Introduction

Digital Banking Adoption and Usage Statistics: Digital banking is evolving with advances in technology. All banking processes can now be completed without visiting a bank branch; customers can use mobile apps, internet banking, and other online services to check their balances, send money, pay bills, open accounts, or apply for loans. Digital banking adoption refers to the extent to which people use these services, whereas digital banking usage indicates how often they use them and for what purposes.

Some people use digital banking only for simple transfers, but others use it for most of their daily banking needs. Studying digital banking adoption and usage is important because it helps banks and government bodies make services easier, faster, and cheaper. It also highlights problems such as online fraud, privacy risks, and the digital divide among individuals with limited internet access or limited technical skills.

Editor’s Choice

- The global digital banking platform market is projected to reach USD 12.94 billion by 2025, growing at a 13.23% CAGR from 2024 to 2032.

- The market size of the digital transaction management is expected to reach around USD 20 billion by 2025, up from USD 15.4 billion in 2024.

- In the United States, approximately 76% of adults use mobile banking apps, and 73% use online banking regularly.

- As of 2024, the largest number of digital banking users was in the Far East and China, at 974.3 million.

- By 2025, the number of digital banking users is projected to reach 216.8 million, with penetration rising to 80.4%.

- Chase Bank is a leading online banking platform with more than 51 million online banking users and 38 million mobile banking users.

- Meanwhile, 37% of digital banking users and 15% of mobile banking app users report inquiring about a product.

- Digital banking users aged 25-34 lead, accounting for 82.3%, with 12.9% primarily using online banking and 69.4% using mobile banking.

- Globally, the number of digital banking users is projected to reach 3.6 billion as of 2024.

- Bank of America is a leader in digital banking, with more than 30 million active mobile app users and more than 40 million online banking customers.

- As of 2025, the graph above indicates that digital remittances account for the largest share of digital payments, at 75%.

- In February 2025, Alipay recorded 220 billion digital banking transactions.

- The primary advantage of digital payments is cost savings, and 75% of consumers consider them a good choice.

- 83% of users in digital banking remain concerned about data breaches.

Digital Banking Market Analyses

- According to coinlaw.io, the global digital banking platform market is projected to reach USD 12.94 billion by 2025, growing at a 13.23% CAGR from 2024 to 2032.

- In the same period, 80% of millennials prefer digital banking, and 48% say they would change banks if the digital service is not seamless.

- In the U.S., 80% of bank transactions are expected to happen on digital platforms.

- Digital-only banks could serve 50 million U.S. customers by the end of 2025.

- Open banking continues to grow, with around 94 million U.S. consumer accounts sharing data via APIs.

- Meanwhile, digital banks’ customer acquisition costs are 60% lower than those of traditional banks.

- Meanwhile, 68% of global banks plan to increase cloud investment by 2026.

- By 2025, the global digital banks will generate a net interest income of USD 956.3 billion, up from USD 822.5 billion in 2024.

- About 3.6 billion people will use digital banking globally.

- In the United States, approximately 76% of adults use mobile banking apps, and 73% use online banking regularly.

- Digital banking revenue is expected to reach USD 1.61 trillion in 2025.

- The global neobanking market is forecast to reach USD 262.36 billion by this year as more customers choose fully digital services.

- Now, over 90% of banking interactions happen online.

- Digital banks achieved an 81% customer satisfaction rate.

- Voice banking is also expanding via Alexa and Google Assistant.

