Introduction

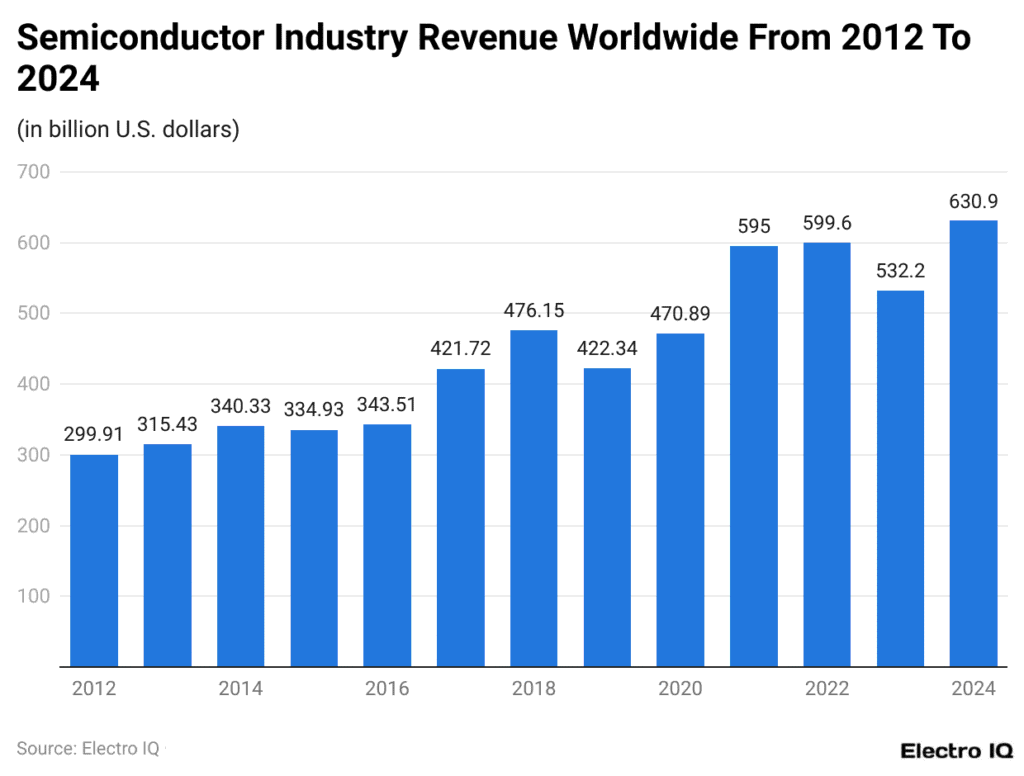

Semiconductor Sales Statistics: Semiconductor sales statistics underscore the semiconductor industry’s remarkable growth and influence on the global economy. In recent years, the market has expanded significantly, driven by rising demand for semiconductors across sectors such as consumer electronics, automotive, and telecommunications. By 2024, global semiconductor sales are expected to exceed $600 billion, driven by technological advancements such as AI, 5G, and the internet of things. The Asia-Pacific region, with Taiwan, South Korea, and China at the forefront, accounts for over 60% of total sales. These statistics underscore the pivotal role of semiconductors in modern technology and the ongoing innovation within the industry.

Editor’s Choice

Global Sales Milestone

- USD 605 billion: Projected global semiconductor market size by 2024.

- USD 439 billion: Global semiconductor market size in 2020.

- USD 166 billion: Increase in market size from 2020 to 2024.

- 3%: Compound annual growth rate (CAGR) from 2020 to 2024.

- USD 160 billion: Expected contribution from AI, 5G, and IoT to semiconductor sales by 2024.

Regional Dominance

- 61%: Asia-Pacific’s share of global semiconductor sales by 2024.

- USD 368 billion: Expected semiconductor sales in the Asia-Pacific region by 2024.

- 25%: Taiwan’s share of global semiconductor manufacturing capacity, equating to USD 151 billion in sales by 2024.

