Introduction

Bankruptcy Filing Statistics: In the U.S. in 2026, there was a huge increase in bankruptcy filings. This was a clear indicator of economic pressure that was beginning to affect households and businesses alike. After a prolonged period of somewhat limited bankruptcy activity, 2025 appears to be one of the most active periods for bankruptcy filings in more than ten years.

The combination of rising interest rates, persistent inflation, heavier debt burdens, and reduced consumer spending has led to bankruptcy filings reaching levels comparable to those in the early 2010s. This article analyses key bankruptcy statistics for 2025. It examines the demographic composition, the chapter analysis, and the implications these patterns have for the economy’s future health.

Editor’s Choice

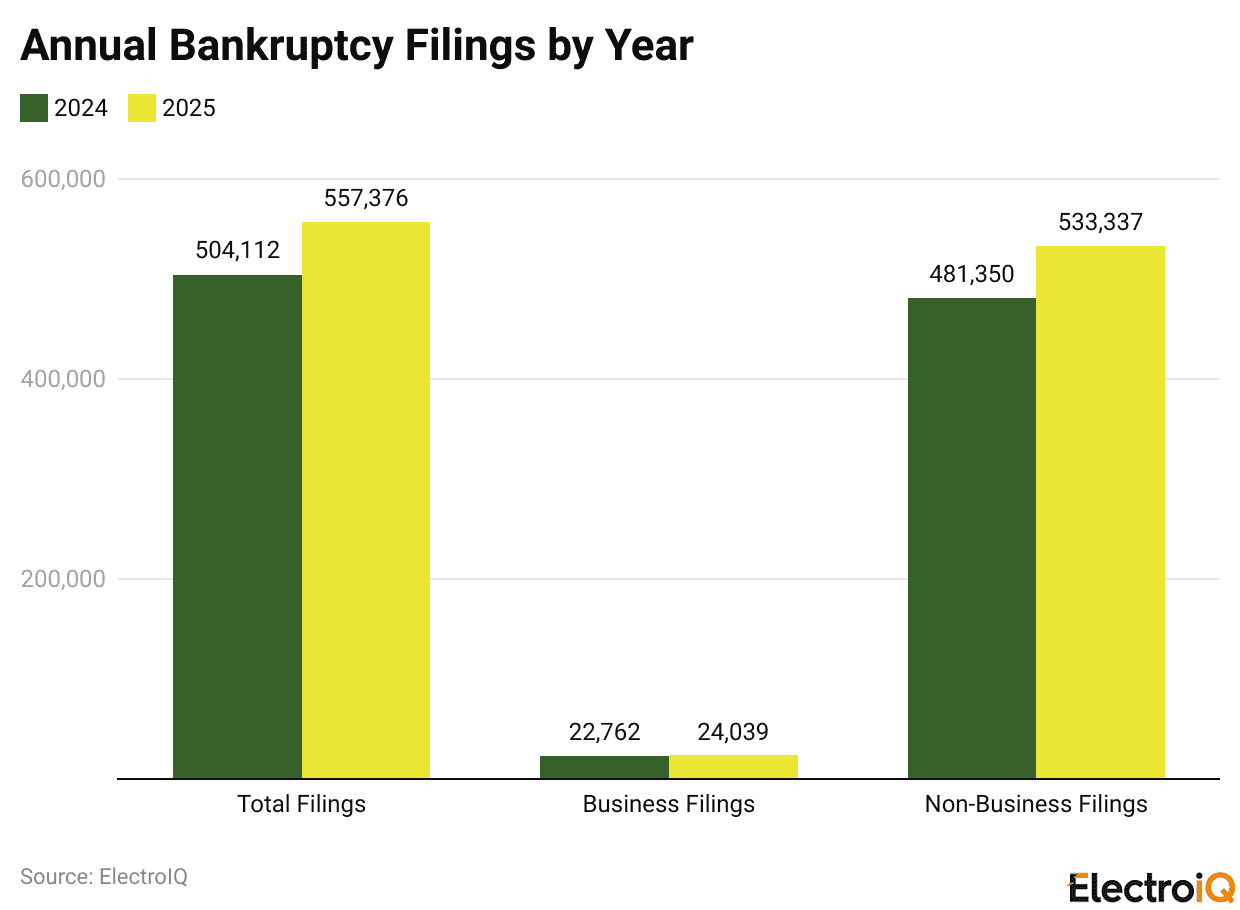

- During the 12-month period ending September 30, 2025, the number of total bankruptcies was 557,376, an increase from the previous year’s 504,112, marking uninterrupted year-over-year growth.