Digital Transaction Management Market Analyses

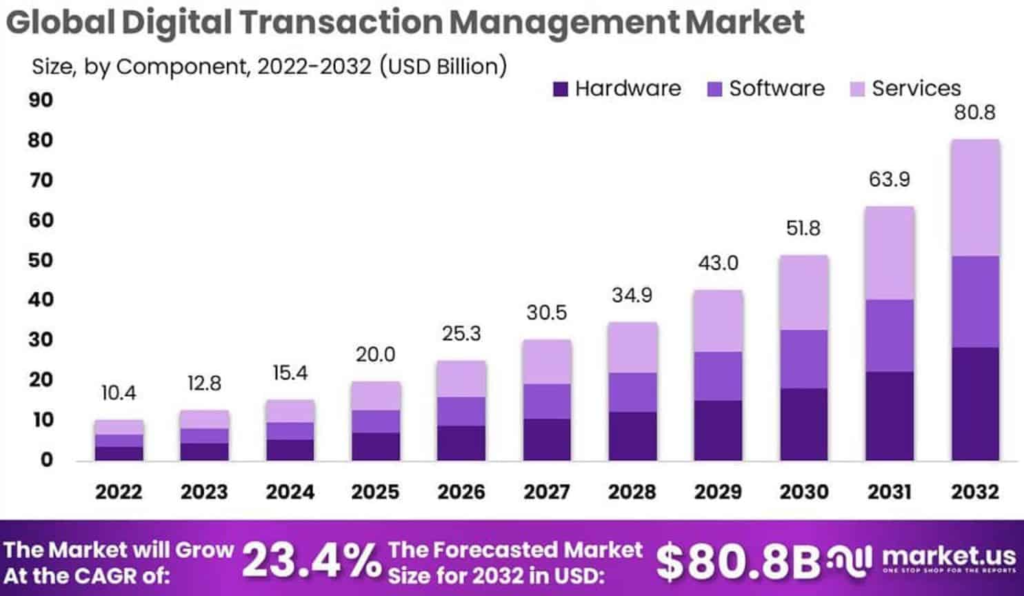

(Source: market.us)

- The Global Digital Transaction Management market is expected to reach around USD 20 billion by 2025, up from USD 15.4 billion in 2024.

- Furthermore, estimated DTM market valuations are as follows: USD 25.3 billion (2026), USD 30.5 billion (2027), USD 34.9 billion (2028), USD 43 billion (2029), USD 51.8 billion (2030), USD 63.9 billion (2031), and USD 80.8 billion (2032).

- The market will grow at a 23.4% CAGR from 2026 to 2032.

Active Digital Banking Users Statistics By Region

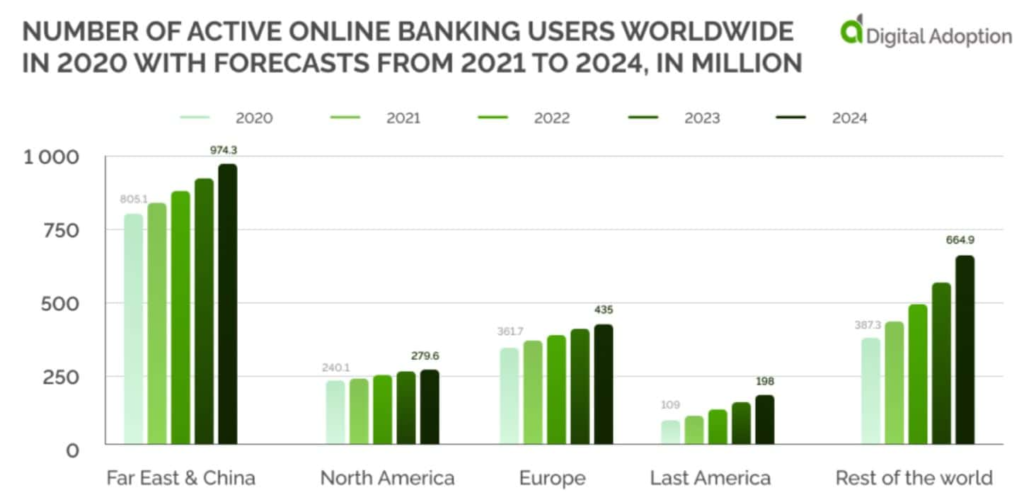

(Source: digital-adoption.com)

- As of 2024, the largest number of digital banking users was in the Far East and China, at 974.3 million.

- Users followed by North America (279.6 million), Europe (435 million), and Latin America (198 million).

- The rest of the world accounted for 664.9 million active online banking users.

