Introduction

Cloud Adoption Statistics: Cloud computing is no longer just one of the many tech trends in the present digital-first world, but has completely taken over as the primary and most influential technology in digital transformation worldwide. To give an example, streaming companies, global brands, and nascent innovators are all moving or have moved to the cloud for their core operations, workloads, and innovation.

There is no longer talk of the cloud just being a part of global IT infrastructure; it has turned out to be one of the powerful factors reshaping the way companies compete, innovate, and scale. In 2025, the cloud will no longer be an option — everybody will be using it, and the number of adoptees will be constantly rising.

This article will reveal cloud adoption statistics for 2025 in depth and back them up with research data, financial figures, and real numbers you can use on adoption trends.

Editor’s Choice

- Adoption of cloud computing in 2025 will be almost total, as 94% of companies around the globe will be using cloud services, and only 3% will remain having not made any future migration plans, thus giving rise to the term core IT infrastructure to describe the cloud rather than optional technology.

- The increase in the percentage of global workloads running on cloud from last year’s 66% to 72% this year also reflects that 78% of the IT leaders consider cloud as their main infrastructural strategy, and 55% of them adopt a cloud-first approach for new technologies.

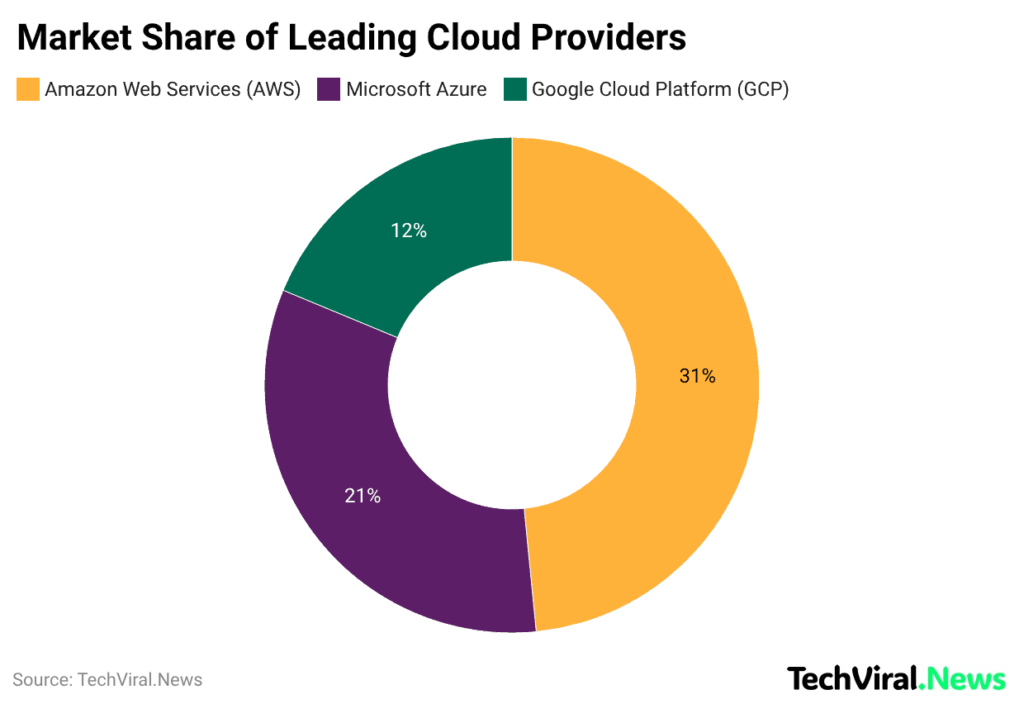

- Amazon Web Services (AWS) topped the worldwide cloud market, holding a 31% market share, Microsoft Azure came next with 21%, and Google Cloud Platform with 12%, demonstrating there is a very concentrated yet competitive provider landscape.

- Big companies are the ones investing the most in the clouds, as already 94% of them follow a cloud-first policy, with an average of USD 14.3 million per year spent on cloud.

