Introduction

BNPL Usage Via Bank Channels Statistics: Buy Now, Pay Later (BNPL) has rapidly grown from a non-mainstream fintech payment option to a credit alternative, driving changes in consumer habits, merchant checkout processes, and banks’ strategic focus worldwide. Initially controlled by fintech innovators like Afterpay, Klarna, and Affirm, BNPL options are now slowly being incorporated into conventional banking networks, blurring the distinction between traditional bank credit and new finance solutions.

In 2025, this trend is not only continuing but also gathering pace, the main factors being customers’ preference for easy payments, the emergence of bank-fintech partnerships, and the upgrading of digital bank infrastructures. However, apart from the gross numbers, BPL usage through bank channels is coming up as a separate sub-segment with its own characteristics, risks, and advantages.

The article examines BNPL Usage via bank channels, bank integration methods, and research-backed insights on BNPL adoption in traditional banking channels for 2026.

Editor’s Choice

- The worldwide BNPL market is growing at a very fast 25.3% CAGR, rising from US$13 billion in 2022 to an expected US$115 billion by 2032.

- The need for flexible, instalment-based payment options for consumers is the main driver of BNPL’s adoption across digital and in-store commerce.

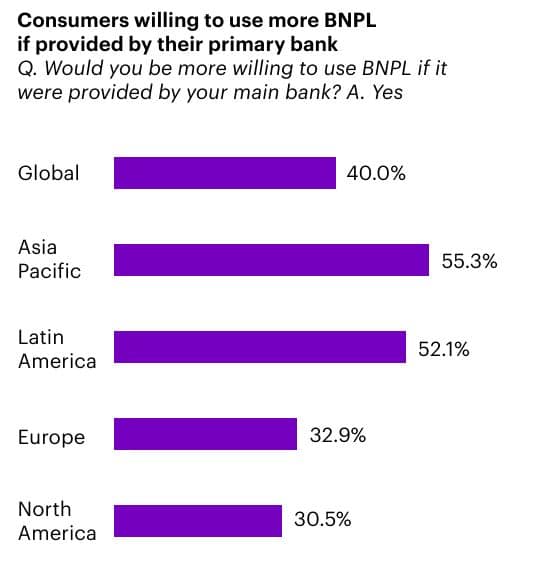

- Trust in banks plays a major role in BNPL adoption, and 40% of global consumers are more likely to go for use BNPL if it is offered by their primary bank.

- Asia Pacific (55.3%) and Latin America (52.1%) have the highest demand for bank-offered BNPL, while North America (30.5%) shows less influence due to its familiarity with fintech.

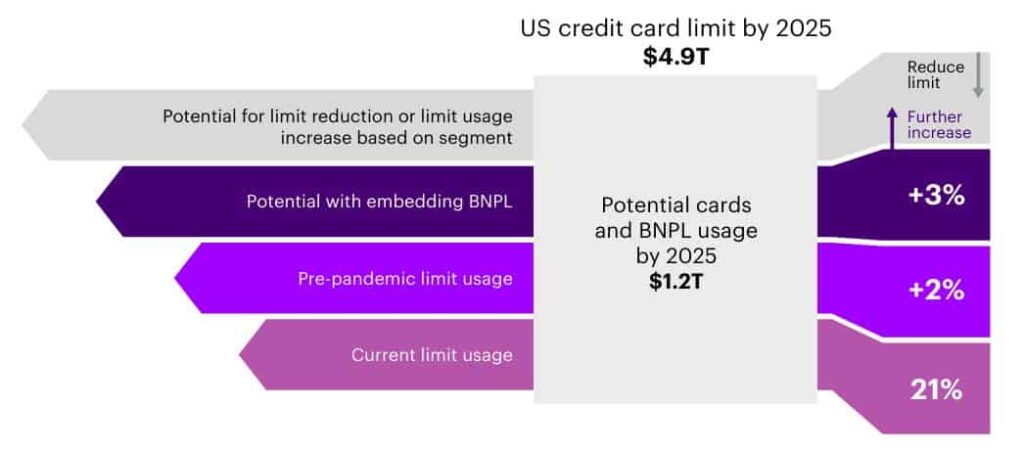

- By integrating BNPL into credit cards, banks would be able to tap into a huge amount of credit that has not been used already, thereby projecting U.S. credit utilization rates to rise from 21% to about 26% by the year 2025.