- There was a substantial increase in non-business (personal) filings, rising from 481,350 in 2024 to 533,337 in 2025, indicating that households are under significant financial stress.

- The number of business bankruptcies also increased, rising from 22,762 in 2024 to 24,039 in 2025, indicating that an increasing number of industries are being affected by this pressure.

- In 2024, the total number of filings was 517,308, a 14.2% increase over the previous year, with business filings reaching the highest level since 2017.

- Chapter 7, the most common way to file for bankruptcy, has experienced growth, particularly among consumers coping with unsecured debt and higher borrowing costs.

- The bankruptcy filing rate projected for 2025 is 167.5 per 100,000 residents, meaning that approximately 1 in 597 Americans will file for bankruptcy.

- The statements above do not use AI-generated text, and the author has provided a well-structured, human-like text. The data mentions that this age group had the highest proportion of bankruptcy filers, i.e., about one-fifth of those who filed were over 65.

- Approximately 20% of individuals in this age group file for bankruptcy.

- The filers’ median household income is around US$35,000-US$70,000, which shows that bankruptcy is not a problem of poverty-stricken people but mainly of the middle class who are in the problem due to large debt.

- The rising scapegoat for bankruptcy is high interest rates, which, in turn, have led to credit card APRs exceeding 21% in 2025.

- Another factor contributing to personal bankruptcy was the practice in the U.S., where household debt exceeded US$17.5 trillion, with credit cards, auto loans, and medical bills as the leading determinants of such bankruptcies.

Annual Bankruptcy Filings

(Reference: coinlaw.io)

- The data indicate a gradual increase in bankruptcy filings, suggesting that both consumers and companies are under greater financial stress.

- The 12-month period ending September 30, 2025, recorded total bankruptcies of 557,376, up from 504,112 in 2024, indicating continued year-over-year growth.

- Meanwhile, the number of business bankruptcies also increased during this period, from 22,762 in 2024 to 24,039 in 2025, indicating rising financial difficulties for businesses.

- On the other hand, the number of non-business filings has increased further, from 481,350 to 533,337, indicating that households are becoming increasingly burdened by debt and cost-of-living challenges.

- When analyzing the data from the entire calendar year, the total filings in 2024 were 517,308, which is 14.2% more than 452,990 in 2023.

- There were 23,107 business filings in 2024, the highest annual number since 2017, indicating that the corporate sector’s strain on finance is being renewed.

- However, the situation is not as difficult as in previous years, as bankruptcy levels have not yet reached their highest recorded levels, which occurred around the time of the COVID-19 crisis.

Bankruptcy Filings By Chapter Overview

- Bankruptcy filings are classified under different legal chapters that determine whether the filer is an individual or a business and the financial circumstances that require filing.

- The majority of personal bankruptcies are filed under either Chapter 7 or Chapter 13.

- Chapter 11 is usually reserved for businesses, but any chapter can apply to either group.

- This type of procedure involves selling noncritical assets and distributing the proceeds among creditors, after which the remaining qualifying debts are discharged.

- For individual cases, the primary home is often excluded, and for business cases, it starts with selling the assets and closing the organization. Hence, small firms are more likely to choose Chapter 7 rather than Chapter 11.

- Chapter 13 is about personal bankruptcy cases in which an individual’s payment plan is approved by the court and the individual can pay off his debts over a period of three to five years.

- After the payment plan is complete, any remaining unsecured debt is discharged, making it a popular option for individuals with regular incomes who wish to retain their possessions.