- The pace of adoption in different industries is not the same, but banks, software, and retailers are the main contributors, with more than USD 190 billion spent on public cloud combined.

- The most widely accepted public cloud platform is still AWS, with a significant portion as high as 53% of organizations utilizing it for primary workloads, whereas Azure takes up 46%, and Google Cloud enjoys good rates of experimentation (20%) that indicate growth in the future.

- Cloud-based business continuity and disaster recovery are the most crucial use-case scenarios, with 73% of organizations depending upon it for resilience and the solution, thereby minimizing downtime by almost 40%.

- It is really small businesses and new companies that are growing more and more dependent on the cloud, with 61% of the small businesses operating in the cloud, with more than 40% of their workloads.

- 72% of the companies with less than 50 employees mainly use SaaS, and 87% of startups are cloud-native.

Market Share of Leading Cloud Providers

(Reference: sqmagazine.co.uk)

- Amazon Web Services (AWS) is at the forefront of the global cloud computing industry with its 31% market share, a fact that accounts for its initial participation, wide-ranging service portfolio, and large-scale acceptance among businesses of all sizes.

- Microsoft Azure, the second largest provider in this market, has a 21% share owing to its firm link with Microsoft’s enterprise software and growing IT infrastructure modernization among organizations.

- Google Cloud Platform (GCP) is the one that has the third position with a 12% market share, which is realized through its strengths in data analytics, artificial intelligence, and open-source technologies, and its increasing focus on industry-specific cloud solutions.

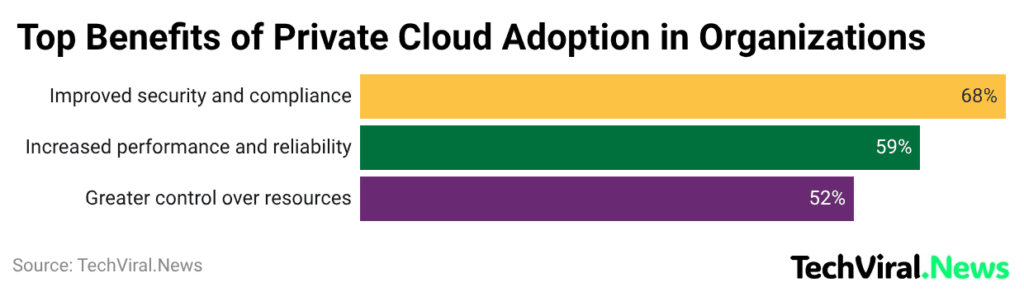

Key Advantages of Private Cloud Adoption In Organizations

(Reference: sqmagazine.co.uk)

- The growing demand for private clouds continues unabated, as businesses desire more control, security, and efficient performance from their IT setups.

- The most frequently mentioned advantages are better security and regulatory compliance, as 68% of organizations confirm that private cloud technology aids them in meeting strict data protection, governance, and industry-specific compliance requirements.

- The firms operating in a sole environment can, in turn, establish their own security controls and, at the same time, mitigate the risk of being exposed to shared infrastructure.

- Another area of cloud adoption, as pointed out by 59% of companies, is performance, reliability, and, additionally, private clouds.

- Environments of private clouds provide such consistency in performance, less latency, and more uptime; therefore, they can be used for mission-critical applications and for workloads with very strict uptime requirements.

- Moreover, 52% of companies appreciate the fact that private clouds provide control over the infrastructure and resources that allow for the implementation of specific configurations, the allocation of resources in an optimized manner, and the alignment with the business and operational needs in a better way.

Worldwide Cloud Adoption Rates

- Cloud computing would almost become a universal service for enterprises by 2025, with 94% of organizations worldwide, in some way or another, using cloud services.

- Workloads being hosted on the cloud keep on increasing and have reached 72% of all the global ones, which is a rise from the previous year’s 66%, indicating clearly the decline of on-premises infrastructure.

