Introduction

Customer Satisfaction and NPS in Banking Statistics (2026): The year 2026 finds the global retail banking sector at a pivotal intersection of rapid digital transformation and evolving consumer expectations. Financial institutions are no longer just places to store and transfer money; they have evolved into comprehensive digital ecosystems powered by AI, data analytics, and hyper-personalized financial services. With billions of users managing their wealth primarily through mobile apps and online portals, the battle for customer retention is fiercer than ever.

Today, a bank’s growth and stability are heavily dictated by its Net Promoter Score (NPS) and overall customer satisfaction metrics. Modern consumers demand a frictionless digital experience, transparent fee structures, robust cybersecurity, and on-demand human support for complex financial decisions.

This comprehensive analysis synthesizes the latest customer satisfaction data, NPS benchmarks, user behavior trends, and industry research. By examining global market shares and shifting demographics, this report depicts the definitive landscape of banking loyalty and the core drivers of customer contentment in 2026.

Editor’s Choice

- Customer satisfaction with digital banking in the USA, UK, and Canada is 86%, 82%, and 80%, respectively, indicating strong confidence in digital-first banking.

- 75% of Indian customers deem local-language support indispensable for digital banking satisfaction.

- Mobile banking usage in Brazil went up by 22% thanks to better internet and smartphone access.

- Japanese banks achieved a 78% customer satisfaction rate, largely due to digital wallets and QR code payments.

- The main reason for the 90% satisfaction rate among Australian digital-only bank customers is fee transparency.

- By introducing real-time fraud alerts, German banks have achieved 85% customer satisfaction.

- South Korea is the world leader, with 94% of customers still actively using mobile banking apps.

- Poor customer service is cited by 79% of customers as a reason for overall dissatisfaction with the bank.

- Banks with 24/7 live chat achieved an 88% satisfaction rating, while those without it earned only 76%.

- In the last two years, 41% of customers have left their banks because of poor service.

- 58% of respondents say fast response time is the most important service factor.

- 65% of customers would rather speak with a human being for complex banking issues.

- Solving complaints before they even arise and engaging the customers in the process led to a 20% increase in customer retention.

- The ability to communicate in different languages has increased non-natives’ satisfaction to 84%.

- By personalising the financial advice, banks have been able to change the image that 68% of their customers had about them.

- The banks that run free financial literacy seminars and workshops have doubled their customer engagement.

- A little less than half (i.e., 47%) of small business owners received proactive banking advice during the recession and period of uncertainty.

- Making customers feel comfortable with the bank’s suggestions to save money and cut down on non-essential spending is preferred by 59% of customers.

- The average Net Promoter Score (NPS) for international banking websites in the 3Q 2025 SUPR-Q database is -9%, which is 10% below the industry average.

