Introduction

Mobile Games Statistics: Once smartphones started to be everywhere, mobile games started to be all around the world. As a result, they made more and more money. In 2025, the mobile gaming industry will have already set itself as the most important part of the entertainment industry. It will have surpassed consoles and PC gaming. Furthermore, the revenues it makes will be the highest in the world. The mobile gaming market is continuously redefining how audiences interact with digital experiences. This is due to the huge number of players, very high engagement, and new monetization strategies.

This article examines thoroughly the main mobile games statistics that are shaping the future of mobile games in 2025. For example, it covers revenue, player numbers, the latest monetization strategies, geographical performance, genre analysis, and a research-based assessment of the industry’s next steps.

Editor’s Choice

- The revenue of the global mobile game market increased from $93.2 billion in 2021 to over $125 billion in 2025, which is a strong indication of market stability for a long time to come.

- The growth of the industry from $140 billion in 2027 will be almost 50% over the six years.

- Women now account for 53% of mobile gamers globally, thus changing the user demographic pattern significantly.

- The App Store and Google Play continue to be the leading channels for app discovery, responsible for 46% of all new installations.

- The annual mobile gaming expenditure of Millennials is $98 on average, which is higher than that of Gen Z.

- Subway Surfers was the most downloaded game worldwide, with more than 330 million downloads, thus proving that even classics have their share of popularity.

- Cloud gaming is used by 27% of mobile gamers, and it is nothing but strong 5G networking and access to AAA games without the need for a console, which is driving the trend.

- Reviews are checked by 49% of gamers before they download a mobile game, thus trust becomes the foremost factor in the download process.

- Honor of Kings is the top 2025 in-app purchase revenue, thus confirming the Asian region’s supremacy in mobile monetization once more.

- The mobile game user monetization was really good as the average revenue per user was raised to $93.42, and retention was not affected in any way.

- There are 25% of the gamers who do not look for information and install games right away, which is a clear signal that the very first moments in-game can really make or break the player.

- Almost (72%) mobile gamers point out relaxation and stress relief as their main motivation for playing mobile games.

- 65% to 75% is the expected ARPU increase by 2027, which sounds like a very user-friendly and predictable spending situation.

- India and Brazil collectively represented 22% of total worldwide mobile game downloads in the year 2025.

Global Mobile Gaming Revenue – A Six-Year Growth Story

| Year | Global Mobile Game Revenue |

| 2021 | $93.2 billion |

| 2022 | $96.2 billion |

| 2023 | $101.3 billion |

| 2024 | $111.4 billion |

| 2025 | $125+ billion |

| 2026 | $133 billion (proj.) |

| 2027 | $140 billion (proj.) |

(Source: tekrevol.com)

- The mobile gaming sector portrays a known case of constantly growing demand and strong structure over the years.

- In 2021, the world’s total revenue for mobile games was $93.2 billion, thereby creating a strong base that is comprised of the global adoption of smartphones and active user engagement.

- The increase in revenue for mobile games during the years 2022 and 2023 was gradual, and thus, the revenue was more than $100 billion, which was already considered a psychological barrier. This indicated that the mobile gaming industry had already developed into a mature entertainment sector and lost the pandemic-driven surge.

- The increase in sales revenue is going to be more visible in 2024, when it is expected to reach $111.4 billion due to the better monetization methods, live-service features, and enlarging markets in Asia, Latin America, and the Middle East.

- The revenue generated from mobile games will be more than $125 billion by the year 2025.

- The market of mobile gaming is going to be worth $133 billion in 2026 and $140 billion in 2027, according to the forecasts, which indicate that it is going to be a market with a steady growth curve and no signs of saturation.

- The $47 billion revenue expansion between now and six years later, sharing about 50% growth, highlights surpassing the high-growth phase of mobile gaming and the establishment of a long-term, durable, and significant revenue source for the global gaming ecosystem that has been around for a while.

