Introduction

Open Banking and API Usage Statistics: Data has become the main driving force of the world, and open banking is one of the signs of this change. It has not only been a fintech trend but a foundation of the modern financial systems. What was initially a regulation-oriented initiative intended to create an environment of transparency and competition has now become a global economic power, literally changing the way individuals and businesses handle money.

APIs (Application Programming Interfaces) are the technology that enables this change, and they are the invisible yet powerful tools that allow banks to share data securely and let third parties develop new services without having to build entire systems from scratch.

This paper will give you a wide and rich picture of the 2025 landscape based on Open Banking and API Usage statistics, research insights, and the generation of financial impact. All the information will be collected from the most current research and industry sources.

Editor’s Choice

- Global consumer adoption reached 51% in 2025, rising steeply from 40% the previous year, and indicating that it has been accepted.

- Open banking transaction volumes amounted to US$676 billion worldwide in 2025, thus indicating a solid annual growth of 36%.

- Europe is at the forefront of the market, with 98% of the financial sector adopting API-based approaches in response to the PSD2 Directive.

- The number of open banking APIs has increased significantly, exceeding 47,000 globally, thereby enabling a very constructive relationship between banks and fintech companies.

- Data security remains a major concern, as reflected in the fact that 68% of consumers voice concerns about protecting their data in open banking situations.

- By using APIs, financial institutions managed to lower their operational costs by an average of 33%, thanks to increased efficiency and automation.

- With the help of API-driven platforms, the entire transaction process was sped up by 56%, and loan approvals were completed in a matter of seconds, resulting in a 44% reduction in loan processing times.

- Banking-as-a-Service platforms are expected to be a significant source of US$30 billion-plus in API revenues by 2025, with a CAGR of 15-18% on the way.

- API-first banking models have slashed the delivery time for new products by 39% which in turn has enhanced the agility of institutions.

- The USA is at the forefront of the global API adoption race, with nearly all of the country’s 97% of financial institutions actively using APIs.

- Roughly 87% of the world’s Tier-1 banks are already moving towards open banking, along with the direct or fintech-partnering route.

- Embedded finance use is on the rise, with the majority (over 60%) of online retail businesses adopting open banking for both payments and user verification.

- The first quarter of 2025 saw massive global open banking API usage, with over 72 billion calls, while top-tier banks demonstrated high reliability with API uptime of more than 99.98%.

Open Banking And API Landscape

- By the end of 2025, open banking will have been recognized as one of the cornerstones of the financial systems of modern times, especially in the case of developed countries.

- The fact that roughly 90% of countries with developed financial markets now govern open banking APIs underscores regulators’ strong support for data sharing and the interoperability that comes with it.

- Alongside the regulatory framework, consumer acceptance has been facilitated, with more than half (51%) of global consumers reportedly using at least one open banking service in 2025, an increase of 11% from the previous year, when the figure stood at 40%.

- The increase in usage has been accompanied by a corresponding rise in transactions, with global open banking transactions reaching US$676 billion in 2025, a 36% year-on-year growth.

- Europe remains at the forefront of global adoption, as evidenced by the fact that 98% of financial institutions are using open APIs to meet PSD2 compliance requirements.

- The number of open APIs worldwide has crossed 47,000, a major factor in tighter collaboration between banks and fintech companies and in extensive innovation across the payment, lending, and personal finance sectors.

- Nevertheless, the exceptionally rapid growth has exacerbated security issues, as 68% of consumers are worried that their data might not be protected in an open banking environment, suggesting the need for strong API security and governance.

- In North America, the scenario is a bit different: even smaller banks have started participating in open banking.

- In 2025, 61% of small banks were reported to be involved in open banking initiatives, a considerable increase from the past.

Strategic API Models In Banking Services

- In 2025, APIs will be the main driver of technical banking innovation and competitive differentiation.

- Global Banking-as-a-Service (BaaS) platforms will purportedly be a source of more than US$30 billion in API-derived revenue by 2025, which will be sustained by the aforementioned robust growth of 15–18% CAGR as the financial institutions monetize their infrastructure and nurture partnerships with other players in the ecosystem.

- The API-first banking models will go a long way toward increasing institutional agility, shortening the time-to-market for new financial products by 39% in 2025, and enabling faster responsiveness to shifts in customer expectations.