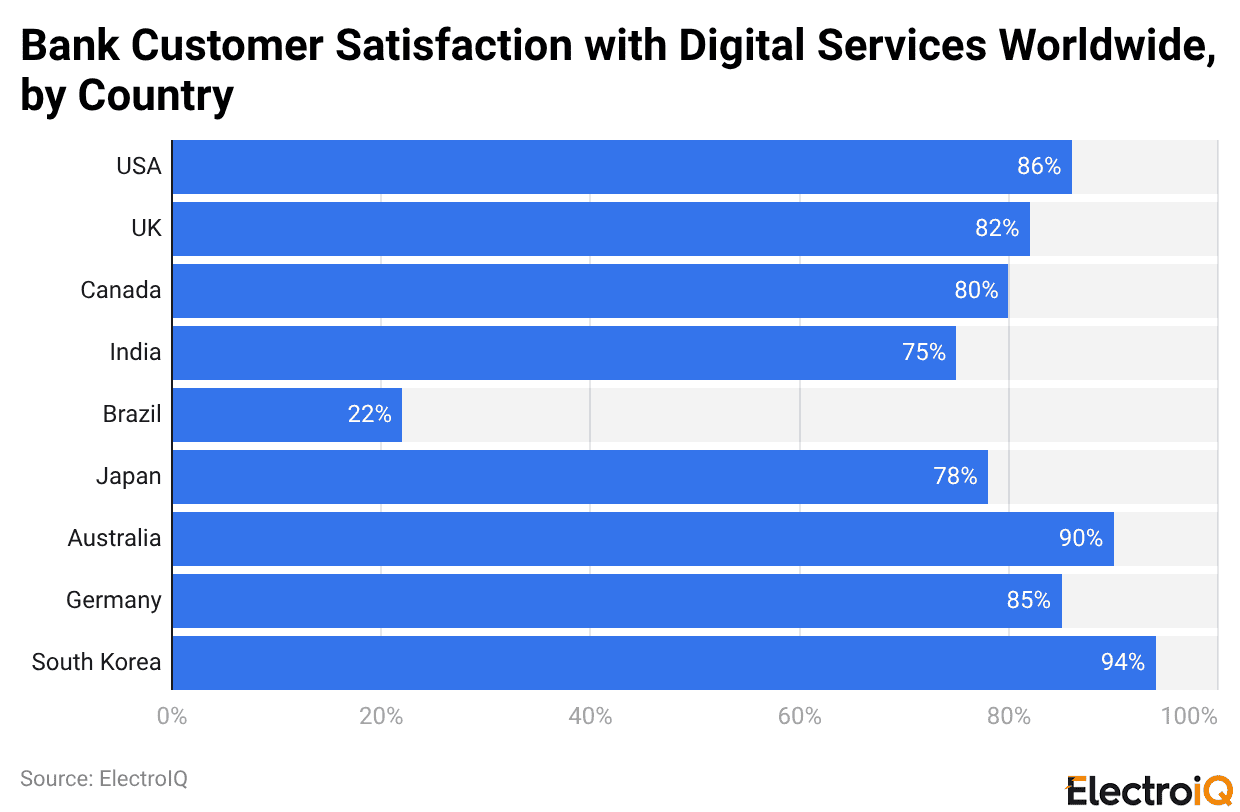

Bank Customer Satisfaction With Digital Services Worldwide, By Country

(Reference: coinlaw.io)

- The global trend is that customer satisfaction with digital banking is high in technologically advanced regions, while customer expectations are also high in these regions.

- The US is the most satisfied country with 86%, while the UK and Canada are close behind, showing great confidence in digital-first banking.

- In India, satisfaction is mostly dependent on service availability and local-language support, as 75% of customers consider these must-haves.

- Brazil has seen a rapid increase in customer satisfaction due to the expansion of smartphone and internet access.

- The high level of customer satisfaction in Japan can be attributed to the extensive use of digital wallets and QR code payments, whereas Australia is praised for being the most transparent about fees, which is a very important factor for those using digital-only banks.

- Germany’s high level of satisfaction is a result of successful real-time fraud alerts, and South Korea is the top country in the world for mobile banking customers, with almost all of them using banking apps.

Customer Service Quality

- The quality of customer service remains a major factor in determining the level of banking satisfaction.

- Most customers think that service quality is the most crucial aspect of their relationship with a bank, in which case, fast response times are the most important factor.

- The banks that provide 24/7 live chat support are far ahead of those that do not, and this clearly shows the importance of always-on support.

- Customer churn due to poor service remains prevalent, and many customers switch banks after a bad experience.

- Although technological tools play a big role, most customers still turn to human agents for help with complicated issues.

- Proactive complaint follow-ups and multilingual support are some of the factors that significantly contribute to customer satisfaction and the retention of diverse customer groups.

Providing Support and Advice Matters To Bank Customers

- Customers are increasingly looking for guidance and personalized financial support, not just transactions.

- Tailored advice improves customer perceptions of the bank and, consequently, leads to higher banking engagement, especially when banks provide financial literacy programs.

- Small business owners’ proactive advice is indispensable during economic downturns, whereas ordinary consumers would rather receive personalized recommendations on the reduction of their costs based on their spending habits.

- Personalized repayment plans have a profound impact on customer satisfaction, especially among those who have loans.