Mobile Gaming ARPU Signals Strong Monetization Momentum

| Year | ARPU (USD) | Year-over-Year Change |

| 2021 | $89.38 | — |

| 2022 | $90.21 | +0.9% |

| 2023 | $91.12 | +1.0% |

| 2024 | $92.31 | +1.3% |

| 2025 | $93.42 | +1.2% |

| 2026 | $94.53 | +1.2% |

| 2027 | $95.41 | +0.9% |

(Source: tekrevol.com)

- The uptrend of average revenue per user (ARPU) in the mobile gaming ecosystem is an indicator of a silent but strong transformation in the player’s value extraction process.

- In 2021, the yearly expenditure of the average mobile game user was $89.38, which became the market’s baseline for engagement-rich but monetisation-deep-refinery.

- During 2022-2024, ARPU growth was stable at around 1% per annum consistently. These gains may seem minor, but they are a sign of a mature mobile game market, where the pricing is not the prime factor, but rather the smartest monetization is.

- In-app purchase design has been improved, subscription models, rewarded advertising, and live-ops content have together lifted user spending without losing retention.

- ARPU hit $93.42 in 2025, showing how effective personalization, AI-driven offers, and hybrid monetization models are.

- The forecast for 2026 and 2027—$94.53 and $95.41 accordingly—are indicative of this momentum being a non-cyclical one.

- The crucial thing is the slow growth rate towards the period’s end, which is indicative of stability instead of stagnation, as developers are concentrating on lifetime value optimization rather than short-term spikes.

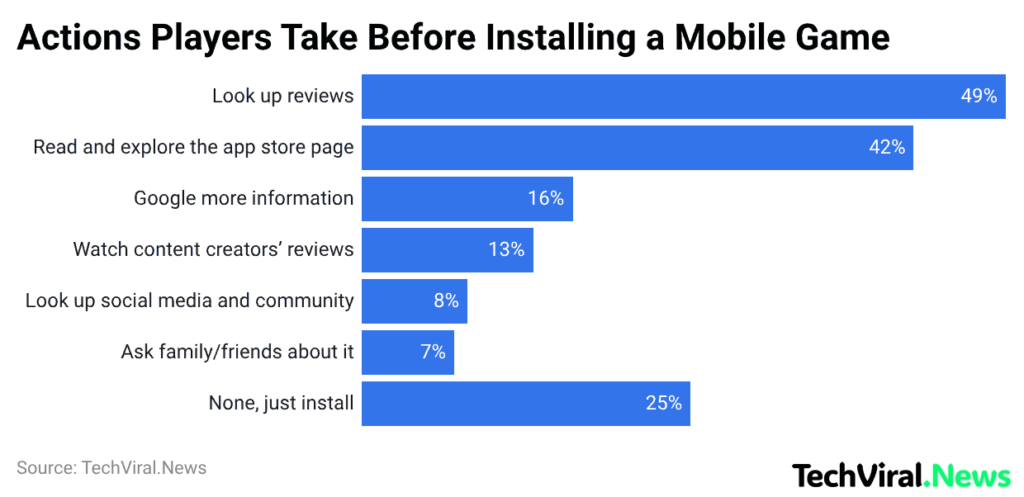

Player Behavior Before Downloading A Mobile Game

(Reference: sqmagazine.co.uk)

- The players’ behavior is very clearly indicated by the data that they mostly adopt a trust-first approach prior to installing the mobile game.

- Peer feedback is the most powerful influence in the decision-making process since almost half of the users (49%) are checking reviews.

- Players are very keen on app store exploration as well, with 42% of them taking a close look at the screenshots, ratings, and gameplay descriptions to judge the quality and value.

- Apart from the app store, 16% of users go on Google to get better and deeper insights, whereas 13% seek help from content creators, which indicates a growing albeit still small role of influencer-driven discovery in the mobile game sphere.

- Social validation is another factor, too, as 8% check community presence and 7% consider recommendations from friends or family as their source of validation.

- Surprisingly, 25% of players simply download a mobile game without researching the game at all. This shows a dual market situation where careful evaluation and quick installs are two sides of the same coin, thereby making first impressions and credibility equally important for the developers.