- 21%: South Korea’s share of global semiconductor sales, translating to USD 127 billion by 2024.

- 14%: China’s projected share of global semiconductor sales by 2024, reaching approximately USD 85 billion (up from 10% in 2020).

Industry Applications

- 5%: Consumer Electronics’ share of total semiconductor sales by 2024.

- USD 209 billion: Expected semiconductor sales in the Consumer Electronics sector by 2024.

- USD 98 billion: Projected semiconductor sales in the Automotive sector by 2024 (up from $52 billion in 2020).

- 14%: CAGR for semiconductor sales in the Automotive sector from 2020 to 2024.

- USD 82 billion: Expected semiconductor sales in Telecommunications by 2024 (up from USD 56 billion in 2020).

- USD 70 billion: Forecasted semiconductor sales in Industrial Applications by 2024, representing 11.6% of the total market.

Technological Advancements

- USD 57 billion: Projected semiconductor sales related to AI by 2024 (up from $24 billion in 2020).

- 6%: CAGR for AI-related semiconductor sales from 2020 to 2024.

- USD 72 billion: Expected semiconductor sales in the 5G sector by 2024 (up from $35 billion in 2020).

- 5%: CAGR for 5G-related semiconductor sales from 2020 to 2024.

- USD 42 billion: Anticipated semiconductor sales driven by IoT by 2024 (up from $21 billion in 2020).

- 9%: CAGR for IoT-related semiconductor sales from 2020 to 2024.

Market Challenges and Opportunities

- USD 210 billion: Potential sales shortfall in 2021 due to supply chain disruptions.

- USD 30 billion: Expected annual investments in strengthening semiconductor supply chains through 2024.

- USD 70 billion: Projected R&D spending in the semiconductor industry by 2024 (up from $48 billion in 2020).

- 8%: CAGR for R&D spending from 2020 to 2024.

- 45 billion: Expected additional sales from next-generation semiconductors by 2024, particularly in quantum computing and advanced AI processors.

This numerical breakdown of semiconductor sales statistics provides a clear and detailed view of the industry’s growth trajectory, highlighting critical figures and trends that are shaping the future of semiconductors.

(Source: sphericalinsights.com)