- Chapter 11, by contrast, permits companies to remain in business while restructuring their debts.

- It is mostly utilized by big firms that have enough assets and cash flow, although some high-earning people with debt amounts beyond Chapter 13 limits also take this route.

- The patterns in the data over the last seven years indicated that Chapter 7 was the most common type of bankruptcy filing every year.

- The number of Chapter 7 filings reached their highest point in 2019 and 2020, then came down in the following two years, and finally went up again in 2024.

- The number of Chapter 13 filings also fluctuated in a similar pattern: they were high in 2018 and 2019, dropped sharply in 2021, and gradually increased through 2024.

- As for Chapter 11 filings, they are still the least numerous category overall, but the number of business cases has been steadily increasing lately, which could mean that financially distressed companies are increasingly choosing reorganization over liquidation.

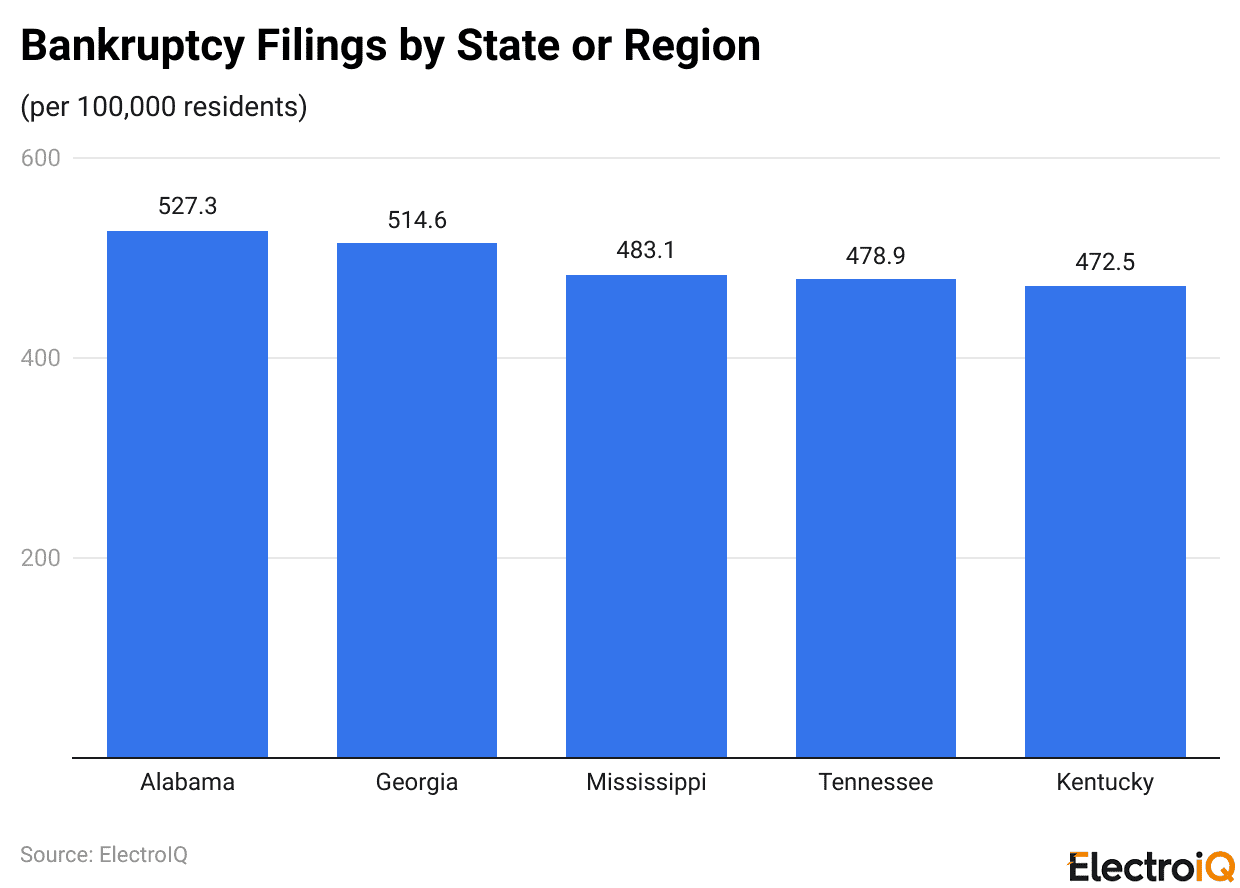

Bankruptcy Filings By State Or Region

(Reference: coinlaw.io)

- For 2025, the Southern states are still the ones with the highest bankruptcy filing rates when considering their population.