The previous years’ user counts are mentioned in the table below:

| Region | 2023 | 2022 | 2021 | 2020 |

| Users (in millions) | ||||

| Far East & China | 928.9 | 885.6 | 844.4 | 805.1 |

| North America | 272.7 | 261.4 | 250.5 | 240.1 |

| Europe | 416.4 | 398.1 | 379.9 | 361.7 |

| Latin America | 170.4 | 146.7 | 126.4 | 109 |

| The rest of the world | 578.5 | 504.9 | 441.8 | 387.3 |

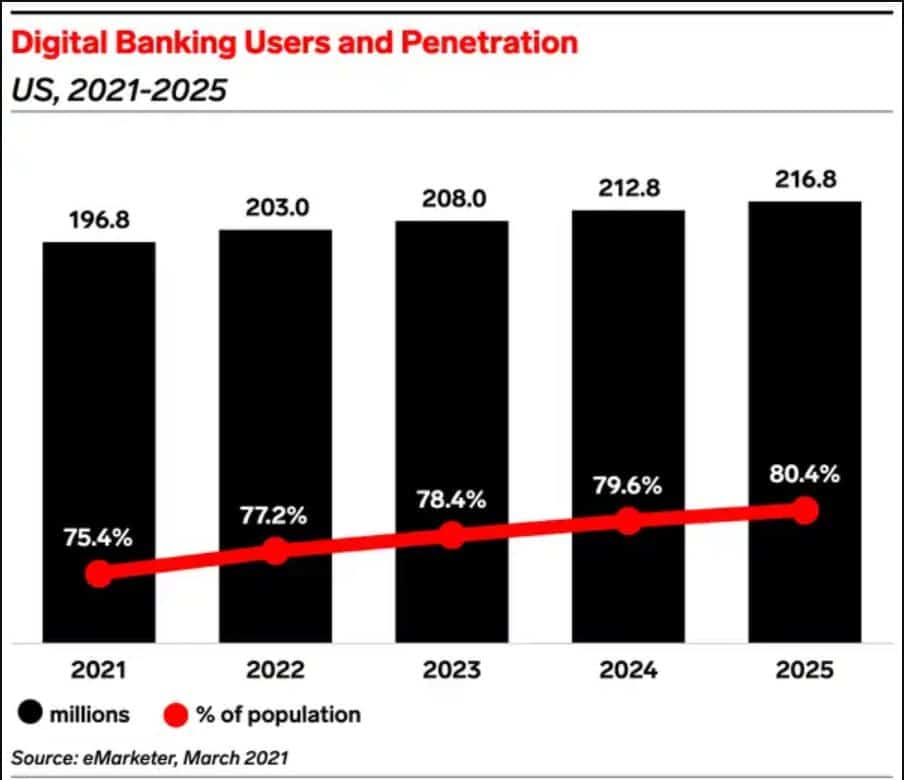

Digital Banking Users Statistics In the United States

(Source: i.insider.com)

- By 2025, the number of digital banking users is projected to reach 216.8 million, with penetration rising to 80.4%.

- As of 2024, there were 212.8 million digital banking users, equal to 79.6% of the population.