- Banks in the U.S. with US$3-4 trillion in assets on their balance sheets might generate an additional 10% in revenue by approving BNPL for credit cards. In Europe, large banks could expect income to increase by 6-16%.

- Credit cards with BNPL integration might double the average transaction value and increase the number of transactions by 3x, especially for high credit-risk customers who already have credit lines not fully used.

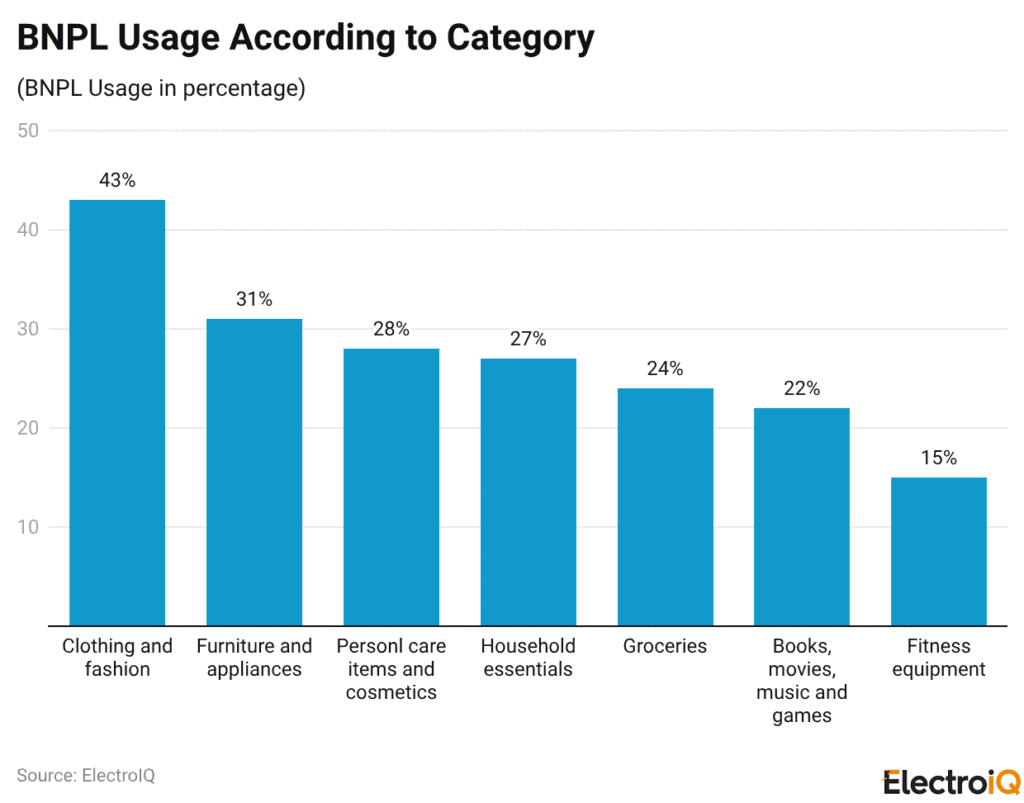

- The largest share of BNPL transactions is by clothing and fashion (43%), followed by furniture and appliances (31%), personal care (28%), and household essentials (27%).

- More and more consumers are choosing BNPL for everyday spending such as groceries (24%), entertainment (22%), and fitness equipment (15%).