- The transition can be seen in the strategic priorities, where 78% of the IT decision-makers now consider cloud as the main infrastructure strategy, and 55% of the companies have a cloud-first policy when it comes to the adoption of new technologies.

- The cloud maturity is getting deeper at the same time. Almost half of the businesses (49%) have embraced cloud-native architectures, which is a 7% increase from the previous year, while 37% have changed over to total cloud-native systems without using any data centers.

- Software-as-a-Service has become a standard, as 83% of companies are using at least one SaaS product, and 93% are dependent on cloud-based tools for collaboration.

- The public cloud has been embraced by 69%, and only 3% of the companies say they will not move to the cloud—this is the lowest number ever.

- In addition, the growth of cloud is accompanied by the fact that 29% of the companies have already implemented edge computing to help with real-time and latency-sensitive workloads.

Cloud Adoption By Business Size

- The cloud adoption differs from one organization to another, depending on its size, but the trend is still strong across all segments.

- Large corporations lead the trend with 94% of them practicing the cloud-first policy and yearly total cloud spending of USD14.3 million, which is a 9% increase compared to last year.

- Medium-sized enterprises are the fastest-to-adopt businesses, increasing cloud usage at a rate of 19% per year, with 83% of them making use of cloud-based ERP or CRM facilities for modernizing their operations.

- A lot of small businesses are also turning to the cloud more, and the percentage of those that run more than 40% of their main workloads in the cloud has increased to 61%, up from 54% last year.

- Startups are the most cloud-using, as 87% of them are following the cloud-native architecture from the very beginning.

- Among SMBs, the average annual cloud spending has reached USD 21,000, while 72% of the companies with under 50 employees are mainly on SaaS now.

- Even microbusinesses with fewer than 10 employees are speeding up adoption, with cloud usage climbing to 42%, pointing to the fact that cloud computing has become the backbone of every organization, regardless of its size.