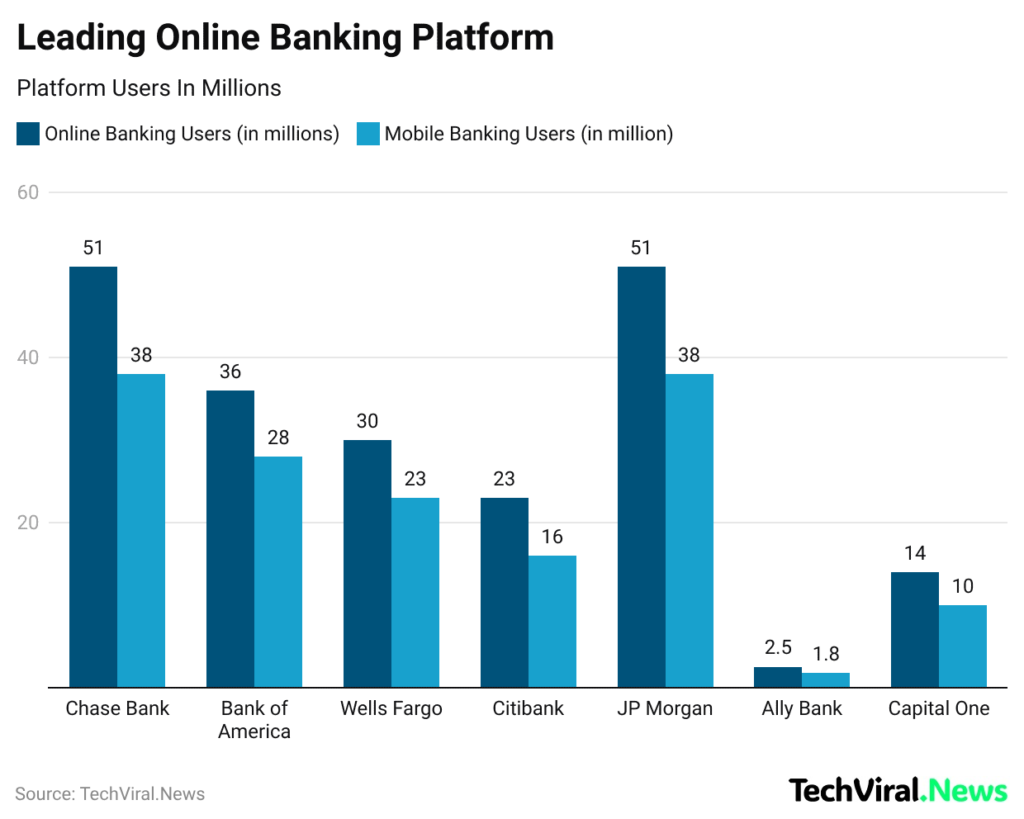

Leading Digital Banking Platforms Statistics By Users

(Reference: scoop.market.us)

- Chase Bank is a leading online banking platform with more than 51 million online banking users and 38 million mobile banking users.

Users of other digital baking platforms are mentioned in the table below:

| Platform Name | Online banking | Mobile banking |

| Users (in millions) | ||

| Bank of America | 36 | 28 |

| Wells Fargo | 30 | 23 |

| Citibank | 23 | 16 |

| JPMorgan Chase | 51 | 38 |

| Ally Bank | 2.5 | 1.8 |

| Capital One | 14 | 10 |

Mobile Banking Statistics

- Globally, the number of digital banking users will reach 3.6 billion in 2024.

- In the United States, almost 76% of adults use mobile banking apps.

- By 2025, digital banking channels are expected to account for over 90% of banking interactions globally.

- The infographic also reports high penetration in China, with over 80% of Chinese internet users engaging in online banking.

- Around 85% of consumers believe mobile banking is safe and secure.

Mobile Banking Activity Statistics By Users

- According to scoop.market.us, 37% of online banking users and 15% of mobile banking app users report inquiring about a product.

Besides, other users’ shares based on activities are stated in the table below:

| Activities | Online Banking | Mobile Banking App |

| Inquire about a product | 37% | 15% |

| International money transfer | 53% | 24% |

| Update an account’s details | 47% | 26% |

| Pay bills | 44% | 41% |

| Transfer money to another person | 38% | 48% |

| Transfer from one account to another | 38% | 46% |

| Balance Inquiry | 29% | 56% |

Digital Banking Adoption And Usage Statistics By Age Demographics

(Source: scoop.market.us)