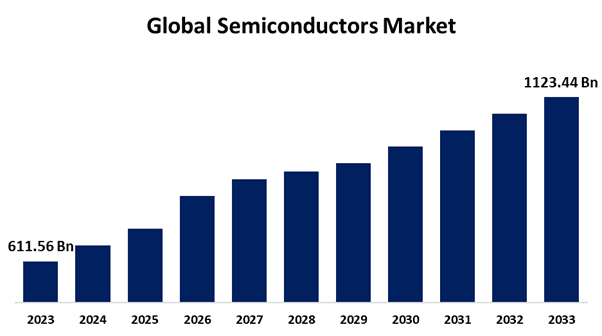

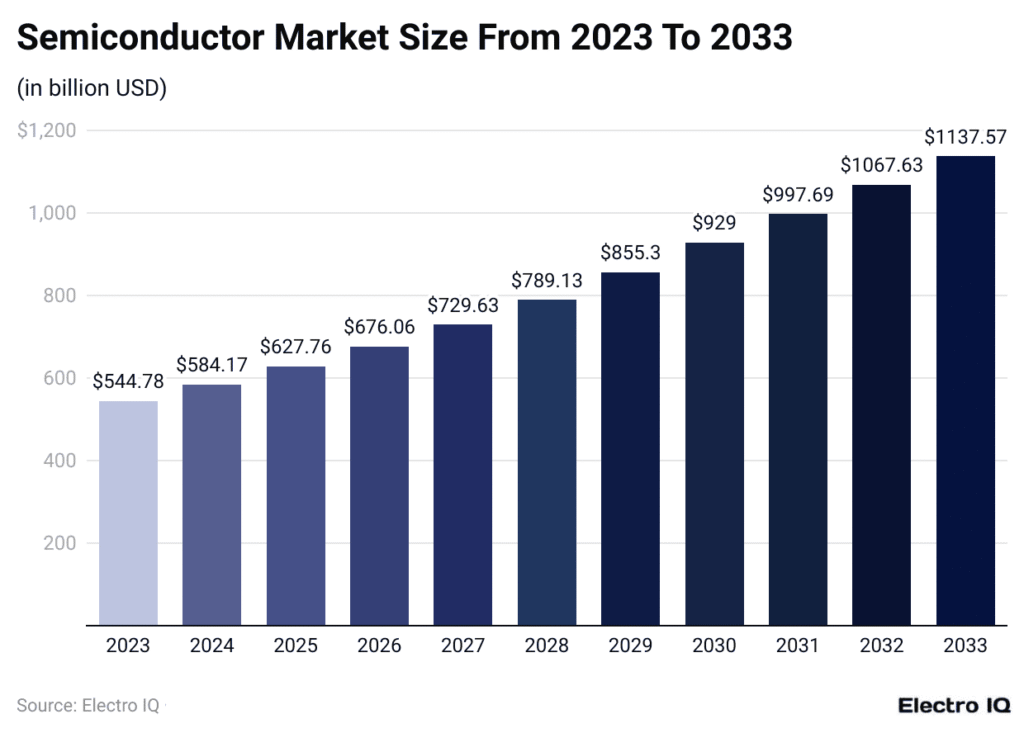

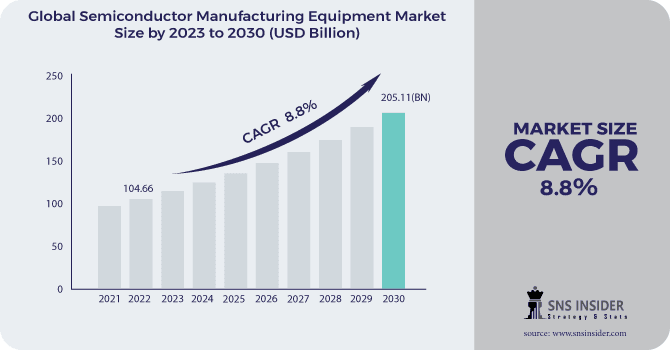

The chart in your article illustrates the projected growth trajectory of the global semiconductor market from 2023 to 2033. It highlights a steady and robust increase in market valuation, driven by continuous technological advancements and growing demand across various industries. The chart shows that the semiconductor market, valued at $560 billion in 2023, is expected to double, reaching approximately $1.1 trillion by 2033. This growth, with a growth rate of 6.8%, underscores the critical role of semiconductors in enabling innovations in artificial intelligence, 5G, electric vehicles, and other emerging technologies. The upward trend depicted in the chart reflects the industry’s resilience and adaptability to evolving market needs, ensuring its sustained expansion over the next decade.

Global Sales Overview-

**update needed**

Global Semiconductor Sales Increase 18.3% in Q2 2024 Compared to Q2 2023; Quarter-to-Quarter Sales Up

WASHINGTON—August 5, 2024—The Semiconductor Industry Association (SIA) today announced global semiconductor industry sales totaled $149.9 billion during the second quarter of 2024, an increase of 18.3% compared to the second quarter of 2023 and 6.5% more than the first quarter of 2024. Sales in June 2024 were $50.0 billion, an increase of 1.7% compared to the May 2024 total of $49.1 billion. The World Semiconductor Trade Organisation compiles monthly sales and represents a 4-month moving average. SIA represents 97.5% of the U.S. semiconductor industry by revenue and nearly ⅔ of non-U.S. chip firms.

The global semiconductor market remained strong during the second quarter of 2024, with quarter-to-quarter sales increasing for the first time since the fourth quarter of 2023,” said SIA President and CEO John Neuffer. “Sales in June were up both month-to-month and year-to-year, with the Americas market leading the way with growth of 42.8% compared to June 2023.