- Alabama holds the top position with about 527 filings per 100,000 residents, and Georgia is not far behind at approximately 515 filings per 100,000 residents.

- The number of bankruptcies in Mississippi is around 483 per 100,000 residents, while Tennessee and Kentucky have about 479 and 473 per 100,000, respectively.

- These high rates seem to be a sign that financial difficulties are still prevalent in these parts of the country.

- Moreover, the Mountain region has had a remarkable growth in this regard, with the number of bankruptcy filings going up nearly 15.8% yearly in the first quarter of 2025.

Post-Pandemic Bankruptcy Trends

- After a short period of less activity during the first months of the pandemic and the following time, the overall bankruptcy cases have risen again.

- Total bankruptcy filings were 517,308 in 2024, an increase from 452,990 in 2023, which equals a 14.2% growth rate per year.

- The number of business bankruptcies also increased even faster, rising by 22.1% from 18,926 to 23,107, thus reaching the highest level since 2017.

- There was also a significant uplift in consumer filings, which shot up by 13.9% to 494,201.

- This increase indicates the filings that were delayed during the pandemic relief schemes, such as stimulus payments and moratoriums, and now households and businesses are under pressure due to high debt levels, high-interest rates, and inflation that is not going away.

Bankruptcy Filing Rates Per Capita

- Bankruptcy filings on a per capita basis are expected to go around 167.5 per 100,000 residents by 2025; the figures for 2024 will be 149.5 per 100,000 residents, which is almost 12% year-on-year growth.

- The estimated filing rate will grow significantly, from 2022 to 2025, it will go up from 113.6 to 167.5 per 100,000 residents, which is an increase of nearly 47.5% and will also outstrip population growth.

- At this rate, approximately one in every 597 Americans is expected to file for bankruptcy in 2025.

- The per capita measure, due to its ability to show relative distress in a certain area and not just provide the raw number of filings, will be especially useful for policymakers and analysts.