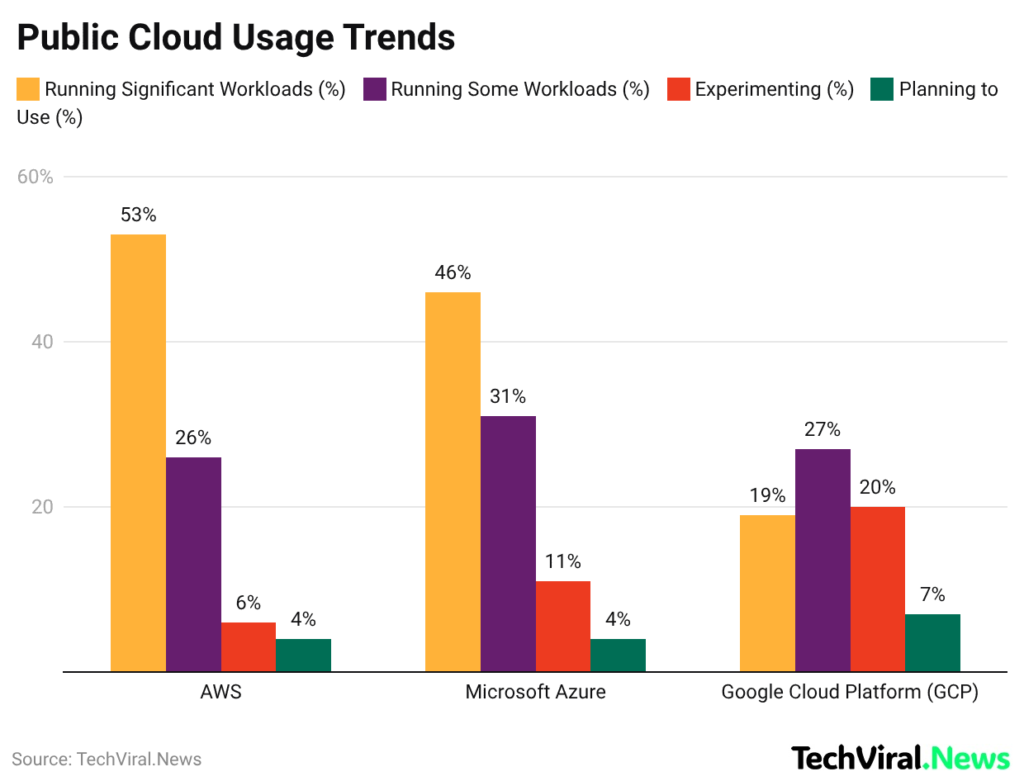

Public Cloud Usage Trends

(Reference: sqmagazine.co.uk)

- The adoption of public cloud services is still on the rise, and Amazon Web Services (AWS) has not lost its ground as the top player in the market.

- AWS is used by about 53% of the companies to cope with the major workloads, which is a sign of its maturity, rich service portfolio, and powerful ecosystem.

- In addition to this, 26% of the organizations utilize AWS for particular workloads, whereas 6% are playing around with the system, and 4% are chalking out their adoption plan, which points out that AWS is still the core of the cloud strategies at the moment and also in the future.

- Microsoft Azure is the second most popular public cloud provider among users. To begin with, 46% of the companies apply Azure for their significant workloads, while 31% depend on it for certain workloads. This success is heavily attributed to the close connection with the Microsoft enterprise software and hybrid cloud features.

- Besides, 11% of the organizations, which do not actively use it, are trying to find their way to Azure.

- 4% have it in their plans as future technology, hence indicating that the companies that are modernizing their IT through existing infrastructure are the ones driving the business upwards.

- Google Cloud Platform (GCP) keeps on steadily increasing its presence more and more with data-driven and innovative-oriented companies.

- Currently, 19% major workloads are on GCP, and 27% are using it for some workloads; however, it is really important to mention that 20% are actively trialling the platform, and 7% have a plan for future adoption.

- Such a high trial rate demonstrates the increasing GCP’s attractiveness in the fields of analytics, AI, and cloud-native development, and thus, it is getting ready for more growth in the coming years.

Drivers of Cloud Adoption

- The most important driving forces for migrating to cloud adoption are scalability and flexibility.

- Real-time resource scaling has been acknowledged by 81% of the organizations as one of the most important factors when dealing with demand changes, who considered it as they were at the forefront of the discussion.

- Moreover, speed and agility are the next in line, with 76% of IT decision-makers highlighting at the very least that the cloud has been the key enabler of faster innovation, facilitated by the cloud, the major factor being the rapid prototyping and on-demand infrastructure that has led to up to 32% reduction in the product development time.

- Global reach is another very important reason, to the extent that 68% of the big firms use the service of having data centers all around the world to enhance the experience of the users in different regions by reducing the delay and providing better service, perhaps even before the customer figures out their location.

- The use of cloud services for AI, analytics, and big data projects is reported by around 64% of organizations, and there are already more than half of data-heavy projects are already getting the maximum benefits from the cloud platforms due to their vast computing power.

- Fortification of business continuity plans is another reason to say that cloud is the way to go, since 73% of organizations have their disaster recovery and resilience through the cloud, which in turn leads them to a nearly 40% reduction in daylight-dependent downtime.

- Regulator and compliance issues are motivating factors for 54% of companies, especially in the heavily regulated sectors such as finance and healthcare.

- Moreover, 69% of firms are taking advantage of cloud vendors’ extensive ecosystems and managed service offerings, which have cut setup times of resource provision by 45%, while 62% are going for a multi-cloud approach in order to have flexibility and avoid being tied to one vendor.