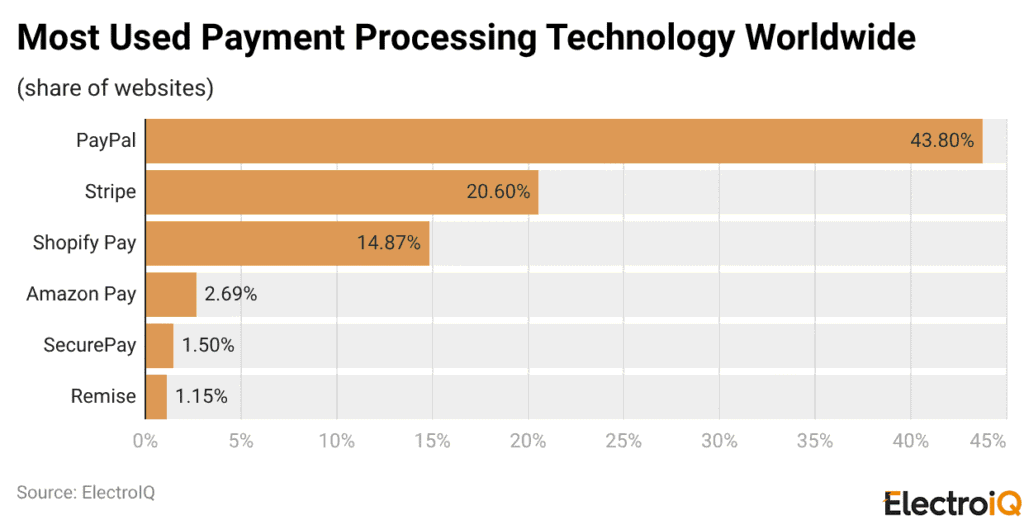

- PayPal is the biggest player in the BNPL market, accounting for 43.08% of payment processing technologies and 68.1% of U.S. consumer adoption in the BNPL sector.

- Klarna has a remarkable position among merchants, enabling BNPL on more than 277,000 U.S. websites and projected to reach 100 million active users by the end of 2025.

- Affirm and Afterpay are both expanding their presence in the market through robust merchant partnerships, with Affirm’s revenue reaching US$783 million in early 2025, a 36% year-on-year increase.

- The use of BNPL is not limited to a specific income group; middle-income consumers opt for it for its flexibility, whereas low-income consumers use it as a necessity.

- The highest percentage of BNPL users is among millennials (33.6%) and Gen Z (26.4%), indicating a close correlation between their payment habits and the digital-first approach.

- Consumers with lower credit scores tend to use BNPL more, with almost 30% of those with a score between 620 and 659 being adopters.

Buy Now Pay Later Market Size

- The Buy Now Pay Later (BNPL) market is one of the fastest-growing segments of the digital payment market, and it has experienced consistent, rapid growth over the past couple of years.

- With a projected CAGR of 25.3%, BNPL has transformed from a niche payment alternative to a widely accepted credit method for consumers and merchants worldwide.

- The year 2022 was a turning point for the BNPL market, as it generated US$13 billion in revenue, marking the beginning of a strong upward growth phase.

- The support for this momentum could still be seen in 2023, when revenue climbed to US$16 billion, followed by US$19 billion in 2024, both indicating the prevailing consumer trust and the growing acceptance among merchants.

- The market envisioned US$26 billion in revenue by 2025, an indication of the dual forces of e-commerce and consumers’ thirst for payment flexibility, driving the rapid adoption of BNPL.

- The second half of the decade shows no signs of the expansion being anything but vigorous.

- The revenue in 2026 is forecast to be US$33 billion, and in 2027, it will be US$40 billion, as BNPL will by then be more or less part and parcel of online and offline checkout processes.

- The sales figures are then expected to be US$46 billion in 2028, US$58 billion in 2029, and US$71 billion in 2030, continually gaining momentum due to better risk management, extensive retail collaboration, and deeper penetration into less developed markets.

- The market’s roadmap is speckled with the highest point of US$89 billion in 2031, followed by an enormous US$115 billion in 2032, as the gradual but robust acceptance of BNPL services as consumers’ flexible, interest-free, or low-cost methods of payment spreads out over time, offering to keep their power over purchases.

- So, BNPL is anticipated to be a key factor in the future payment ecosystem developments, affecting consumer spending patterns, credit models, and the overall growth of digital commerce.

Consumer Willingness To Use BNPL When Offered By Their Primary Bank

(Source: bankingblog.accenture.com)

- The data we have studied suggests that the use of BNPL products offered by banks could be quite high, but people’s attitudes towards them differ from one region to another.

- On a global scale, 40% of customers said they would be more open to BNPL if it were offered by their primary bank.

- In terms of willingness to adopt BNPL solutions offered by the main bank, Asia Pacific is the region with the highest percentage of consumers answering positively, at 55.3%.

- Following closely behind is Latin America with the figure of 52.1%, which means that bank-led BNPL could be a very important factor in credit expansion in areas where the traditional credit market is not well-established yet.

- It seems that LATAM consumers prefer to try new financial products when they feel the banks are secure and familiar to them.

- On the other hand, Europe has a moderate reaction with 32.9% of willingness. This could be due to strict credit regulations, mature consumer credit markets, and widespread familiarity with the instalment payment method.

- North America is at the bottom with a figure of 30.5%, indicating that BNPL services offered by fintech companies and retailers have already earned consumers’ trust in that region.