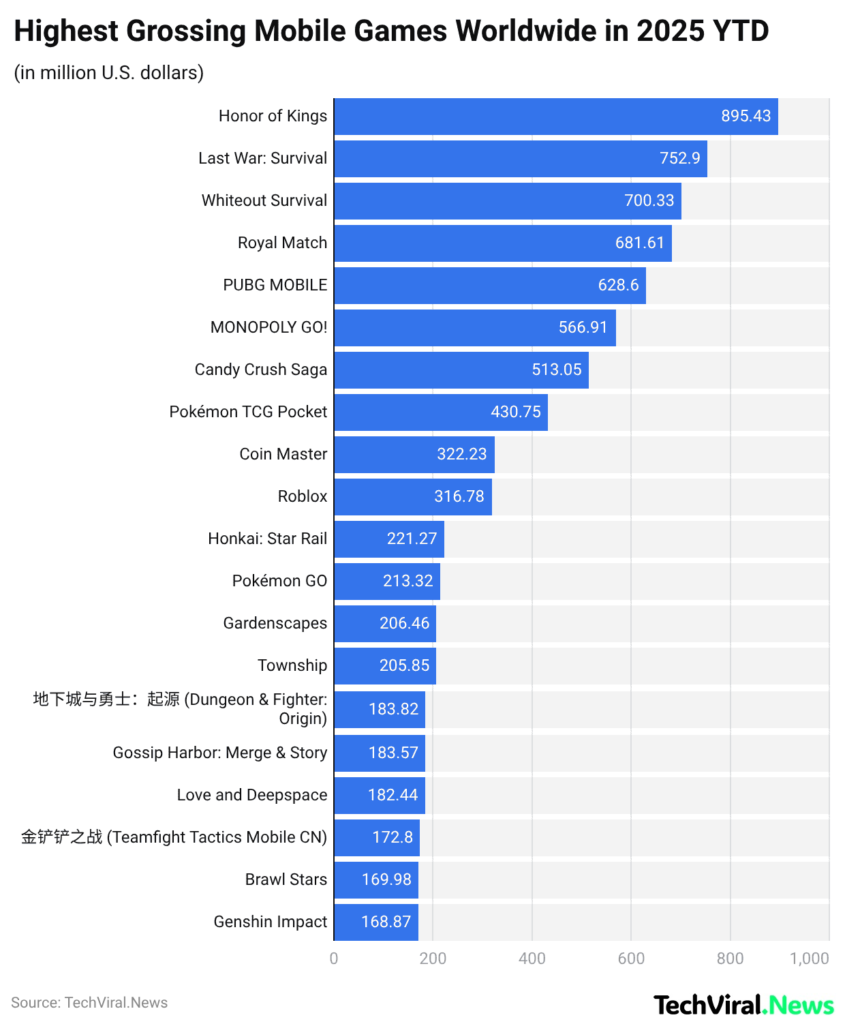

Top-Grossing Mobile Games Worldwide By In-App Purchases

(Reference: statista.com)

- The fiscal numbers of the current year, up to 2025, underline the unbelievable power of monetization from the top-ranked mobile games to be released today.

- Mobile gaming is not only taking the most considerable share of the global gaming time, but also, in-app purchases (IAPs) have turned into the leading revenue engine for the mobile gaming industry to grow further.

- The game of the Chinese developer Tencent, Honor of Kings, is the highest-grossing mobile game of the future by far, which strengthens the position of Asia in the premium mobile monetization and competitive gameplay ecosystems.

- Last War: Survival, the second game, made more than $752 million worldwide, which points out the strong commercial appeal of games based on tactics and survival with long-term engagement and repeat spending.

- In general, the data indicates that, in 2025, sustained engagement is the main factor that drives mobile gaming revenue growth rather than just downloads.

The Most Downloaded Mobile Games Around The Globe In 2025

- The downloading trends of 2025 indicate that the main factors of the global mobile game market are scale, accessibility, and social integration.

- The game Subway Surfers has again confirmed its classic appeal, reaching more than 330 million installs and proving that timeless gaming can be done across different generations.

- Free Fire’s comeback to 270 million downloads is a clear indicator of the need to target mobile games at low-end devices in price-sensitive markets through improving performance and marketing.

- The fact that Roblox Mobile reached a massive number of 248 million downloads is a clear indication of Generation Z’s preference for social, creator-driven environments over single-title experiences.