- Low-income customers depend on banks for easily accessible credit counselling, while younger generations, particularly Gen Z, prioritize long-term financial planning advice over immediate product promotions.

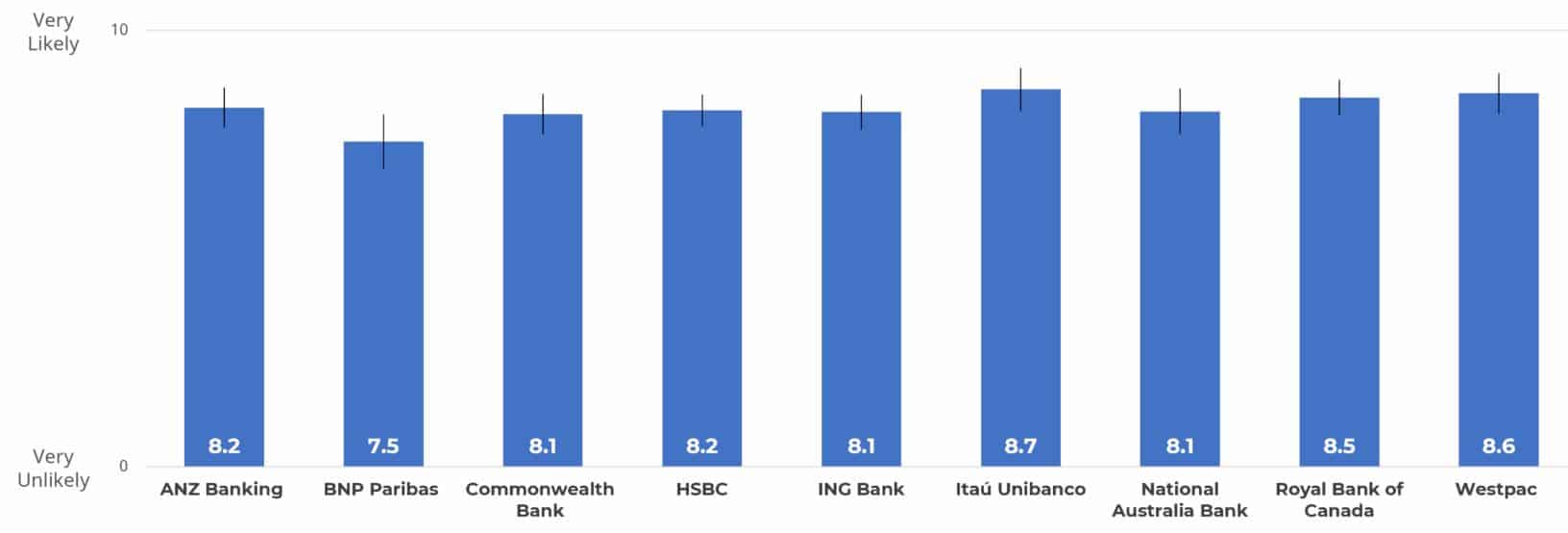

Loyalty / Net Promoter Scores

(Source: measuringu.com)

- In general, the majority of international bank websites managed to score positive Net Promoter Scores, indicating that customers of these banks are, on average, slightly more satisfied and willing to recommend them than those who are dissatisfied.

- However, three large banks mentioned—BNP, HSBC, and National Australia Bank—were exceptions to the rule, and their customers were less supportive of them.

- The websites of the international banking sector, on average, had an NPS of 9%, which means that promoters were just slightly more than detractors.

- This result is indeed much lower than the overall average of 19% in the 3Q 2025 SUPR-Q database, suggesting that the banking industry is less capable than others at fostering customer loyalty.

- The highest-scoring bank was Itaú Unibanco, with an NPS of 58%, while the lowest was BNP Paribas, with a negative NPS of −18%, indicating that this bank had more detractors than promoters.