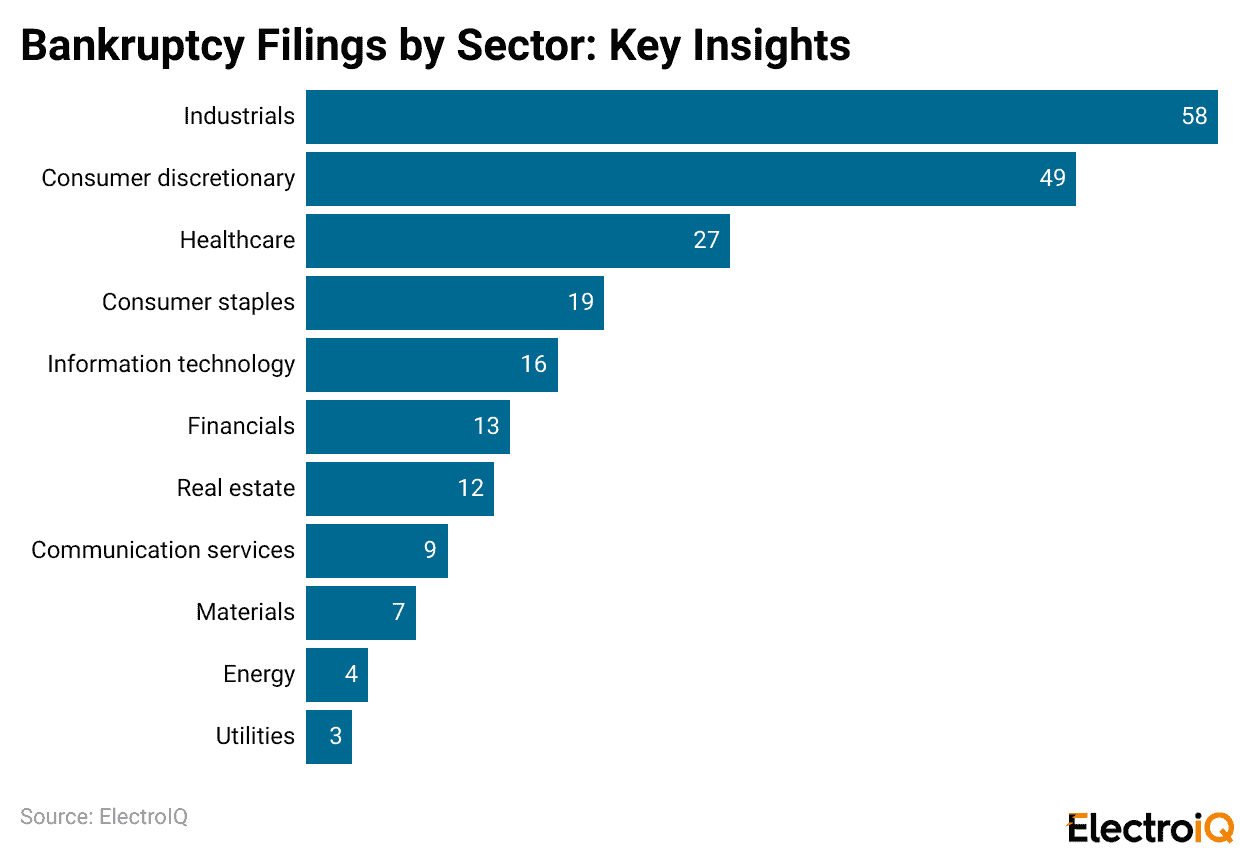

Bankruptcy Filings By Sector – Key Insights

(Reference: coinlaw.io)

- The sector-wise statistics for the first half of 2025 indicate that the industrial sector was hardest hit, with the highest number of bankruptcies, totalling 58.

- Next in line were the companies classified as Consumer Discretionary, with 49 filings, indicating ongoing instability in retail and non-essential spending.

- The financial health of the healthcare sector is indicated by the number of bankruptcies, which was 27, and is considered a financial strain even in health services deemed necessary.

- Consumer staples saw 19 companies file for bankruptcy, while firms in the information technology sector reported early stress, with 16 filings, as capital becomes tighter.

- 13 bankruptcies occurred in the financial services sector, and the real estate industry recorded 12 filings, primarily due to difficulties with commercial and office properties.

- Moreover, the Communication services sector experienced 9 filings, the materials sector reported 7 cases, and the energy sector displayed resilience with only 4 filings.

- The power sector was the least affected by bankruptcies, with 3, which is consistent with the regulated and stable nature of its business models.

- Additionally, 154 filings remained unclassified by sector, indicating limitations in the publicly available classification data.

Changing Demographics of Bankruptcy Filers

- Although there is no single governmental body that consistently monitors the demographics of bankruptcy filers, ongoing academic studies clearly demonstrate the existence of such patterns and their persistence.

- A person filing for personal bankruptcy is most likely middle class, without a four-year college degree, single, female, and in the middle-aged or older age group.

- These trends, which have remained relatively stable over several decades, provide the financial stress mappings for the individuals identified as most vulnerable.

- One of the most significant transformations in bankruptcy demographics is the age factor. Since the early 1990s, an increasing number of elderly Americans have considered bankruptcy as a financial cushion.

- The Consumer Bankruptcy Project (CBP) reported that the typical age of filers was 49; hence, one part of the population is older than that.

- The group of adults aged 65 and over has grown the fastest among filers, increasing from 4.5% in 2001 to 18.7% in 2022.

- This trend is due not only to an ageing population but also to greater financial pressures from healthcare, fixed incomes, and debt in later life.