- At the same time, the 190 million installs of Ludo King are a confirmation that culturally familiar formats are still the main players in the emerging markets, just because they are simple and relevant locally.

- Another indication of the mobile RPG market is the blow-up of Chrono Odyssey Mobile, which went beyond 100 million downloads in mere six months’ time, indicating the demand for high-quality mobile RPGs is increasing.

- The puzzle and hyper-casual genres have also come back to life, as they perfectly fit with the wellness trend (people playing for relaxation) and short attention spans.

- The combined power of India and Brazil as the two top regions in the world (22% of the total installs) definitely points out where the future growth of the mobile game market will be.

- TikTok integrations and cross-platform titles helped the discovery of the games; it is a necessity to consider social media and ecosystem play as the key factors in mobile gaming success.

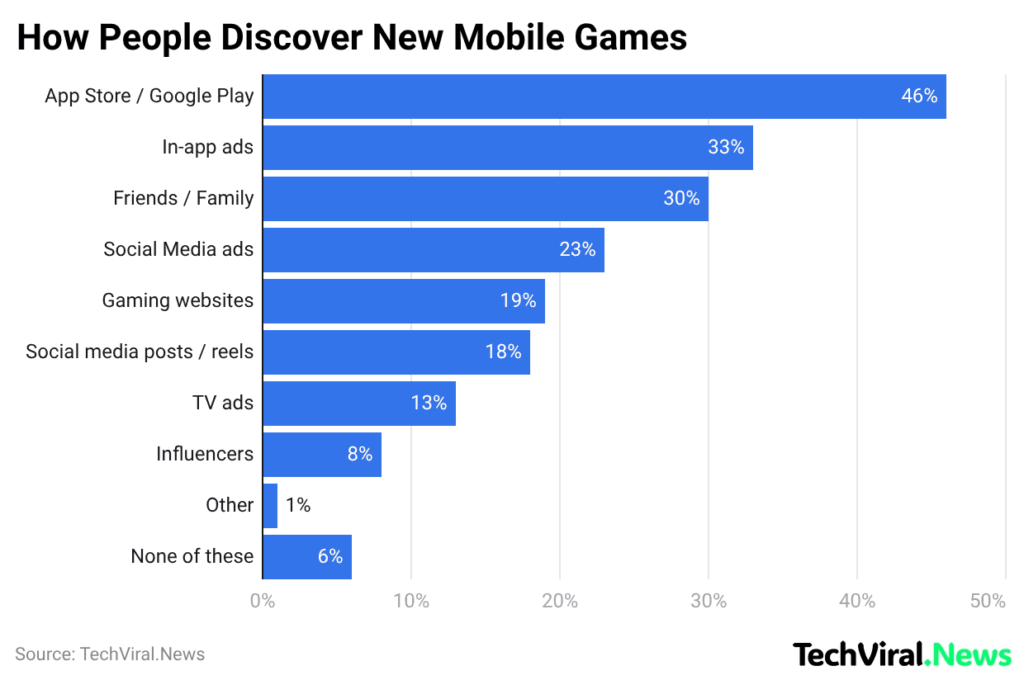

Ways People Find New Mobile Games Today

(Reference: sqmagazine.co.uk)

- The discovery path for a mobile game in 2025 is a mix of platform visibility, paid promotion, and social impact.

- The App Store and Google Play hold the top position, reported by 46% of the users, supporting the essential role of search rankings, featured placements, and strong metadata that lead to organic installs.

- In-app advertising is closely behind at 33%, confirming that cross-promotion and ad networks are still very effective tools to get to the users already in a gaming mood.

- 30% of players depend on the opinions of their friends and family, which is a sign that the quality of the game and retention are the main factors for the long-term growth of the industry.

- Social media ads account for 23% of the discovery effect, while organic posts and reels account for 18%, demonstrating that short-form content is playing a larger role in mobile game awareness.

- The traditional channels like gaming sites (19%) and TV ads (13%) are still there, but in a different supportive role, especially for big-budget titles.

- Influencer marketing is, at 8%, a slightly niche but still a growing lever that will be mainly effective in the communities where it is produced and not in the mass market.

Mobile Gamers Demographics

- The 2025 mobile gaming audience is highly assorted and mature compared to the outdated stereotypes.