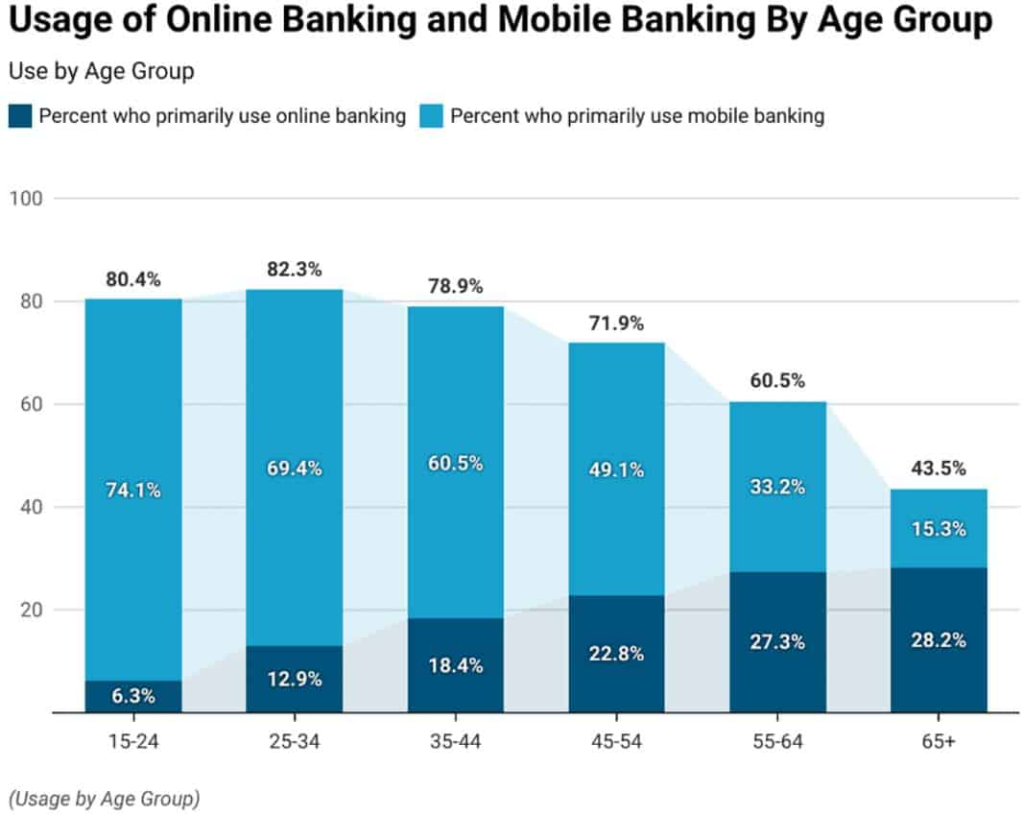

- Digital banking users aged 25-34 lead, accounting for 82.3%, with 12.9% primarily using online banking and 69.4% using mobile banking.

- Next are ages 15-24 at 80.4% (6.3% online, 74.1% mobile), followed by ages 35-44 at 78.9% users (18.4% online, 60.5% mobile), 45-54 come next with 71.9% users (22.8% online, 49.1% mobile) and 55-64 total 60.5% users (27.3% online and 33.2% mobile).

- Finally, users aged 65 years and above have the lowest overall share at 43.5%, with 28.2% online and 15.3% mobile.

By Ethnic Groups

- Among people identifying as two or more races, 52.3% use a mobile banking app and 20.6% use online banking.

Other ethnic group users’ shares are stated in the table below:

| Ethnicity | Mobile Banking App | Online Banking |

| White | 50.6% | 13.3% |

| Native American or Alaska Native | 49.6% | 11.6% |

| Hispanic | 48.6% | 25.7% |

| Asian | 45.4% | 12.1% |

| Black | 41.1% | 25.8% |

Digital Banking Usage Statistics

- According to market.biz, Bank of America is a leader in digital banking, with more than 30 million active mobile app users and more than 40 million online banking customers.

- In China, the digital banking market is projected to reach USD 4.6 billion by 2026, with a 19.9% CAGR.

- Across the Asia-Pacific region (including India, South Korea, and Australia), the market is projected to reach USD 615.6 million by 2026.

- Japan and Canada are also strong markets: from 2021 to 2026, Japan may grow at an 11% CAGR, while Canada may grow at 13.1%.

- In Europe, Germany is estimated to grow at about a 14.5% CAGR, and the rest of Europe is expected to reach USD 5.2 billion by 2026.

- India already has 295.5 million digital banking users, with over 70 million more than the U.S.

- Net interest income of the digital banking sector will grow at a 6.86% CAGR from 2024 to 2029, reaching USD 2.09 trillion by 2029.

- By 2029, customer deposits at digital banks may exceed USD 5.4 trillion worldwide.

- By 2025, more than 90% of banking interactions may occur through digital channels.

- Digital spending per USD 1 billion in assets accounted for USD 200,000 in 2022 to nearly USD 780,000 in 2024, a 310% increase.

Digital Banking Adoption Rates

- In 2024, Finland has the highest online banking adoption rate at 95%.

- Followed by Norway and South Korea at 91%, while the US and UK are near 72%.