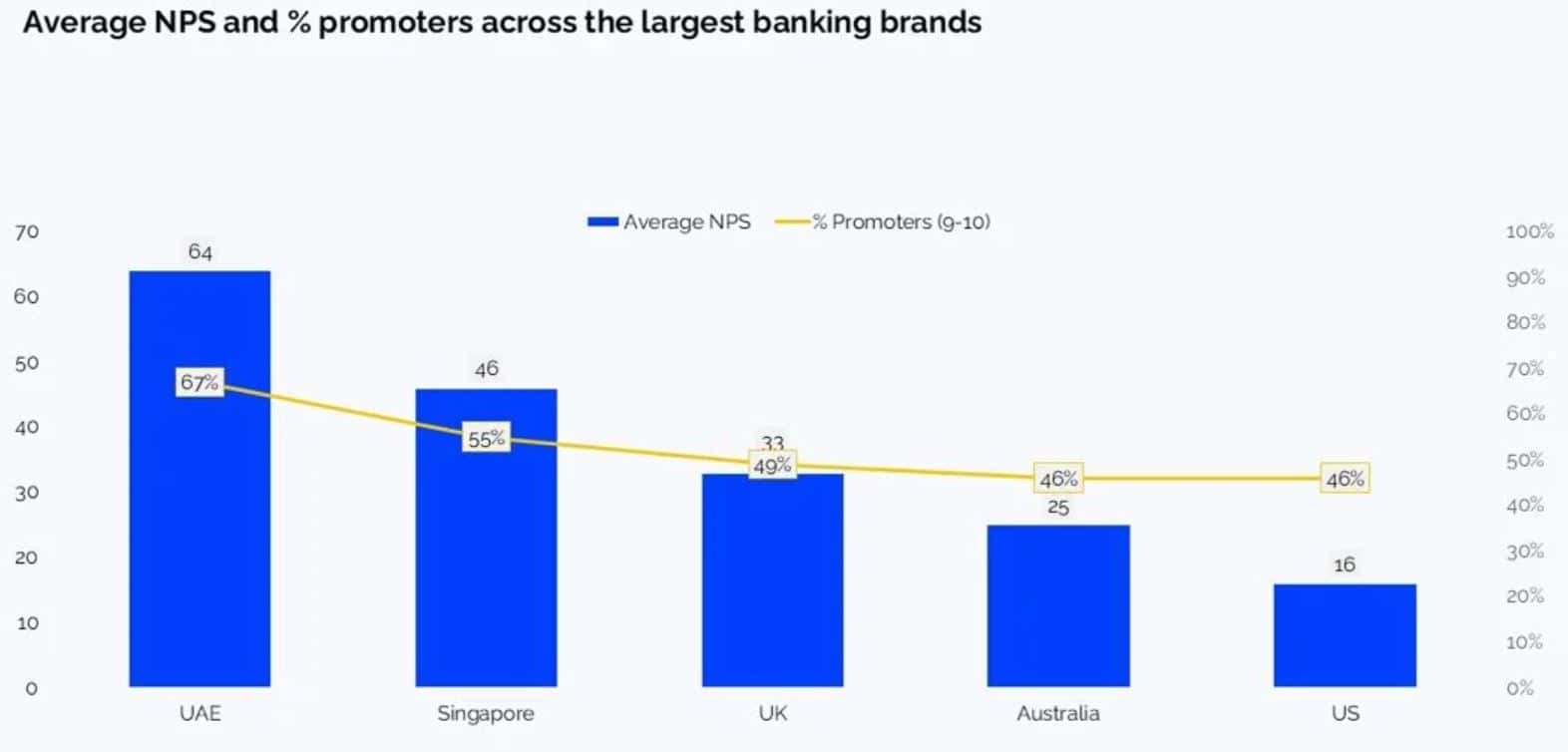

Average NPS and % Promoters Across the Largest Banking Brands

(Source: rfi.global)

- It is important to ensure that the comparison of major bank networks’ Net Promoter Scores and promoter percentages is both fair and meaningful.

- One of the main factors affecting customers’ reactions to NPS surveys is cultural differences between countries.

- In some countries, people are more likely to give very high or very low scores, whereas in others, people prefer to express their opinions through moderate ratings.

- This situation implies that NPS numbers based on teams from different countries could be misleading if taken literally.