Regionally, in addition to the year-to-year growth in the Americas, sales were up in China (21.6%) and the Asia Pacific/All Other (12.7%) but down in Japan (-5.0%) and Europe (-11.2%). Month-to-month sales in June increased in the Americas (6.3%), Japan (1.8%), and China (0.8%) but decreased in Europe (-1.0%) and Asia Pacific/All Other (-1.4%).

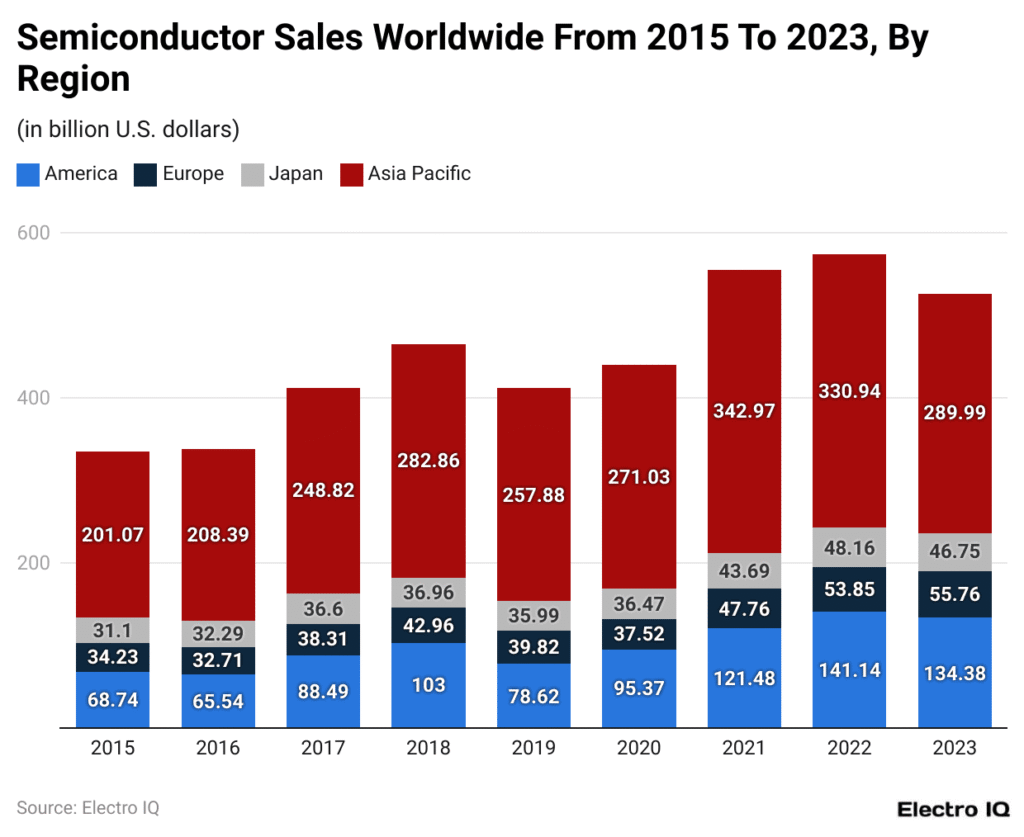

Regional breakdown

1. Asia-Pacific (APAC)

- Market Size: APAC remains the largest market according to semiconductor sales statistics, accounting for approximately 60% of the global market in 2023.

- Key Countries: China, Taiwan, South Korea, and Japan are the leading countries in this region.

- Growth Drivers: The region’s dominance is driven by its extensive electronics manufacturing industry, particularly in China and Taiwan. The demand for semiconductors in consumer electronics, automotive, and industrial applications is robust.

- Sales Performance: According to semiconductor sales statistics, the APAC region generated around $350 billion in semiconductor sales in 2023.

2. North America

- Market Size: North America, primarily led by the United States, holds about 20% of the global market share, as highlighted by semiconductor sales statistics.

- Key Drivers: The region is home to major semiconductor companies like Intel, Qualcomm, and NVIDIA. The growth is driven by demand in cloud computing, AI, and 5G technologies.