Adoption Rates By Region

North America está en la cima del mercado mundial de nubes, haciendo a USD 248.07 billion the total revenue of public clouds and USD 183.57 billion in the US only in 2024. Asia-Pacific is a region of one of the fastest growth, as digitalization in China, India, and Southeast Asia has been very quick, with China’s public cloud revenue expected to be USD 121 billion by the year 2027. Europe is still a big market, but the stricter GDPR certainly moves towards more private and hybrid cloud adoption through the private cloud model if not. Focusing on public cloud adoption, the emerging areas of Latin America and Africa witness the slow but steady growth, at times, however, the progress is halted by connectivity problems and the heavy hand of regulations.

In the mature markets, it is said that over 90% of organizations are in the cloud in one way or another, while about 60% to 80% of the companies in the developing markets still do not have a cloud presence. The countries with strict data localization laws are investing in local cloud data center infrastructure, while the regions of rapid growth in edge computing and IoT—such as Southeast Asia and parts of Latin America—are seeing the hybrid cloud adoption, which is faster than the traditional cloud migration.

Cloud Adoption By Industry

- Cloud investment patterns will always be influenced by specific needs demanded by various industries.

- The banking, software, and information services, as well as retail sectors, are projected to together spend USD 190 billion on public cloud services in 2024, accounting for almost one-third of total global cloud expenditures.

- In addition, the professional and financial services sectors use SaaS the most, thereby consuming 40% to 50% of total cloud budgets for CRM, ERP, and collaboration platforms.

- Manufacturing and energy companies are increasing their edge-cloud investments significantly, resulting in approximately 25% CAGR overall spending to back up IoT applications and real-time predictive maintenance.

- Over 60% of healthcare and life sciences sectors support a hybrid or private cloud environment for sensitive data to comply with HIPAA and changing regulatory requirements.

- Retail and e-commerce businesses raised their cloud budgets 28% year over year, mainly for real-time personalization and managing traffic surges during weddings, holidays, etc.

- The education industry has already experienced a 16% increase in cloud uptake in 2024, facilitated by the prevalence of online learning management systems and virtual collaboration tools.

- At the same time, the percentage of telecommunications and media companies running both AI and machine learning workloads in the cloud has reached about 70%, with annual investment in this area expected to hit USD 10 billion by 2025.

Cloud Migration Drivers

- Scalability keeps being the most powerful reason for cloud migration in 2025, with 71% of the decision-makers stating that the ability to scale resources on demand is the biggest advantage over traditional on-premises systems.

- Another reason for the widespread adoption of cloud technology is cost efficiency; 64% of companies fast-tracked their migration to the cloud to cut down on the infrastructure, maintenance, and hardware costs.

- There is also a performance-oriented factor, with 58% of IT managers mentioning quicker application performance and better system responsiveness among the main advantages of transferring to the cloud.

- 52% of enterprises regard cloud platforms as the main factor in making remote and hybrid work possible.

- 39% of businesses see cloud adoption mainly as a means to support AI and machine learning workloads that need flexible computing power.

- Security enhancements have a friendly impact on 45% of companies, indicating rising trust in the security of the cloud systems.

- However, on the other hand, outdated system limitations are leading 45% of firms to opt for modernization, with 33% of large companies seriously considering the exit of their data center.

- The global corporate world is also using the cloud for regional expansion, with 27% considering covering more territory to be the main factor, and 31% mentioning compliance and regulatory issues—such as GDPR and HIPAA—as being pivotal to their migration plans.

Statistics On Cloud Cost Optimization

- In the process of cloud adoption growth, cost optimization has turned into a strategic matter of focus.

- Companies that have applied FinOps practices managed to save 19% on average in 2025, thus pointing out the significance of financial oversight in cloud environments.

- The largest proportion of waste–38% of firms– comes from unused or inactive resources, and still, this problem is being tackled with optimization practices yielding positive results.

- It is estimated that globally, auto-scaling has already saved approximately USD 11.2 billion, and the rightsizing measures have allowed 26% of companies to cut their expenses by 20% or more.

- The percentage of enterprises relying on cost observability tools as part of their daily operational processes has increased to 54%, while the use of reserved instances or commitment-based pricing models has brought down the average cloud bills by 28%.