- For example, in the UAE, 67% of customers are rated by their bank as promoters (scores of 9 or 10), whereas this figure is only 46% in the United States.

- Consequently, the average NPS appears much higher in the UAE (+64) than in the US (+16).

- However, it is not correct to conclude that banks in the US provide significantly worse services; rather, it is a matter of different scoring behaviors and cultural standards.

- Digital-only banks, traditional full-service banks with branch networks, and customer-owned institutions such as credit unions are very different types of banks and have distinct customer expectations.

- Comparing their NPS scores directly can lead to inaccurate conclusions. Not accounting for these differences may lead to comparing brands that have nothing in common.

- The matter is so clear when we consider the market leaders. In both the UK and Australia, digital-only neo-banks claim the highest NPS scores, +50 and +69, respectively.

- The opposite is true in the US, where the market leader is a credit union focused on the armed forces sector, with a score of +67.

- These disparities indicate that NPS leadership is heavily dependent on market structure, customer expectations, and the type of bank, rather than on a single parameter—service quality—alone.

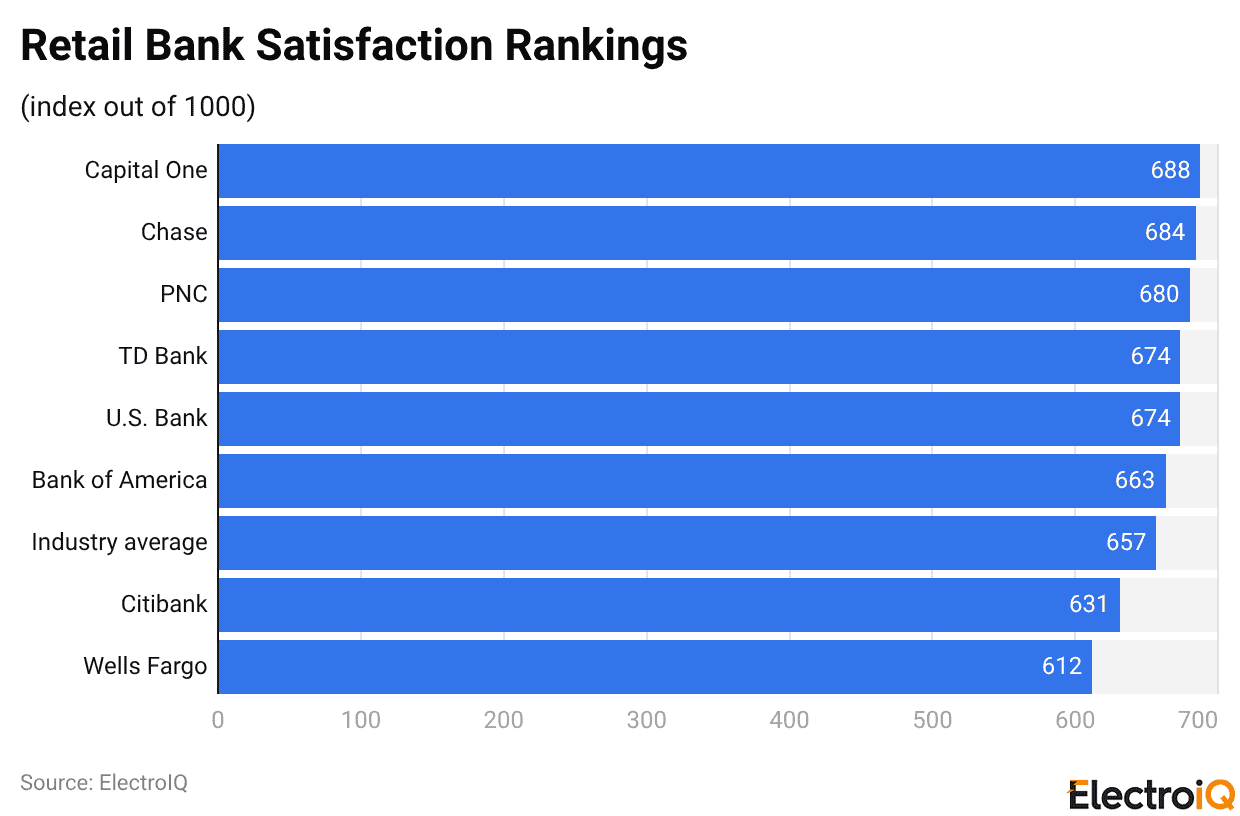

Retail Bank Satisfaction Rankings

(Reference: coinlaw.io)

- The ranking clearly differentiates the customer view of the biggest retail banking players.