- Women are now the leading category of players with 53%, which indicates that the mobile gaming ecosystem is no longer limited to competitive or action-heavy games but has also included relaxation, puzzle, and lifestyle-driven experiences.

- 75% of female gamers claim that they play mainly to relieve stress, thus putting mobile gaming in the domain of wellness rather than pure entertainment.

- The 18-34 age group, which contains almost all users, is the age group that clearly dominates the mobile game market. However, growth among older players is also very noticeable.

- One of the signs that the mobile game market has started to attract working professionals and parents is that one-third of gamers in the U.S. are now 35+.

- Teens are still able to influence the market the most, through their high playtime, rather than through their spending power, and they are the ones who determine the trends by engaging more.

- On average, Gen Z spends $98 less per year than Millennials. Nevertheless, Gen Z makes up for it by trying out and owning more apps.

- The increase in participation of parents by 11% year-onyear points to the significance of family-friendly and educational mobile game titles.

- Moreover, players from LGBTQ+ communities are becoming more involved in narrative-driven genres, and women’s participation is on the rise in esports-style games, all of which indicate a more inclusive, globally nuanced mobile game market—one that is not only driven by gameplay but also by identity and lifestyle.

Companies That Lead The Mobile Gaming Industry

- The mobile gaming industry in 2025 is characterized by enormous size, ecosystems, and elegance in monetization mastery.

- Tencent is in the brightest spot, raking in over $36 billion and commanding the gaming market with evergreens like Honor of Kings and PUBG Mobile.

- The company’s strategic investments in Epic Games, Ubisoft, and Activision Blizzard continue to reinforce its influence and enlarge it beyond China, with Tencent being less a publisher and more a global gaming infrastructure.

- Sony’s gaming revenue of $28 billion is an indication that the traditional console manufacturers are already incorporating mobile strategies into their game plans.

- Apple, with its $18 billion in App Store gaming revenue, further supports this view, showing that platform holders reap the economic benefits of mobile game ecosystems without making games themselves—their control comes from subscriptions and in-app purchases.

- The gaming giant Activision Blizzard keeps on leading the pack with $9.3 billion in revenue and more than 410 million active users every month, primarily owed to such mobile-first hits as Call of Duty Mobile and Candy Crush Saga.

- Epic Games continues to be a great player in the mobile game market with both Fortnite and Unreal Engine, and this situation shows that engines, not just the games, shape the economy of this area.

- On the other hand, companies such as Supercell and Garena demonstrate that focused regional power can be as good as or even better than global presence.

- The undeniable growth of hyper-casual publishers like Supersonic Studios indicates that speed, data-driven design, and ad monetization are still very much the key forces in the industry.

Mobile Games And The Impact On Society And Everyday Life

- The social impact of the mobile game ecosystem in 2025 is so enormous that it goes beyond just entertainment.

- Mobile gaming has become almost every player’s primary reason for using the device; hence, 72% of players say relaxation and stress relief are the top motives behind their mobile gaming activities.

- According to psychologists, modern humans are using it as a digital coping tool amid the growing pressure of living in a fast-paced world.

- Cognitive studies point to this very trend as they report significant enhancements in memory and attention, especially through puzzle and brain-training formats.

- With the rise of socially-oriented mobile games, the gaming industry has become a major player in connecting people.

- The interaction of the gaming titles and the chats held in-game is creating a situation where the shy users and the socially anxious ones can have a non-threatening way to relate to each other, while the existing communities in Discord and Reddit—which already have more than 320 million members—are providing digital places where these users can hang out.

- 43% of gamers are actively participating in multiplayer modes, which proves that the modern gaming lifestyle is primarily about collaboration and sharing goals.

- In fact, the 19% increase in educational app downloads is a sign of the acceptance of games as a medium for the development of language, logic, and math skills in the case of the underserved communities.

- On the other hand, location-based games like Pokémon Go are playing a big part in the real-world lifestyle change, as 43% of the players claimed to be leading a healthier and more active life.

Security and Privacy

- The notion of security and privacy was one of the main characteristics of the mobile game sector in 2025.