How Embedding BNPL Can Unlock Major Credit Growth Opportunities For Banks

(Source: bankingblog.accenture.com)

- The graphic indicates that U.S. credit card limits will total US$4.9 trillion by 2025. However, only a small share of this capability is going to be used actively.

- About 21% of credit cards are used in the U.S., indicating that a large share of the available credit is not used. U.S. consumers have, for years, been draining about US$856 billion from US$4.1 trillion in available credit limits, which explains the huge efficiency gap.

- According to the chart, the BNPL-enabled credit cards can push the combined card and BNPL usage to around US$1.2 trillion-1.27 trillion in 2025; hence, the credit utilization would increase 21% to approximately 26%.

- The rise is driven by two primary factors: encouraging clients to use more of their existing credit limits and allowing the payment of high-priced goods in instalments instead of in one go.

- The picture portrays the current usage being enhanced by an additional 2–3% increase in the utilization of the cards when BNPL gets completely embedded and optimized in the card products.

- Customers are more likely to avoid huge one-time charges to their cards and are becoming more comfortable with payments being spread out over time as a result of this growth.

- The revenue opportunity is big from the bank’s viewpoint. By adopting BNPL into its credit card portfolio, a leading U.S. bank with assets of US$3–4 trillion could increase its total card income by approximately 10% in 2025.

- In the same way, a major European bank with more than US$2 trillion in assets could experience a 6–16% increase in income from credit cards, depending on the rates of adoption and the behavior of customers.

- Integrating BNPL, in addition to the utilization, could drastically alter the patterns of spending. Banks might, in fact, be able to increase average transaction (ticket) size by 2x and number of card transactions by 3x, resulting in a steady stream of interchange fees, interest income, and customer engagement that would be almost impossible to interrupt.

BNPL Usage By Category

(Reference: scoop.market.us)

- Data indicates that Buy Now, Pay Later (BNPL) is a prevalent payment option across both non-essential and essential spending categories, suggesting its growing role in consumer finance on a daily basis.

- The highest penetration is in the clothing and fashion sectors, where 43% of BNPL users opt for instalment plans to finance their purchases.

- Such a situation indicates that buyers are seeking leniency on non-essential but frequently purchased items, especially since fashion purchases often involve several or higher-priced items.

- Following Furniture and appliances comes the 31% which indicates that BNPL is favoured in larger, more costly household purchases that the consumers might want to do a payment plan rather than pay all at once.

- Personal care and cosmetic products account for 28% of BNPL usage, indicating that people are becoming increasingly accustomed to spreading the cost of basic lifestyle and grooming activities.

- Household items, which 27% of BNPL customers have reported using, are not merely luxury or big-ticket items but everyday necessities, demonstrating the application of BNPL in this area.

- The groceries buying category accounted for 24% of usage, further confirming this trend by indicating the inclusion of BNPL in regular and repeat spending areas and, consequently, supporting short-term cash flow management.

- Books, movies, music, and games as entertainment purchases account for 22% of users, indicating the presence of BNPL in the realm of voluntary leisure spending.

- Lastly, health and fitness equipment, which has been used by 15% of BNPL customers, is also among the items, suggesting that consumers are making the most of the instalment payment option for wellness and health investments.

BNPL Industry Growth, By Service Provider

(Reference: digitalsilk.com)

- The information reveals that the fast growth of Buy Now, Pay Later is driven by the consumers’ desire for the major player’s scale and strategy.

- BNPL platforms are increasingly competing on their reach, merchant integration, and ecosystem strength, and these factors directly determine how widely these services are adopted across digital commerce.

- PayPal is the most significant player in the market, with a 43.08% share of the global payment processing technologies market, which includes both traditional payment gateways and BNPL services.

- The strong brand and existing user base drive high consumer adoption of PayPal BNPL, at 68.1% in the U.S.

- The integration of BNPL into a trusted payment platform gives PayPal a significant competitive advantage.

- Klarna is making its mark through widespread merchant and user acceptance. Klarna is the BNPL method available on over 277,000 U.S. websites, underscoring its dominance in the online retail industry.

- Klarna, the world’s largest buy now pay later operator, by the end of Q1 2025, had over 100 million users across the planet, and this was backed up by US$701 million in revenue that the company had at the beginning of the year, which indicated that the company has done very well in terms of monetization alongside rapid user growth.

- Afterpay’s position in the USA is the most powerful, with more than 52,000 online retailers offering BNPL options to their customers. This large number of retailers accepting Afterpay gives the company a dominant role in instalment payments across all retail categories.