- With a score of 688, Capital One is on top of the list and is thus considered the premium source of overall customer experience among big retail banks.

- Next in line is Chase, with a score of 684, reflecting the bank’s steady flow of customer approval. PNC has secured the third place with a score of 680, thus being the slightly favored competitor over the rest.

- TD Bank and U.S. Bank are equal at 674; both their scores are above the industry standard and proving that they are doing fairly well in terms of customer satisfaction.

- Bank of America, which scores 663, stays below the leading banks but is still competitive.

- The mean score for the banking sector is 657, providing a point of reference for comparison.

- Citibank, with 631, is far from the reference point, indicating that the bank is having difficulty meeting customer expectations, while at the same time Wells Fargo, with 612, has the lowest score, indicating a significant gap in customer satisfaction compared to the other banks.

The AI Impact on Banking Satisfaction

- Hyper-Personalisation at Scale: According to 2025 industry reports from Zendesk and PwC, 77% of banking leaders acknowledge that deeper AI-driven personalisation directly correlates with increased customer retention. AI enables institutions to shift from generic automation to proactive, individualised financial advice by analysing transaction patterns and life events in real time.

- Efficiency and Operational ROI: PwC’s 2025/2026 AI Business Predictions indicate that banks fully embracing “Agentic AI” (AI agents capable of automating complex, high-value workflows) can drive up to a 15-percentage-point improvement in their efficiency ratios, allowing them to scale customer service without proportional cost increases.

- The Necessity of the Human Touch: While AI chatbots efficiently deflect routine queries and provide 24/7 support, customer satisfaction drops significantly if the AI lacks contextual awareness or problem-solving capabilities. Research shows that 71% of customers still prefer human intervention for complex, high-stakes financial decisions, necessitating a “human-in-the-loop” design in which digital flows seamlessly escalate to live agents.

- Security as a Satisfaction Driver: AI-powered fraud-detection systems and biometric authentication are strengthening customer trust. Systems that analyse transaction patterns to block threats in real-time turn cybersecurity from a backend operational necessity into a frontline driver of customer satisfaction.

The Customer Experience Is All About Personalisation

- Personalisation has become an indispensable requirement in today’s banking landscape.

- It is now about 70% of customers who demand that banks provide personalised experiences and even customised financial counselling, which signifies a departure from the all-in-one approach that has been dominant for a while.

- Banks that practice individualisation in communication are sure to enjoy higher retention and satisfaction, as 80% of customers are inclined to use brands that offer custom services.

- 53% of the total number of customers, which is more than half, expect the banks to support the communication process by using their data, for instance, by making relevant product suggestions or providing insights.

- Nevertheless, there is a significant gap between what is expected and what is delivered—only 23% of consumers think they receive really personalised financial advice from their bank at present.

- Personalised recommendations, such as tailored loan offers or bespoke dashboards, go a long way toward increasing customer engagement.

- A lovely 20% more customers are likely to engage with banks that incorporate personalization in their services, and thus personalization says very loudly its role in customer relationships.

Balancing Digital And Human Touch In Banking Services

- The digital part of the banking industry continues to grow; human contact is vital, particularly when matters are complex and involve large sums of money.

- A considerable 71% of customers still favor talking with a human advisor when making major financial decisions, showing that the trust factor and personal coaching cannot be completely taken over by technology.

- The younger generation, especially, is one group that shows this preference more clearly, with 57% of Millennials and 65% of Gen Z stating they want humans when dealing with complicated banking issues.