- Digital-native banks are hugely reliant on APIs; hence, 82% of neobanks depend on the API-based ecosystems to offer their customers top-notch, flexible, and digital experiences.

- The trend of embedded finance is growing, as the number of APIs for embedded finance technologies reportedly increased by 47% in 2025, enabling the provision of financial services directly on non-banking platforms such as e-commerce, mobility, and SaaS applications.

- It can be said that APIs have played a major role in the digital payments rush, with APIs for wallets alone said to have processed more than US$970 billion in global transactions in 2025.

- To cater to different customer requirements, banks are now offering customizable API packages, with 68% of banks offering them.

- In addition, 58% of conventional banks have implemented hybrid API strategies that integrate modern digital services with legacy core banking systems.

Country-Specific Statistics And Information

- API adoption shows regional variation, but it is indicative of strong global progress overall.

- The United States is at the forefront of global API adoption, with 97% of banks fully integrating APIs into their operations by 2025.

- Europe remains the global leader in setting and enforcing regulations, achieving a remarkable 98% open banking compliance rate under PSD2.

- In China, fintech companies are boosting API investment by 32% annually in 2025, mainly due to the fast-growing digital payments industry and the popularity of platform-based financial services.

- Furthermore, India is one of the best-realized countries when it comes to the instant payment system, and its API-enabled UPI network processing over US$4.2 trillion transactions in 2025 is clear evidence of that.

- On the other hand, 94% of banks in Australia have been empowered by the Consumer Data Rights (CDR) framework to use APIs for safe data sharing, while the open banking market in Canada is supported by large-scale API rollouts and growing at 22% per year.

- Brazil’s open banking scheme is expected to be participated in by 68% of the banks in 2025, which will enhance the financial sector’s modernization and competitiveness, as it has been in the case of the Latin American region.

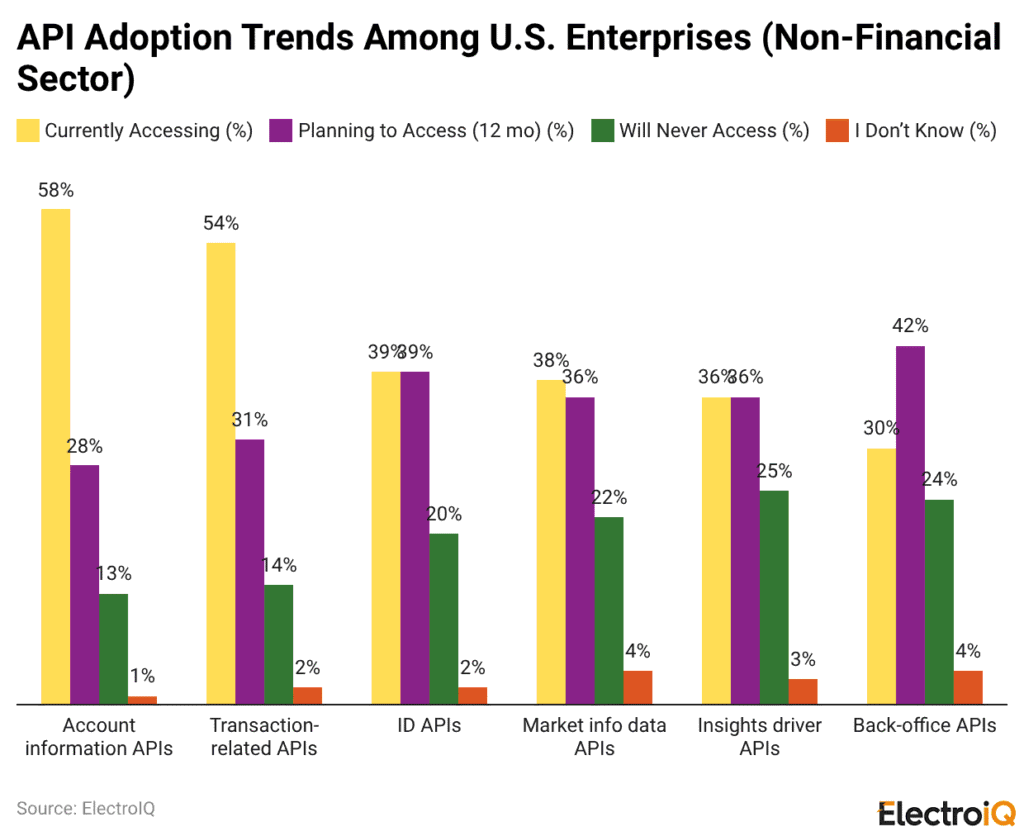

API Adoption Trends Among U.S. Enterprises (Non-Financial Sector)

