Introduction

Data Privacy and Trust in Banks Statistics: In recent years, to gain customers’ trust, banks have implemented data privacy measures as their banking processes collect and store personal data, including names, phone numbers, account numbers, and transaction histories. Customers provide this information while opening an account, using debit or credit cards, applying for loans, or logging in to mobile banking apps.

Advanced digital systems are interconnected; therefore, users’ personal information can be quickly shared with third-party service providers. As a result, data privacy has become a major factor in banking trust. By keeping data secure and using it only for legitimate purposes, banks help customers feel safe and respected. However, if information is leaked, shared carelessly, or stolen, confidence can drop fast.

This article on Data Privacy and Trust in Banks Statistics presents several statistical analyses and insights that will help readers better understand the topic.

Editor’s Choice

- According to Coherent Market Insights, the global digital trust market size was USD 425.33 billion in 2025.

- A survey by the ABA Banking Journal reports that 81% trust their main bank’s data security.

- According to usercentrics.com, data protection rules covered approximately 6.3 billion people (79% of the global population) in 2024.

- The global data privacy software and technology market is projected to increase to USD 5.37 billion by 2025.

- Consumers value security and transparency; 72% switched banking institutions for stronger protection.

- In approximately 44% of cases, data breaches expose personal customer details, such as names, email addresses, and passwords.

- Globally, 68% worry about online privacy, and 85% strongly want to protect it in 2025.

- Banking data analytics is mainly used for risk analytics and credit scoring (30%), followed by fraud detection and prevention (25%).

- Edelman’s 2025 Trust Barometer reports that trust in traditional banks in India is 89%.

- Usercentrics’ report further states that from 2019 to 2024, total privacy spending increased by more than double.

General Statistics On Data Privacy And Bank Customers’ Trust

- Thales Cyber Security Solutions reports that banking ranks #1 in personal-data trust: 44% (51% over-55s; 32% Gen Z).

- ABA Banking Journal survey reports that 81% trust their main bank’s data security.

- Compared with 58% for other traditional banks, 45% for other digital banks, 44% for tech companies, and 45% for other financial services providers.

- 62% would lose confidence, and 43% would stop engaging.

- Thales reports that 19% were told their data had been compromised in the past year, and 82% abandoned a brand in the last 12 months due to data-use concerns.

- 86% expect privacy rights, and 63% feel too much responsibility is put on consumers.

- Meanwhile, 37% share data only when required, and 34% share because they trust organisations.

- 64% preferred passwordless login, biometrics, and MFA.

- EPAM report further stated that approximately 79% of respondents trust banks.

- 37% of consumers aged 18-34 switched within 12 months due to a security issue.

Data Privacy Statistics By Rules, Fines, And Public Opinion

- According to usercentrics.com, data protection rules covered around 6.3 billion people (79% of the global population) in 2024.

- At the start of 2025, 144 countries had data and consumer privacy laws.

- In the U.S., 21 states (42%) had passed privacy laws by early 2025.

- In Europe, as of January 2025, the EU had three active laws and one forthcoming law related to online privacy and the use of digital technologies.

- California’s CCPA protects more than USD 12 billion in personal data annually.

- In 2024, GDPR violations led to fines totalling EUR 2.1 billion in the EU.

- Most of the largest fines were issued in EMEA (54%), followed by North America (43%).

- 62% of UK citizens report feeling safer sharing data after the GDPR/UK GDPR, and 72% of Americans favour stronger regulation.

- More than 50% of U.S. voters support a national privacy law, including limits on data sales (87%), reduced data collection (86%), stronger child privacy protections (86%), and the right to sue after data breaches (82%).

- Yet 63% of Americans know little about current privacy laws.

- 79% of Cisco’s corporate respondents reported that privacy laws helped their organisations.

Importance of Data Privacy In Banks

- It helps Banks to comply with regulations, such as the GLBA and FFIEC, and avoid substantial fines or legal action.

- Next, implement safeguards to protect customer trust, as a breach can erode it and make it harder to acquire new customers.