- Affirm is another player following the same upward trend, and it is already offering BNPL solutions on more than 18,500 U.S. websites.

- With 21.9 million people using the service in early 2025 and a 36% annual revenue increase to US$783 million, Affirm is a perfect example of how targeting the right partnerships and developing consumer-friendly financing models can lead to both high adoption and profitability.

- Sezzle, while being a smaller player than the top providers, still has a respectable niche that is usually occupied by larger companies, as it accepts payments from more than 22,000 online businesses in the U.S.

- Its persistence in adoption shows that even mid-sized BNPL platforms can be competitive by choosing a specific merchant and customer segment and meeting those segment’s needs.

The Data of Buy Now Pay Later Acceptance Among Different Consumer Groups

- BNPL is not only for financially distressed shoppers but also for consumers who appreciate flexibility and control over their budgets, and for those who see it as a short-term financial solution.

- Income significantly impacts the use of BNPL both ways and means. Presumably, about 26.6% of BNPL users earning between US$50,000 and US$100,000 use it as a cash-flow management tool, while the rest use it for different reasons.

- Still, the vast percentage of the latter group, i.e., 26.9%, earns below US$50,000, and this indicates that, for the low-income segment, BNPL is less of a luxury payment choice and more of a tool to overcome low liquidity.

- According to the latest reports, Millennials hold the dominant position as the most significant group of BNPL users in the U.S., with a percentage of 33.6% and then, Gen Z with 26.4% just a step behind them.

- It’s quite clear that the younger crowd is the one that prefers to pay in instalments the most, as evidenced by the popularity of PayPal’s “Pay in 4,” which is used by 51% of customers, split between Millennials and Gen Z.

- This is a clear indication that BNPL has not only adapted to younger generations’ digital preferences and spending habits, but that Gen X still finds it relevant, as they comprise 35% of Pay in 4 users.

- Cultural and ethnic factors also play a role in determining BNPL use. Black Americans are the leading group among BNPL users, with 25%, followed by Hispanic Americans at 21%.

- These numbers imply that BNPL is a significant source of financial support in communities that might otherwise have difficulty obtaining credit through traditional channels.

- Besides, one out of five shoppers aged 18 to 32 starts their purchasing process at BNPL marketplaces, which indicates that these sites are increasingly being recognized as both product discovery and shopping channels rather than only payment facilitators.

- Gender differences can be observed, but their scope is rather limited. In 2024, 15% of women, compared with 12% of men, adopted BNPL services.

- Around 30% of adults with credit ratings between 620 and 659 availed themselves of the BNPL service, which is almost three times the usage rate among people with scores of more than 720.

- The indicators of financial stress give a clearer picture of why the BNPL behavior occurs. A majority of users (55%) affirm that they choose BNPL because it allows them to buy what would otherwise be unaffordable.

- In 2024, 77.7% of BNPL users had to resort to at least one financial coping strategy, such as working extra hours, borrowing money, or using savings, whereas only 66.1% of non-users did so.

- Additionally, 57.9% of BNPL users had experienced a major financial interruption, such as losing a job or incurring unexpected bills, compared with 47.9% for non-users.

- By contrast, the state of being prepared for emergencies reveals a critical vulnerability among BNPL users.

- Just 37% of them could, without any stress, pay the full amount in cash or with a credit card during an emergency, whereas the same percentage among non-users is 53%.

- These findings combined suggest that the BNPL is located right at the intersection of easy and hard, functioning equally as a budgeting tool for the economically stable ones and a coping mechanism for those who are experiencing economic uncertainty.

Conclusion

BNPL Usage via Bank Channels Statistics: Buy Now, Pay Later (BNPL) is a payment option that has been in the market for some time and has become the norm in digital payments. North America and Asia Pacific have been the largest adopters of this service, with the US and Chinese markets alone accounting for a significant share of the global BNPL trend. The global BNPL market size was US$26 billion in 2025 and is expected to grow to over US$100 billion by the decade’s end.

Banks are believed to play an important role in building consumers’ trust in the adoption of BNPL in the future, especially in Asia Pacific and Latin America. By offering BNPL through credit cards, banks can easily reach and sell to a larger customer base, thereby increasing their revenues. The use of BNPL covers both necessities and luxuries, and its acceptance has no barriers of income, age, or credit history, thus making it both a convenient and lifesaving tool.