- Trust had already been established as a competitive factor, with 42% of the players revealing their worries about the manner in which their data is collected and shared, particularly via third-party ad SDKs.

- Google’s Privacy Sandbox for Android is one of the major platform-level transitions being made, which is leading to changes in the whole structure, mainly affecting more than 30% of ad networks and urging developers to go towards the privacy-first monetization models as the only option.

- The banning of more than 1.3 billion fake accounts not only reflects the tremendous value that in-game economies have reached, but also the extent to which bad actors are going after them.

- An 18% increase in phishing through fake gaming clones indicates the extent of the weaknesses in the system and the reaction of app stores, which removed thousands of deceitful titles in just one quarter.

- Two-factor authentication is now being used to secure more than 50% of active players, while biometric logins are becoming popular in the case of high-revenue games, where security is of utmost importance.

- The safety of children has also become a top priority, with the strict enforcement of COPPA leading to changes in the design and data policies of games aimed at children.

- At the same time, AI-based chat monitoring is demonstrating its effectiveness, cutting down toxic interactions and lowering the risks of grooming by almost 33%.

- Transparency dashboards and zero-knowledge login systems are marking a distinctive industry change.

- Safeguarding user trust is not just a necessity—it is a fundamental part of the growth strategy for the contemporary mobile game market.

The Expanding Influence of Cloud Gaming On Mobile Play

- Cloud gaming is quickly changing the mobile game ecosystem in 2025. Now, 27% of mobile gamers are availing themselves of cloud-based services, which means that the transition is no longer an experiment but has become widely accepted.

- The combined mobile-driven revenue of Xbox Cloud Gaming and NVIDIA GeForce NOW at $2.1 billion is an indication of strong commercial validation.

- 70% of consumers depend on cloud streaming to enjoy AAA titles without the need for costly consoles or PCs, and thus, the premium gaming market is becoming less difficult to access.

- Technology has been a major factor behind this change.

- The implementation of 5G has cut down latency by as much as 40%, thus making mobile phones a practical platform for fast-paced real-time games with improved responsiveness.

- The shift to cloud delivery has also been very beneficial as it has eliminated heavy downloads and thus reduced the players’ average game title storage by 3.4 GB, and therefore, not being a limit to mobile game installs, even when it was storage that was being referred to.

- Subscription-based models are also getting a good deal out of it, as Netflix Games and Apple Arcade Cloud have seen an 18% increase in retention over the past year.

- The growth story is particularly robust in the developing regions, where cloud gaming usage amongst the smartphone-first audience and limited PC access has increased by 33%.

- Cross-save adoption and cloud infrastructure are also proving to be a blessing for the indie studios, which are now able to produce and distribute worldwide complex multiplayer mobile game experiences with the least technical friction.

Conclusion

Mobile Games Statistics: The mobile gaming picture in 2025 has, for the most part, revealed an industry that has gradually progressed from the stage of rapid experimentation to the phase of strategic maturity. The mobile game ecosystem today depends on co-existing large-scale with sophisticated, as it were, combining a great global reach with better- informed monetization, more extensive personalization, and stronger social integration. Revenue growth, rising ARPU, and sustained download momentum indicate long-lasting demand instead of temporary hype.

At the same time, player demography changes, cloud gaming usage, and privacy concerns are hot issues that show how the market is adapting to the long-term user desires. The mobile gaming sector has become the foremost leader in interactive entertainment. In addition, it is also the one that dictates the rules and methods of how digital experiences will be created, monetized, and trusted in the coming years.

FAQ

The mobile gaming sector worldwide made a total revenue of over $125 billion in 2025 and is likely to reach $140 billion by the year 2027.

In the year 2025, the ARPU for mobile games was $93.42 per year, which shows a continuous increase in the monetization of the industry via in-app purchases and subscriptions.

Honor of Kings was at the top of the list for global mobile game revenue in 2025 and was closely followed by Last War: Survival, with in-app purchases being the main source of revenue for these games.

During 2025, the mobile games with the highest ranking in terms of downloads worldwide were Subway Surfers, Free Fire, Roblox Mobile, and Ludo King.

The share of women comes to 53% among the mobile gamers, while nearly the entire player base of the world belongs to the 18–34 years age group.