose from 27% (2023) to 38% (2024).

- Account takeover losses increased to nearly USD 13 billion in 2023, up from USD 11 billion in 2022.

- Synthetic identity fraud accounts for 80% of new-account fraud and is projected to cause at least USD 23 billion in losses by 2030.

- Globally, the average breach costs approximately USD 4.88 million, and in the financial sector, it costs approximately USD 6.08 million.

- Moreover, 41% of logins used compromised passwords.

- Public-sector checks saw 6.7% suspected digital fraud in 2024, up 31% from 5.1% in 2023.

- Approximately 850 million people lack official identification, and 3.3 billion lack a government-recognised digital ID for online transactions.

- In the EU/EEA, users bore 45% of card payment and 51% of cash withdrawal fraud losses in H1 2023.

KYC Verification Statistics

- Burton Taylor (TP ICAP) forecasts global AML/KYC data & services spend at UISD 2.9 billion in 2025 (+12.3% YoY), with AML/KYC budgets rising 22% CAGR over the past five years.

- Polaris Market Research estimates the e-KYC market at USD 1.33 billion in 2025 (from USD 1.09 billion in 2024).

- It is projected to reach USD 8.09 billion by 2034, a 22.3% CAGR (from 2025 to 2034).

- Fenergo reports that 2025 onboarding abandonment is just over 10% (1 in 10) among 600 senior executives across the UK/US/Singapore.

- Meanwhile, 47% already use AI in compliance, while 6% use agentic AI.

- McKinsey estimates that KYC/AML activities take up roughly 10%-15% of banks’ total full-time staff capacity (FTEs).

- As of October 2025, e-KYC reduced onboarding time from 120 to 12 hours, costs from ₹180 to ₹25, and fraud from 12.0% (120/1000) to 4.5% (45/1000).

Steps of KYC Verification

| Step | Phase | Description |

| 1 | Information & Document Collection | The user provides basic personal details and submits official government-issued identity documents (e.g., PAN, Aadhaar, Passport) and proof of address. |

| 2 | Document Verification | The submitted documents are scanned and checked for authenticity. This step ensures the documents are not forged, tampered with, or expired. |

| 3 | Identity & Liveness Check | The user takes a real-time selfie or a short video. Biometric technology matches the user’s face to the photo on their ID and ensures they are a live person (preventing masks or photos of photos). |

| 4 | Background & AML Screening | The individual’s details are screened against global watchlists, Anti-Money Laundering (AML) databases, and Politically Exposed Persons (PEP) lists to assess risk. |

| 5 | Decision & Onboarding | Based on the verification results, the application is automatically approved, rejected, or flagged for a manual review by a compliance officer. |

| 6 | Ongoing Monitoring | KYC isn’t just a one-time event. Institutions continuously monitor customer transactions and periodically update KYC records to ensure ongoing compliance. |

Technologies Used For Digital Identity and KYC Verification

| Category | Technology | Purpose & Application |

| Biometric Verification | Liveness Detection | Uses 3D depth sensing and “active” challenges (blinking, nodding) to ensure the person is physically present and not a deepfake or photo. |

| Face/Iris/Fingerprint Matching | Compares live biometric data against official government records (e.g., e-Passports or national ID databases like Aadhaar). | |

| Behavioral Biometrics | Monitors passive patterns like typing rhythm, mouse movements, or device handling to confirm identity throughout a session. | |

| Artificial Intelligence | Computer Vision & OCR | Automates data extraction from IDs and detects “micro-tampering” (e.g., font inconsistencies or photoshopped holograms) that the human eye misses. |

| Agentic AI & ML | Orchestrates the entire KYC workflow, calculating real-time risk scores based on thousands of data points and flagging suspicious patterns. | |

| Deepfake Defense | Specialist AI models designed specifically to detect synthetic media and AI-generated personas during video calls (V-CIP). | |

| Decentralized Systems | Blockchain & DLT | Creates an immutable, tamper-proof audit trail of verification events without storing sensitive personal data in a central “honeypot” database. |

| Self-Sovereign Identity (SSI) | Allows users to own their “Identity Wallet” and share only necessary “Verifiable Credentials” (e.g., proving you are over 18 without revealing your birth date). | |

| Zero-Knowledge Proofs (ZKP) | Cryptographic methods that allow a user to prove a claim (e.g., “I have a valid license”) without actually sharing the document itself. | |

| Data & Connectivity | NFC (Near-Field Comm.) | Scans the encrypted chips inside modern e-passports and IDs for 100% accurate, tamper-proof data retrieval via a smartphone. |

| API-based eIDV | Real-time cross-referencing of user data against authoritative sources like credit bureaus, utility records, and government registries. | |

| Device Fingerprinting | Analyzes the hardware (IP address, SIM details, OS version) to ensure the device hasn’t been used in previous fraud attempts. |

The Threat of Deepfakes and GenAI in KYC Evasion

- The Surge in Synthetic Identity Fraud: Generative AI has industrialised identity fraud. According to a 2026 industry analysis by the Business Information Industry Association (BIIA), U.S. lenders faced over $3.3 billion in exposure to synthetic identities tied to new accounts in the first half of 2025 alone. Financial institutions project that AI-enabled fraud losses could reach $40 billion in the U.S. by 2027.