- Moreover, security gaps can lead to fraud, including identity theft and money laundering, thereby damaging the bank’s assets and stability.

- Also secure sensitive business information, including intellectual property such as trading algorithms.

- Data breaches can disrupt day-to-day banking operations, resulting in downtime and irreparable damage.

- They also raise legal exposure and costs, while major incidents can undermine markets and financial stability.

Digital Trust Market Size Analysis

- According to Coherent Market Insights, the global market for digital trust totalled USD 425.33 billion in 2025.

- Meanwhile, it is expected to reach USD 1,090.7 billion by the end of 2032, with a CAGR of 14.4% from 2025 to 2032.

- The Finance and Banking sector is projected to account for the largest share of the digital trust market in 2025, at 36.0%.

- As of 2025, North America accounted for the largest share of the digital trust market at 35%, followed by Europe at 30%, while Asia-Pacific ranked third at 20%.

- Mastercard reports that its AI-driven Decision Intelligence reviews billions of transactions, reducing false declines by up to 54% and boosting fraud detection by 50%.

- Meanwhile, 69% of banking platforms argue that AI is essential for responding to cyberattacks.

- Moreover, 60% of finance platforms consider cybersecurity risk a key factor when working with third parties.

Data Privacy Software And Technologies Statistics

- The global data privacy software and technologies market has increased from USD 5.37 billion in 2025 to USD 45.13 billion by 2032, with a CAGR of 35.5% over the period.

- The United States market is projected to reach approximately USD 17.19 billion by 2032.

- Small and medium-sized businesses are also adopting privacy tools, particularly consent management platforms will grow at a 10.6% CAGR.

- By the end of 2025, approximately 60% of large organisations are expected to use at least one privacy-enhancing computation (PEC) method in analytics, BI, and/or cloud systems to protect data in use.

- Importantly, 95% of organisations report that privacy investments deliver more value than they cost.

Data Privacy Regulations Impacting Banking Services

| Regulation/Region | Key update/impact |

| GDPR (Global/EU) | CoinLaw reports that by Aug 2025, total GDPR fines exceeded €6.2 billion. |

| CCPA (California, USA) | Rules required audits and risk assessments for more than 60% of U.S. banks. |

| DPDP Act 2025 (India) | Non-compliance may result in penalties of up to ₹250 crore. |

| LGPD (Brazil) | Fines crossed BRL 98 million, affecting multinational financial entities. |

| Digital Finance Package (EU) | Stronger privacy and open finance regulations affected more than 70% of fintech companies. |