- However, even with these improvements, 45% of IT departments still find it hard to forecast the costs of multi-cloud accurately, thus creating budgeting difficulties.

- Cloud spending optimization has become a top priority for 61% of CFOs, while organizations that are using automation are claiming an average of 15% savings every year. Consequently, overprovisioning has been reduced to 12%, the lowest wastage level in the last five years.

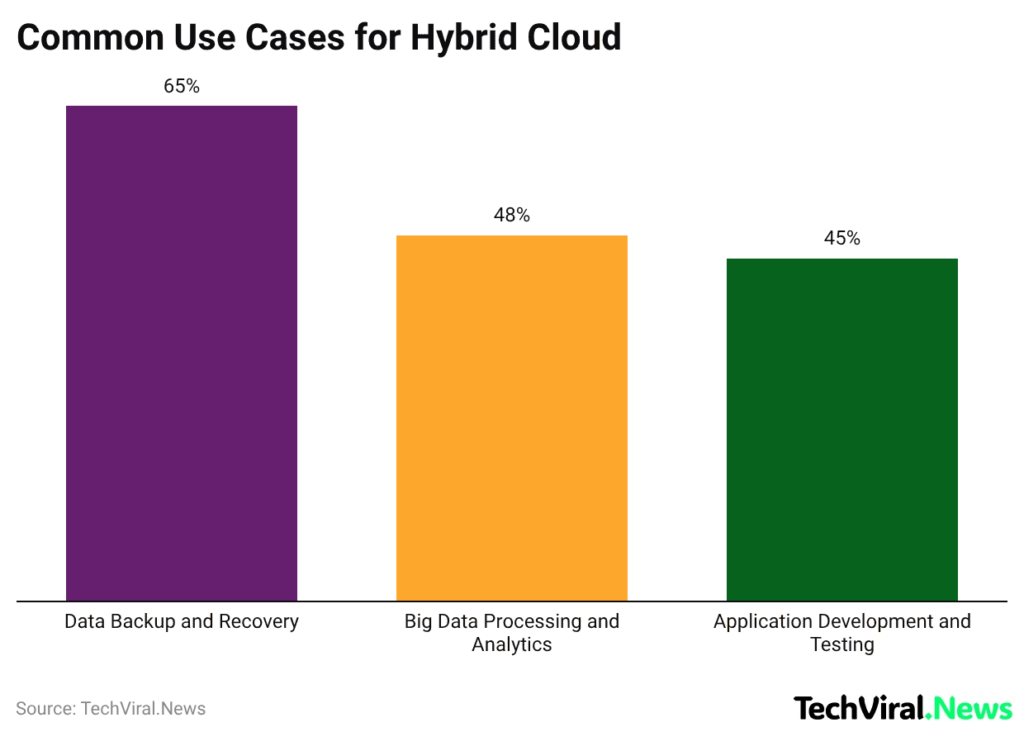

Common Use Cases For Hybrid Cloud

(Reference: sqmagazine.co.uk)

- Organizations extensively use hybrid cloud environments for data management, with 65% of companies using this model to guarantee business continuity and resilience.

- Through the integration of local data center and public cloud storage, companies can have full access to and control over their data while still enjoying the benefits of cloud in terms of scalability and cost for backup, archiving, and disaster recovery.

- Big data processing and analytics come as the other major use case, reported by 48% of businesses.

- Hybrid cloud allows companies to process large amounts of data using the public cloud’s elastic computing while keeping sensitive or regulated data on-premises.

- Furthermore, 45% of companies turn to hybrid cloud for app development and testing, meaning developers can create and test their apps in various cloud environments and then move the successful ones to the production systems, whether they are located on-premises or in the cloud.

Cloud-Native Technologies Adoption

- The cloud-native adoption will keep on boosting, or rather, it will accelerate all the way to the year 2025, implying the total change over to the use of cloud-native architectures by companies worldwide.