- Camera Injection Attacks: Fraudsters are no longer relying on simple presentation attacks like holding up a printed photo. The World Economic Forum’s 2026 Unmasking Cybercrime report highlights a shift toward “injection attacks.” Using emulators and virtual environments, attackers bypass a device’s physical camera entirely, injecting highly realistic, AI-generated synthetic video streams directly into the KYC app to defeat live biometric checks.

- Real-Time Face-Swapping and Voice Cloning: Advanced face-swapping tools now allow criminals to map a target’s facial features onto their own face in real time during video-based onboarding. Furthermore, AI voice cloning is weaponised to bypass voice biometric systems, allowing fraudsters to mimic legitimate customers and authorise account takeovers or fund transfers.

- The Evolution of Liveness Detection: Traditional active liveness checks (e.g., asking a user to blink or turn their head) are easily defeated by modern deepfakes. In response, the industry is pivoting toward passive liveness detection combined with stringent Injection-Attack Detection (IAD). New technical specifications, such as the European CEN/TS 18099 and the upcoming global ISO 25456 standard, formally establish testing protocols for injection-resistant systems to ensure the authenticity of the digital data feed itself.

The Shift to Self-Sovereign Identity (SSI) and Decentralised Wallets

- Exponential Market Growth: The Self-Sovereign Identity (SSI) sector is experiencing rapid adoption, transitioning from an experimental Web3 concept to an enterprise standard. Market research indicates the SSI market expanded from $3.49 billion in 2025 to an estimated $6.64 billion in 2026, driven by stringent data protection regulations and growing consumer demand for privacy and data ownership.

- User-Controlled Verified Credentials: Unlike traditional centralised databases—which act as honeypots for hackers—SSI leverages decentralised identifiers (DIDs) and zero-knowledge proofs (ZKPs). This architecture allows users to store verified credentials locally on their devices. They can prove specific attributes (e.g., being over 18) to a service provider without handing over the underlying sensitive data (e.g., their exact date of birth or ID number).

- Mainstream Mobile Driver’s License (mDL) Adoption: The infrastructure for decentralised identity is already reaching critical mass. In the U.S., over 17 states (including California and New York) actively issue mDLs. These digital credentials integrate seamlessly with Apple Wallet and Google Wallet, and ABI Research projects that 143 million Americans will hold an mDL by 2030.

- Reducing KYC Friction and Abandonment: By allowing users to present a reusable, cryptographically verified digital identity directly from their smartphone wallet, businesses drastically reduce KYC onboarding abandonment—which currently hovers around 10% for traditional financial institutions—while eliminating the liability of storing raw identity documents on their own servers.

Global Regulatory Drivers: eIDAS 2.0 and Deepening AML Mandates

- The eIDAS 2.0 Mandate: The European Union’s revised eIDAS 2.0 regulation is fundamentally restructuring the digital identity landscape. Having entered into force in May 2024, the mandate requires every Member State to offer its citizens a European Digital Identity Wallet (EUDI Wallet) by late 2026. Crucially, by December 2027, “relying parties” across the financial sector—including banks and payment service providers—are legally compelled to accept these wallets for strong customer authentication (SCA) and KYC onboarding.

- A Record Surge in AML Fines: Regulators globally have lost patience with “growth at all costs” business models that neglect compliance. In the first half of 2025 alone, global Anti-Money Laundering (AML) fines skyrocketed by 417% year-over-year, totalling approximately $1.23 billion.

- Sector-Specific Regulatory Crackdowns: The cryptocurrency sector absorbed the heaviest regulatory blows, facing over $1 billion in fines globally in 2025 (including a massive $500M+ penalty for OKX and €21M for Coinbase) due to inadequate KYC screening and transaction monitoring. Traditional banking also faced penalties exceeding $200 million, with major institutions fined for systemic gaps in identifying ultimate beneficial owners (UBOs) and high-risk clients.

- The Pivot to Continuous KYC (pKYC): Regulators are explicitly penalising firms that rely on static, annual risk assessments. To maintain compliance in 2026, financial institutions are shifting toward perpetual KYC (pKYC) and dynamic transaction monitoring. This involves integrating real-time behavioural analytics and alternative data (such as telecom signals for SIM-swap detection) to flag illicit financial flows before they settle.

Conclusion

Rather than merely being a legal requirement, digital identity and KYC have become key systems that foster trust and safety online. As banking, shopping, healthcare, and government services move online, it becomes necessary to verify a person’s identity through KYC. This even helps to prevent fraud, enhance user safety, and comply with legal requirements.

In the future, KYC will become faster and more efficient with risk-based checks, enhanced biometric security, and reusable digital IDs. Strong KYC builds trust, reduces risk, and supports long-term growth.