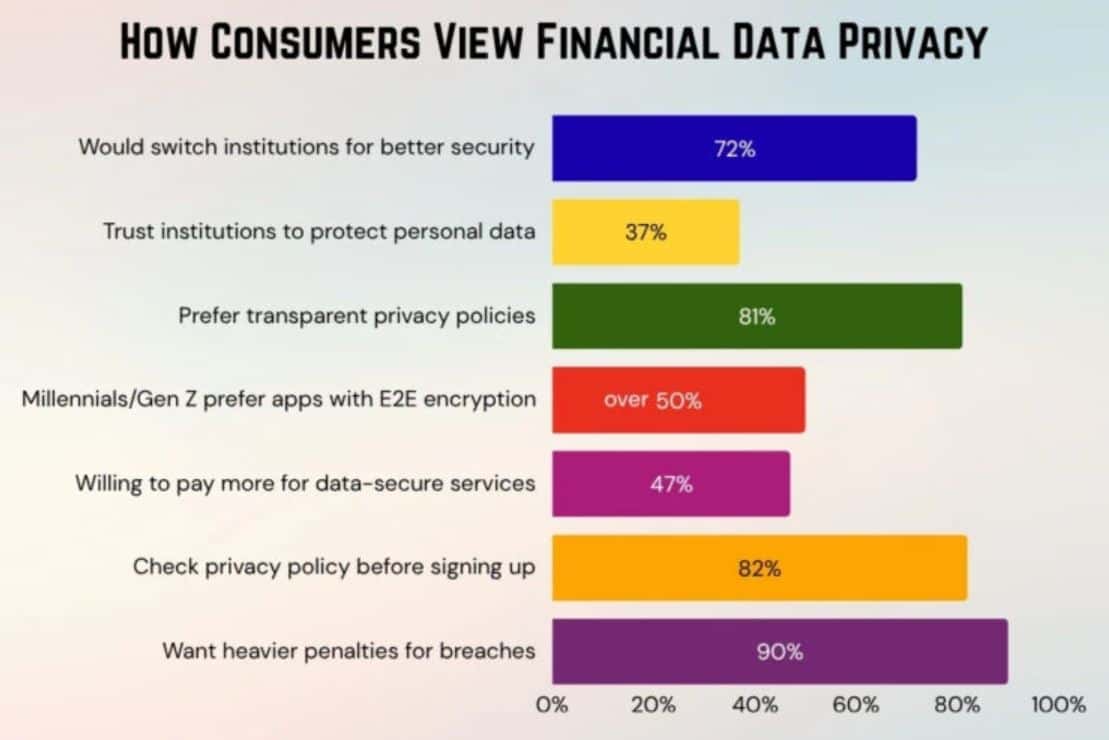

Consumers’ Review of Financial Data Privacy

(Source: coinlaw.io)

- As of 2025, nearly 90% consumers favour increased penalties for data breaches.

- Meanwhile, 82% check the privacy policy before signing up, 81% want clear privacy policies, and 72% would switch institutions for stronger protection.

- More than 50% of Millennials/Gen Z prefer apps with end-to-end (E2E) encryption, 47% are willing to pay more for data-secure services, and 37% trust institutions to protect personal data.

Data Privacy Breaches Analysis

- Data breaches often expose personal customer details, such as names, email addresses, and passwords, which accounted for 44% of cases.

- As of 2025, global losses from cybercrime are estimated at approximately USD 10.5 trillion annually.

- Between 2024 and 2029, the global cost is projected to increase by USD 6.4 trillion (a 69.41% increase).

- In 2024, the average breach cost for banks increased by 12% year-on-year to USD 4.62 million.

- Nearly 30% of breaches worldwide were linked to phishing, making it one of the top causes.