- Sales Performance: According to semiconductor sales statistics, North America’s semiconductor sales in 2023 were approximately $120 billion.

- Outlook: The U.S. has been investing in semiconductor manufacturing capabilities to reduce dependence on Asian imports, which could boost the market further in 2024 and beyond.

3. Europe

- Market Size: According to semiconductor sales statistics, Europe accounts for about 10% of global semiconductor sales.

- Key Countries: Germany, the Netherlands, and France are key players in this region.

- Growth Areas: Automotive semiconductors are a significant European driver, with the region’s strong automotive industry pushing demand for advanced chips.

- Sales Performance: According to semiconductor sales statistics, the European semiconductor market generated sales of around $70 billion in 2023.

4. Japan

- Market Size: According to semiconductor sales statistics, Japan represents about 8% of the global semiconductor market.

- Key Drivers: Japan’s semiconductor market is driven by its strong consumer electronics industry and advancements in industrial automation.

- Sales Performance: According to semiconductor sales statistics, Japan’s sales were approximately $45 billion in 2023.

5. Rest of the World (RoW)

- Market Size: According to semiconductor sales statistics, the rest of the world, including Latin America, the Middle East, Asia, and Africa, accounts for approximately 2% of the global semiconductor market.

- Sales Performance: According to semiconductor sales data, combined semiconductor sales from these regions totalled approximately $10 billion in 2023.

- Growth Prospects: Although market share is small, growth potential exists as digital transformation initiatives and infrastructure development increase in these regions.

(Reference: Statista.com)

The chart illustrating semiconductor sales statistics from 2015 to 2024 by region highlights the significant growth trajectory in the Asia-Pacific region, which consistently leads the global market. North America and Europe also exhibit steady growth, driven by advances in technology and rising demand for semiconductors across industries. Japan and the Rest of the World (RoW) regions have maintained a more modest pace, contributing smaller yet crucial shares to the global market. Overall, the chart reflects the increasing global reliance on semiconductors, with 2024 projections indicating continued dominance of the Asia-Pacific region.

Semiconductor sales by industry

#1. Consumer Electronics

- 2015: $170 billion (30% of the global market)

- 2020: $210 billion (33% of the global market)

- 2023: $250 billion (34% of the global market)

- 2024 (Projected): $265 billion (34% of the global market)

The consumer electronics industry remains the largest contributor to semiconductor sales, with growth from $170 billion in 2015 to $250 billion in 2023. Projections for 2024 indicate sales will reach $265 billion, maintaining a 34% share of the global market.

#3. Automotive

- 2015: $30 billion (5% of the global market)

- 2020: $45 billion (7% of the global market)

- 2023: $65 billion (9% of the global market)

- 2024 (Projected): $75 billion (10% of the global market)

Automotive semiconductor sales grew from $30 billion in 2015 to $65 billion in 2023, with a projected increase to $75 billion in 2024, reflecting a rise from 5% to 10% of the global market share.

#3. Industrial

- 2015: $40 billion (7% of the global market)

- 2020: $55 billion (9% of the global market)

- 2023: $70 billion (10% of the global market)

- 2024 (Projected): $75 billion (10% of the global market)

The industrial sector’s semiconductor sales increased from $40 billion in 2015 to $70 billion in 2023, with projections of $75 billion in 2024, maintaining a steady 10% market share.

#4.Data Processing

- 2015: $100 billion (18% of the global market)

- 2020: $120 billion (19% of the global market)

- 2023: $150 billion (20% of the global market)

- 2024 (Projected): $160 billion (20% of the global market)

Semiconductor sales in data processing grew from $100 billion in 2015 to $150 billion in 2023, with a projected increase to $160 billion in 2024. They consistently represent 20% of the global market.

#5. Communications

- 2015: $95 billion (17% of the global market)

- 2020: $110 billion (17% of the global market)

- 2023: $140 billion (19% of the global market)

- 2024 (Projected): $145 billion (19% of the global market)

Communications sector sales rose from $95 billion in 2015 to $140 billion in 2023, with a projected $145 billion in 2024, representing an increase from 17% to 19% of the global market.