(Source: seon.io)

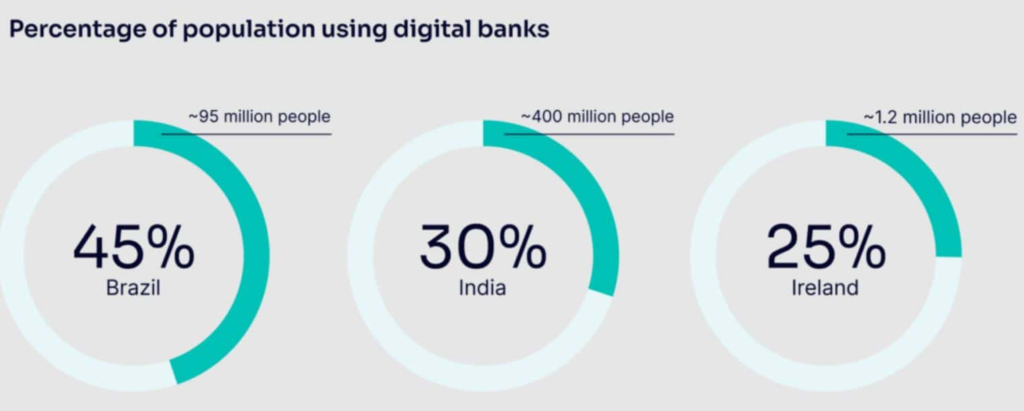

- 45% of people in Brazil use the digital banking in recent years.

- In India, 30% of people use a digital account, and this may rise to 46% in the next three years.

- In Ireland, approximately 25% of people use digital-only banks (about 1.2 million), and this share is projected to reach 36% by 2027.

Digital Banking Payment Adoption Statistics By Industries

(Reference: magecomp.com)