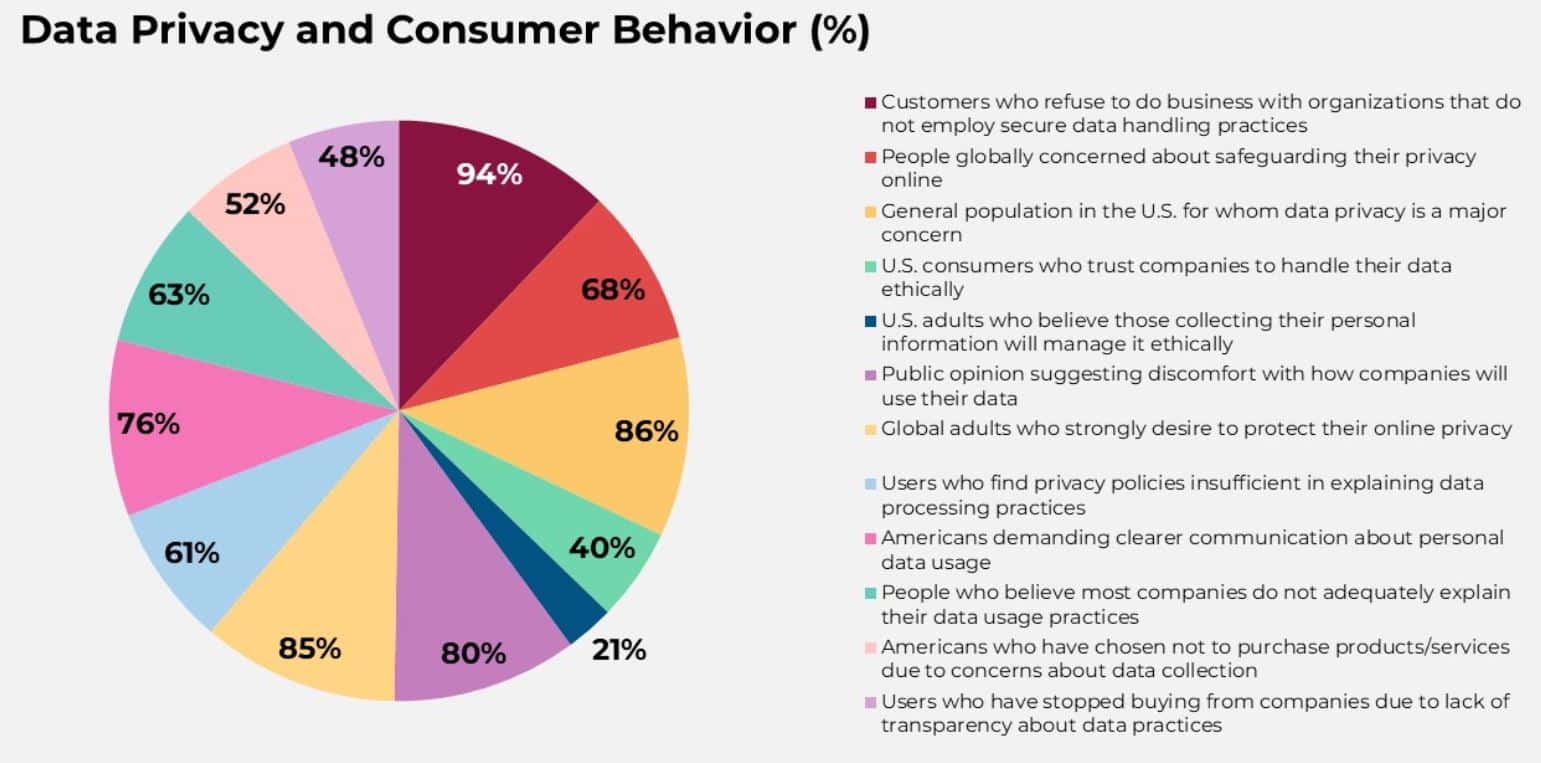

Data Privacy And Consumer Behaviour Statistics

(Source: market.biz)

- As of 2025, nearly 68% of respondents worried about online privacy, and 85% strongly wanted to protect it.

- 86% reported data privacy as a risk concern, but only 40% trusted that their data would be handled ethically.

- Only 21% trusted data collectors; many anticipated uncomfortable uses, and 80% anticipated unintended use.

- 94% said they wouldn’t do business with firms that lacked secure data-handling practices.

- About 61% found privacy policies unclear, and over half accepted them without reading.

- 76% wanted clearer data-use communication, while 63% said most companies didn’t explain well, 52% avoided buying, and 48% stopped buying.