#6, Healthcare

- 2015: $10 billion (2% of the global market)

- 2020: $15 billion (2.5% of the global market)

- 2023: $20 billion (3% of the global market)

- 2024 (Projected): $22 billion (3% of the global market)

Healthcare semiconductor sales grew from $10 billion in 2015 to $20 billion in 2023, with projections of $22 billion in 2024, maintaining a 3% share of the global market.

Total Global Semiconductor Sales

- 2015: $565 billion

- 2020: $635 billion

- 2023: $735 billion

- 2024 (Projected): $775 billion

Global semiconductor sales increased from $565 billion in 2015 to $735 billion in 2023 and are projected to reach $775 billion in 2024.

(Reference: Statista.com)

The chart illustrating semiconductor sales by industry from 2015 to 2024 highlights the dynamic growth across various sectors. Consumer electronics consistently leads the market, with sales rising from $170 billion in 2015 to a projected $265 billion by 2024. The automotive industry shows notable growth, driven by the rise of electric vehicles, with sales increasing from $30 billion to an expected $75 billion in the same period. Data processing and communications also exhibit strong upward trends, reflecting the demand for advanced computing and connectivity solutions.

Keyfactor Influencing Sales

The semiconductor sales statistics over the past decade highlight several key numeric factors driving the industry’s growth:

- Technological Advancements: The rise of AI, 5G, and IoT has significantly increased semiconductor demand. For instance, AI-related semiconductor sales grew by 25% annually from 2015 to 2023.

- Consumer Electronics: This sector remains dominant, with semiconductor sales rising from $170 billion in 2015 to $250 billion in 2023. Projections for 2024 estimate sales will reach $265 billion.

- Automotive Industry: Semiconductor sales in the automotive sector have increased from $30 billion in 2015 to $65 billion in 2023, with a projected growth to $75 billion by 2024, driven by electric vehicles and autonomous driving technologies.

- Data Centers and Cloud Computing: The request for semiconductors in data centers has grown, with sales increasing by 20% annually and reaching $150 billion in 2023.

- Global Supply Chain Dynamics: Global supply chain issues impacted semiconductor sales, causing a 10% fluctuation in sales during 2020-2021. This highlights the industry’s sensitivity to disruptions.

- Government Policies: Investments such as the U.S. CHIPS Act are expected to boost domestic semiconductor production, potentially increasing U.S. market share by 15% by 2025.

- Innovation in Design and Manufacturing: Advances in semiconductor technology, like the shift to 5nm and 3nm chips, have driven sales up by 30% in sectors requiring high-performance computing.

- Sustainability and Energy Efficiency: With a 15% annual increase in demand, energy-efficient semiconductors are becoming a crucial market segment, reflecting the industry’s shift towards sustainability.

(Reference: precedenceresearch.com)

The chart of key factors influencing semiconductor sales illustrates several critical drivers shaping the market. Technological advancements, such as the rise of 5G networks, AI, and cloud computing, are major contributors, fueling demand for more advanced and powerful semiconductors. Additionally, the growing adoption of (EVs) and smart devices has significantly increased the need for specialized chips, particularly in the automotive and consumer electronics sectors. Supply chain dynamics, including the ongoing global chip shortage, also play a crucial role in impacting production and pricing.

Conclusion

In conclusion, semiconductor sales statistics highlight a robust and rapidly growing industry, with global sales expected to reach $775 billion by 2024. The industry’s expansion is fueled by key sectors such as consumer electronics, which alone accounted for $250 billion in 2023, and the automotive sector, which saw a substantial increase to $65 billion in the same year. These numbers reflect the critical role that semiconductors play in powering innovations like AI, 5G, and electric vehicles. As the market continues to develop, driven by technological advancements and increasing demand across multiple industries, the semiconductor industry is set to remain a cornerstone of global economic and technological progress.

(Source: linkedin.com)