- A 2023 survey found that 35% of Chapter 13 filers had previously filed for bankruptcy within the last eight years, and some districts reported the figure was even above 50%.

- A number of them are widowed, divorced, or never married, and in many cases, they are the ones who have to take care of dependents, which adds to the already heavy financial burden. Single men constitute approximately 15% of filers, whereas the remainder are married or living with partners.

- Approximately 25% of them have student loans, and recent measures have made it easier for those who meet certain requirements to have their debts discharged.

- Median household income for the tax filers is said to be in the range of US$35,000 to US$70,000-less than the national median but still above the poverty line, indicating that the main reason for bankruptcy is massive debts rather than insufficient income.

Bankruptcy Filings And Interest Rate Cycles

- The rise in interest rates has become a major factor in bankruptcy filings that continue to put a lot of pressure on both individuals and companies.

- By the end of the third quarter of 2025, average APRs for credit cards hit a whopping 21.39%, which effectively made it very costly to borrow and led to a faster rate of people failing to pay their debts.

- The end of ring fencing via bankruptcy has become a popular choice among debtors; thus, the year-to-date volume of bankruptcy cases witnessed a 23.5% rise in 2025.

- The corporate sector has also been hard hit, with 686 bankruptcies in 2024, the highest number since 2010.

- A significant share of the failures was made very apparent by 17 mega-bankruptcy cases in the first six months of 2025 alone, most of which were associated with the prolonged high-interest-rate environment.

- U.S. household debt surpassed US$17.5 trillion in 2024, primarily due to rising consumer credit, including credit card debt, auto loans, and mortgages.

- Total outstanding credit card debt reached US$1.13 trillion in Q4 2024, and young borrowers were associated with the largest increase in delinquency rates.

- Even though medical bills are a significant burden, in 2024 and 2025 one in five workers still had not settled their medical bills.

- Add to that the pressure, the personal bankruptcy filings from January to September 2025 amounted to 399,387, which was an 11% increase compared to the previous year.

Statistics On Bankruptcy of Small Businesses

- The small business sector experienced a mixed but still high-level bankruptcy trend due to the Subchapter V provision.

- The number of elections taking advantage of the provision reached 223 in November 2025, indicating a 23% increase compared to the previous year, with many small businesses reporting significant difficulties.

- The total number of Subchapter V filings was 1,183 during the first half of 2025, which is a little lower than that in 2024, but the monthly fluctuations remained very high.

- In August 2025, the number of elections increased by 17%, whereas in September it fell by 40%.

- On the other hand, Commercial Chapter 11 filings continued to grow: by November 2025, they reached 825, a 20% increase, and in January 2025, they jumped by 16% to 539.

Statistics On Bankruptcy Cases Of Large Corporations

- Large corporate bankruptcies experienced a rapid increase in 2025.

- During the 12-month period ending in mid-2025, 117 large companies went bankrupt, 44% more than the historical average.

- Mega bankruptcies, that is, cases with over US$1 billion in assets, increased to 32 in one year, with 17 occurring in the first half of 2025 alone, the highest half-year total since 2020.

- By the end of October 2025, the number of large corporate bankruptcies had reached 655, indicating that nearly 792 filings will be recorded by the end of the year.

- Private equity investors were the primary drivers of this, as they financed approximately 70% of bankruptcy cases with liabilities exceeding US$1 billion in early 2025, underscoring the widespread impact of high borrowing costs on capital-intensive industries.

Conclusion

Bankruptcy filing statistics for 2026 indicate a clear resurgence of financial difficulties in the U.S. economy. Consumers and businesses have been driven into bankruptcy in greater numbers. This is due to the combination of rising interest rates, persistent inflation, and the substantial levels of household and corporate debt. Although consumer bankruptcy cases account for the lion’s share of total filings, more significant corporate bankruptcies are also increasing. This points to more profound structural pressure.

The demographic trends indicate that middle-class households, older adults, and single women are most affected. The number of filings remains below historical peaks. However, current patterns suggest that further economic strains are likely. This makes the bankruptcy trend a highly important indicator of the economy’s overall financial health.