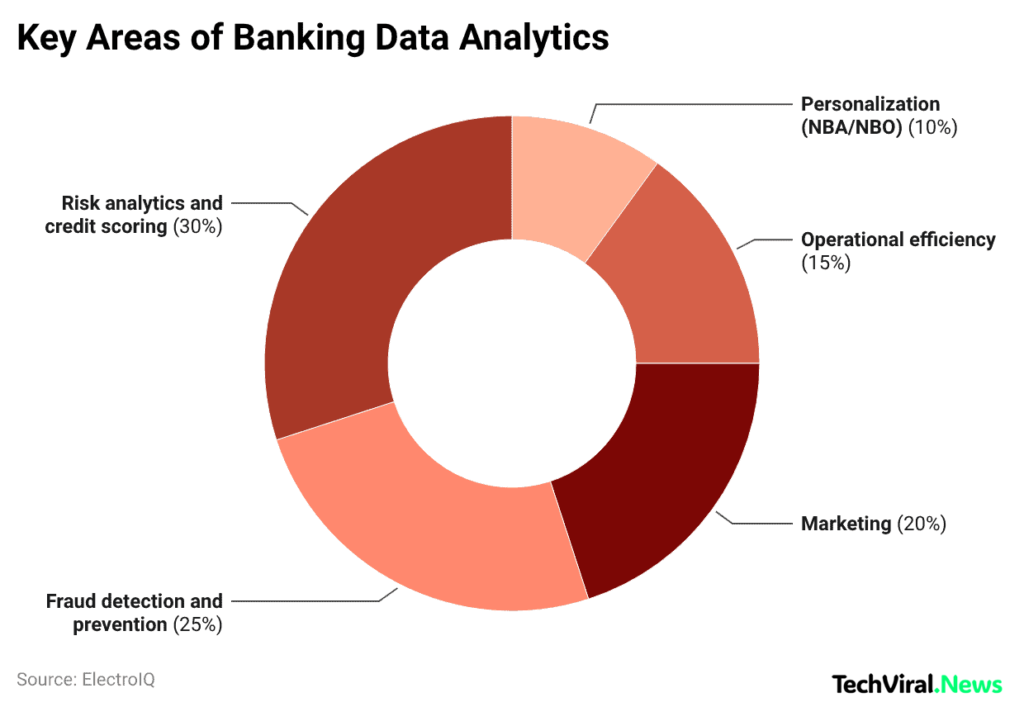

Key Areas of Banking Data Analytics

(Reference: innowise.com)

- Banking data analytics is mainly used for risk analytics and credit scoring (30%), followed by fraud detection and prevention (25%).

- It also supports marketing (20%), followed by operational efficiency (15%), and personalisation, including next-best-action/next-best-offer (10%).

Bank Customer Trust Levels Worldwide In 2025, By Country

- Edelman’s 2025 Trust Barometer reports that trust in traditional banks in India is 89%, up 2 points from 2024.

Furthermore, the trust level of other countries is mentioned in the table below:

| Country | Trust in traditional banks shares | Change rate |

| China | 89% | -4% |

| Thailand | 82% | +1% |

| Indonesia | 81% | -6% |

| Singapore | 80% | +7% |

| Saudi Arabia | 78% | -2% |

| Malaysia | 77% | -8% |

| Mexico | 75% | +5% |

| Nigeria | 75% | +2% |

| South Africa | 75% | +3% |

| Kenya | 74% | +1% |

| UAE | 74% | -10% |

| Brazil | 73% | +2% |

| Canada | 67% | +1% |

| Colombia | 67% | +12% |

| Netherlands | 67% | +8% |

| U.S. | 66% | +5% |

| Argentina | 65% | +10% |

| UK | 64% | +7% |

| South Korea | 60% | -2% |

| Ireland | 57% | +11% |

| Australia | 56% | -2% |

| Germany | 55% | +5% |

| France | 53% | -4% |

| Japan | 53% | -1% |

| Sweden | 53% | 0% |

| Italy | 49% | +1% |

| Spain | 48% | +3 |

Benefits of Investing In Data Privacy Statistics

- Usercentrics’ report further states that from 2019 to 2024, total privacy spending increased by more than double.

- More than 70% of business professionals reported that their privacy work has delivered “significant” or “very significant” value.

- Many firms achieve positive payback, and more than 40% report benefits at least twice their spending.

- On average, each USD 1 invested in privacy yields approximately USD 2.70 in benefits.

- Privacy investment also builds trust: 80% of organisations report higher customer loyalty, and 84% of consumers report greater loyalty to companies with strong security controls.

- It also helps internal performance, with 78% reporting better efficiency, agility, and innovation.

Conclusion

Customers’ trust and loyalty increase when people feel confident that their banks are keeping their personal information as secure as their financial assets. As online banking has expanded in recent years, many systems have become interoperable, increasing the risk of personal data loss. Thus, data privacy is treated as an important criterion that helps banks build trust by collecting only the data they need, along with safeguarding all personal information with robust security.

Customer trust plays a significant role in banks’ investment decisions, as it is informed by clear permissions, straightforward policies, prompt action following breaches, and shared responsibility with partners.