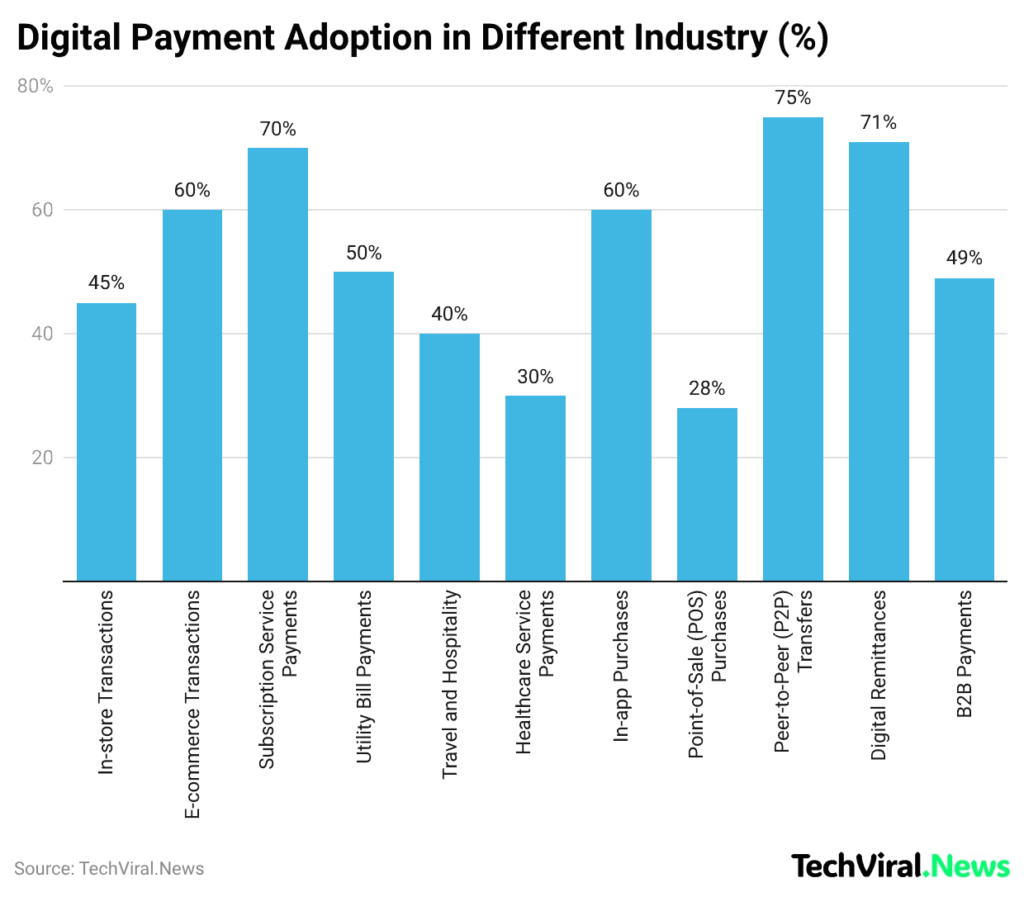

- As of 2025, the graph above indicates that digital remittances account for the largest share of digital payments, at 75%.

- Next come peer-to-peer (P2P) transfers at 71%, and subscription service payments at 70%.

Furthermore, other digital payment adoption rates are mentioned in the table below:

| Industry /Use case | Adoption Rate |

| E-Commerce Transactions | 60% |

| In-app Purchases | 60% |

| Utility Bill Payments | 50% |

| B2B Payments | 49% |

| In-store Transactions | 45% |

| Travel and Hospitality | 40% |

| Healthcare Service payments | 30% |

| Point-of-sale (POS) Purchases | 28% |

Digital Banking Payment Transaction Statistics By Platforms

- A report published by MageComp indicates that, by February 2025, Alipay recorded 220 billion transactions.

- Meanwhile, BHIM UPI accounted for 125 billion transactions in India, followed by PhonePe (120 billion) and Paytm (95 billion).

Besides, the number of transactions by other digital platforms is stated below:

| Platforms | Number of Transactions (in billion) |

| Google Pay | 85 |

| Amazon Pay | 40 |

| Razorpay | 12 |

| Apple Pay | 10 |

| PayPal | 10 |

| Samsung Pay | 7 |

| MobiKwik | 5 |

| Freecharge | 3 |

Reasons For Using Digital Banking Statistics

- A report on publications.iadb.org stated that the primary advantage of digital payment banking is cost savings and that 75% of consumers consider it a good choice.

| Reasons | User Share |

| Cutting down on cash usage | 74% |

| Making payments more convenient | 66% |

| Helping with budgeting | 58% |

| Making loans and investments easier to access | 51% |

| Offering greater security than cash | 49% |

| Supporting emergency preparedness | 48% |

| Increasing sales | 46% |

| Reducing issues with change | 38% |

| Enabling automated record-keeping | 28% |

Digital Banking Statistics By Security Concerns And Authentication Advances

- According to the CoinLaw report, 83% of users in digital banking remain concerned about data breaches.

- On mobile, 77% of users now rely on biometric sign-in, higher than in earlier years.

- Around the world, 70% of banks use multi-factor authentication to protect accounts better.

- In 2025, AI-based fraud checks will help stop more than USD 9.3 billion in losses each year.

- Strong protection is common too, with 94% of digital banks using end-to-end encryption for data in transit.

- Also, 59% of banks use device-based checks.

- Phishing affects 11% of users in 2025.

- About 48% of digital banks use tokenisation.

- Behavioural biometrics reduces fraud by 15%.

- Passwordless login is offered by 52% of banks.

Conclusion

In conclusion, digital banking has now become a regular part of life for many people because it is fast, easy, and accessible at any time via smartphones. Customers use it for both everyday activities and important financial needs like loans and investments. Nevertheless, people in different places and groups do not adopt digital banking in the same way due to several challenges, including fraud, low trust, limited digital skills, weak internet connectivity, and a lack of appropriate devices.

Building stronger confidence and encouraging wider use of digital banking should make their services easier to understand, safer to use, and more user-friendly, while also providing prompt and reliable support whenever users need assistance.

FAQ

The primary reason for its use is to enable fast, easy, secure, and accessible banking at any time.

East money transfer, balance check, view statements, apply for loans, and invest online.

Digital banking is safe if you use strong passwords, avoid scams, and never share OTPs.

Due to fear of getting fraud, low trust in technology, poor digital skills, weak internet connectivity, and limited smartphone use.

It may reduce branch visits, but branches remain important for complex services and personal support.