- Nearly one in two (49%) firms worldwide now utilize the entire cloud-native stack, which marks a considerable increase from last year’s 42% and indicates a firm move towards the more scalable and resilient models of design.

- Besides, containers are actually to be regarded as the backbone or main part of this change, since up to 71% of new deployments in the cloud are container-based, while 68% of all the cloud-native teams have chosen Kubernetes or equivalent to be their orchestration platform for scaling up the management of their containerized workloads.

- The developers’ feedback about CI/CD(continuous integration and continuous delivery) has grown along with the increasing number of its adoption in the cloud-native environments, which is nearly 27% growth as compared to the previous year, thus operating with agile and rapid-release workflows becomes quite easy.

- Also, in 2025, almost one-third (29%) of the total companies went ahead and replaced their monolithic applications with microservices-based architectures, which offered them the advantage of better flexibility and scalability.

- Such a complicated environment is greatly supported by the cloud-native observability tools, which witnessed a rise of 41% in the rate of adoption, along with 36% of major organizations that now set up dedicated platform engineering teams.

- Furthermore, the security maturity is improving too, as there has been a 22% hike in the number of enterprises that are employing container security platforms, which is a good sign and reflects the spread of DevSecOps in general.

Cloud Adoption By Application Or Workload Type

- Applications and workloads of various types are the main reason for the wide usage of the cloud, with the customer-facing applications being at the top of the list at 81% of the total enterprise adoption, as organizations give main importance to both scalability and user experience.

- Email and collaboration tools are the most cloud-hosted workloads across the board, being used by 92% of the enterprises, whereas CRM platforms such as Salesforce and HubSpot are cloud-based in 85% of sales-oriented companies.

- The development and testing environments are also very much dependent on the cloud, reaching 74%, which leads to faster development cycles and more experimentation.

- Around 66% of the organizations are using cloud for hosting the data analytics platforms, while 39% of them are depending on it for disaster recovery and backup to ensure better resilience.

- Their core business systems are also getting migrated at a faster pace; ERP systems are cloud-hosted by 58% of the mid-to-large enterprises, while HR and payroll systems are by 62% of the mid-market companies.

- In the industrial sector, 34% of manufacturing firms are using the cloud for IoT analytics, thus indicating the cloud’s growing significance in operational as well as real-time data processing.

Conclusion

Cloud Adoption Statistics: Cloud adoption, in 2025, is the bedrock of modern digital infrastructures, and its acceptance is now almost universal across various industries and geographical locations. The public, private, and hybrid cloud models are gradually adopted by organizations, large and small, daily as they see their benefits in terms of scalability, innovation, resilience, and cost-efficiency. The scenario of AWS, Azure, and Google Cloud being the market leaders indicates a mature yet competitive ecosystem, while the increase of cloud-native, hybrid, and AI-driven workloads points out the greater importance of cloud in the center of business operations.

Throughout this evolution of cloud strategies, the focus has been shifting from adoption to optimization, security, and performance, which has ensured that the cloud is the enabler of sustainable growth and digital transformation for the long term.

FAQ

From an analyst point of view, the cloud has become so prevalent that it is hard to find areas of non-use. By 2025, around 94% of all the world’s large companies will use at least one cloud service.

Projections from the market suggest that expenditures on public cloud services will be about USD 723.4 billion in 2025, showing a steady growth of double digits that is going to be mainly caused by AI workloads, data analysis, and corporate modernization projects.

The big three – AWS, Microsoft Azure, and Google Cloud – will together account for around 63% of total enterprise cloud infrastructure spending in Q1 2025, thus solidifying their leading position in the global cloud market.

Approximately 32% of the cloud budgets are claimed to be wasted because of operational inefficiencies.

The cloud computing market worldwide is projected to be more than USD 600 billion in 2025 and also to cross the USD 1 trillion mark by 2030, thus implying a CAGR of around 16–18%, which is mainly due to digital transformation in enterprises and AI taking over as one of the main technologies in the future.