- The investment in personal relationship managers for selected customers pays off directly, leading to a concomitant 22% rise in retention.

- The majority of customers—82%—think that digital tools ought to support and enhance human services rather than take over.

- When banks combine AI-assisted tools with human advisors, customer satisfaction increases by 16%.

- Traditional physical banking is still a must for the elderly population. According to the survey, 45% of Baby Boomers say they conduct major transactions at a bank branch.

The Rise of Neobanks and Direct Banking vs. Traditional Banks

- Digital-First Dominance in Satisfaction: The J.D. Power 2025 U.S. Direct Banking Satisfaction Study reveals that direct (online-only) banks drastically outperform traditional brick-and-mortar retail banks. The overall customer satisfaction score for direct bank checking accounts sits at 692 (out of 1,000)—which is 24 points higher than regional banks and 35 points higher than national branch-based banks.

- The Neobank Advantage: A 2025 banking analysis highlights a widening gap, with top neobanks (such as Revolut, Cash App, Chime, Ally, and SoFi) exceeding the satisfaction scores of the highest-rated legacy banks. For instance, Revolut led digital banks with a 59.4 satisfaction score, vastly outpacing traditional market leaders.

- Support During Economic Uncertainty: The core driver of this satisfaction is perceived support. Direct banks achieve high loyalty by equipping customers with easy-to-use digital tools for budgeting, credit improvement, and fee avoidance during challenging economic times.

- Mainstream Demographics: Neobank adoption is no longer limited to a niche cohort of early-adopter millennials. In 2025, neobank customers comprise roughly 31% of the U.S. population, with significant growth in the 30–64 age brackets, proving that superior UI/UX and low-fee structures have widespread appeal.

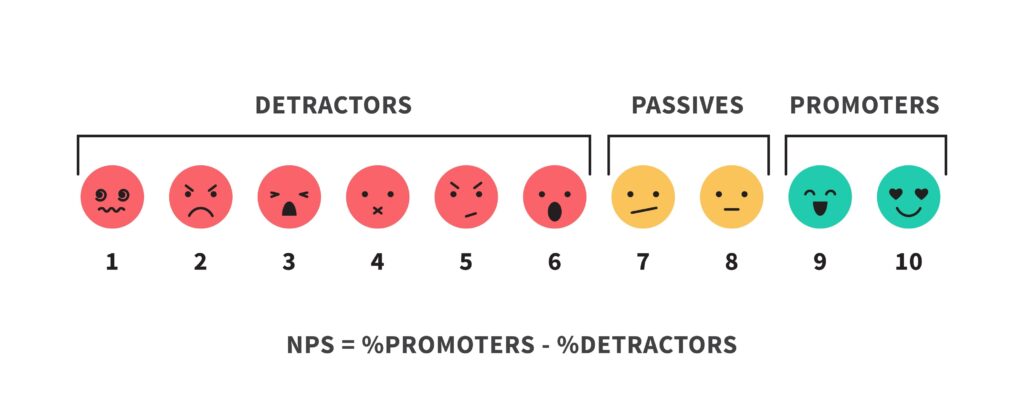

Understanding the NPS Scale in Banking

The NPS Framework: The Net Promoter Score (NPS) is a gold-standard metric measuring customer loyalty and satisfaction on a scale from -100 to +100. It is calculated based on responses to a single, critical question: “How likely are you to recommend [Bank Name] to a friend or colleague?”

Customer Segmentation: Respondents are categorised into three distinct groups:

- Promoters (Scores 9-10): Loyal enthusiasts who fuel organic growth and brand referrals.

- Passives (Scores 7-8): Satisfied but unenthusiastic customers who are vulnerable to competitive offerings.

- Detractors (Scores 0-6): Unhappy customers who have high churn rates and can damage brand reputation.

2025 Industry Benchmarks: According to 2025 benchmark data from SurveyMonkey and CustomerGauge, the financial services sector maintains a median NPS of 44, though traditional retail banking often scores lower (around 30). In this sector, an NPS above 30 is considered good, above 50 is excellent, and above 70 is world-class.

Market Leaders: Institutions like USAA consistently achieve world-class NPS scores (frequently around 75) due to transparent fee structures and exceptional customer service, whereas many traditional legacy banks hover in the 15 to 30 range.

Fee Structures And Transparency

- The clarity of the fees charged by a bank plays a significant role in customer trust and satisfaction.

- The majority of customers (54%) cite hidden fees as the biggest reason for their dissatisfaction with banks.

- Banks that clearly disclose all charges during account opening have 30% fewer customer complaints; hence, the power of upfront transparency is proven.

- A whopping 70% of the customer base said they would switch banks to avoid hidden fees, even though they might end up paying higher maintenance fees.

- On the contrary, banks that allow customers to choose the types and amounts of fees they will pay attract loyalty and retention 15% higher.

- The trend of switching is very clear among younger customers, with 36% of Millennials inclined toward subscription-based banking fees rather than the traditional model.

- The trust is also strengthened by banks that voluntarily disclose their overdraft procedures; in fact, 84% of customers consider this a sign of trustworthiness.

- Also, banks that began offering budget-friendly student accounts saw a 40% surge in new customers, demonstrating that clear, welcoming pricing can attract new groups.

Trust Security In The Digital Banking Era

- The majority of customers (81%) trust their main bank and believe it will take good care of their personal and financial information.

- Biometric authentication has made a significant difference, reducing unauthorised account access by 35%.

- Likewise, AI-based fraud detection systems have enabled banks to report 30% fewer cybercrime incidents.

- Customer trust goes even further with the implementation of additional security measures; 68% of clients feel more protected when two-factor authentication is offered across all services.

- Cybersecurity is especially crucial for the younger generation, as 52% of Millennials and Gen Z rank it among the top reasons for selecting a digital bank.

- Banks that offer real-time fraud alerts experience a 25% rise in customer trust; moreover, 40% of customers are even willing to pay higher fees for extra security features, which clearly shows that protection and trust dominate the banking choice.

Generational Divides in Banking Preferences

- Gen Z and Millennials (The Digital Natives): Deloitte’s 2026 banking outlook indicates that Gen Z and Millennials are converging into a unified, digitally native segment. They view banking primarily as an app-centric experience, prioritizing seamless mobile UI/UX, fast peer-to-peer transfers, and immediate access to alternative credit like Buy Now, Pay Later (BNPL).

- High Switching Intent: Despite reporting high overall satisfaction with their primary banks, younger consumers exhibit the highest risk of switching. Data shows that 82% of Gen Z consumers are willing to switch financial institutions entirely for a better digital experience, viewing banking relationships as easily interchangeable rather than lifelong commitments.

- The ESG Mandate: Environmental, Social, and Governance (ESG) factors are critical retention tools for younger cohorts. Approximately 64% of Gen Z consumers expect their banks to have clear, transparent sustainability strategies and are even willing to pay a premium for sustainable financial products.

- Baby Boomers and Gen X (The Traditionalists): Conversely, older generations retain a strong preference for omnichannel banking with a reliable physical footprint. Over 60% of Boomers still prefer to open deposit accounts and resolve complex financial matters face-to-face at a physical branch, valuing relationship longevity and institutional trust over digital novelty.

Conclusion

Customer Satisfaction and NPS in Banking Statistics: In 2025, customer satisfaction and loyalty in the banking sector were found to depend on a fragile equilibrium among digital technology, personal experiences, and the human touch. Despite the fact that digital banking was gaining popularity everywhere and very fast, trust, transparency, and the quality of service still determined the customer’s view.

The banks that managed to keep their customers very satisfied were those that offered strong customer support, used simple fee structures, implemented robust security measures, and provided meaningful personalisation. Net Promoter Scores, at the same time, indicate that customer loyalty differs across regions – varying with cultures and bank types – thus underscoring the need for such comparisons.

However, it still remains that the banks that can combine high-end digital tools with human know-how, active support, and solid security will be the ones to leave the longest imprint of trust, engagement, and even advocacy in their customers’ hearts.