(Reference: coinlaw.io)

- In addition to the financial sector, API use in non-financial sectors is becoming more common as U.S. companies turn to financial APIs to improve operations and data accessibility.

- Account Information APIs are the most popular, with 58% of survey participants reporting their use.

- The next up are Transaction-related APIs, with 54% already using them and an additional 31% intending to adopt them in the next 12 months.

- Identity-related APIs are experiencing balanced growth, with 39% of businesses using them and another 39% planning to adopt them.

- This is the only case where current and future adoption levels are equal. Market Information Data APIs have a current usage of 38% and a planned adoption of 22% of respondents declare that they will never use them. Insights Driver APIs show the same level of present and intended adoption at 36%, along with a relatively high rejection rate of 25%.

- Back-office APIs are used the least at 30%, but they send the strongest future growth signal: 42% of companies plan to use them, indicating greater demand for automation and operational efficiency.

Open Banking Usage By Financial Institutions

- Open banking has undergone gradual acceptance and is now commonplace in 2025, when the main financial systems were already using it.

- A little over 87% of the top banks worldwide have given open banking capabilities either through their own-built platforms or partnerships with fintech providers.

- Almost 60% of regional banks in the United States have at least one data API enabled and are frequently working with aggregators like Plaid or MX to speed up deployment, learning from large banks’ experiences.

- Community banks and credit unions have also increased their participation, with a 31% year-over-year rise, driven by API initiatives led by consortia that reduce implementation costs.

- Open banking is no longer an exception but rather a standard practice among digital-first and most European financial institutions, with neobanks such as N26 and Revolut offering full open banking integration as a default.

- Asia is also seeing impressive scale in open banking adoption, with major banks like DBS and ICICI offering more than 20 APIs each to third-party developers.

- In the payments space, Brazil is the leader, with over 80% of banks active and offering PISP (Payment Initiation Service Provider) functionality.

- Open finance in Latin America is also expanding beyond the banking sector into insurance and pension funds, which are adopting the same data-sharing standards.

- Investments enabled banks to implement API infrastructure, reducing third-party onboarding time by 29%.

- Moreover, payment processing systems among banks in some parts of the world, such as Europe and India, are becoming more open and thus faster as they use banking rails.

Reasons For Open Banking To Grow

- Regulations are the strongest global instigator of open banking adoption.

- Regulations like PSD2 in Europe, Consumer Data Right (CDR) in Australia, and Brazil’s Open Finance framework are still pushing financial institutions towards standardized APIs and secure data sharing.

- Simultaneously, the increasingly digital-savvy consumer base is prompting banks to adopt open, API-based experiences to retain their customers.

- Embedded finance is a major force, as over 60% of online retail platforms rely on open banking for account verification and payment processing.

- The trading of customer data through APIs has led to the average KYC (customer due diligence) completion time falling by 30% making it time-wise beneficial for both banks and fintechs.

- Consumer demand for personalization has prompted around 72% of U.S. fintechs to bring open banking technologies into their product stacks.

- Cloud-native banking platforms like Thought Machine and Mambu have enabled the rapid rollout of open banking products.

- From a consumer perspective, data control will be the main reason for using banking tools for sharing in 2025.

- On the lending side, the use of income and transaction APIs for real-time loan decisions has reduced the approval wait time by 43% in Europe.

- The advent of financial super apps that now cater to over 100 million individuals worldwide is, at the same time, a direct result of open banking partnerships.

- The rivalry is very fierce, with the majority of the banks (81%) in the aforementioned markets declaring that open banking is vital for their long-term survival.

Industry Segments Benefiting From Open Banking

- Several sectors have started to reap the benefits of open banking adoption. For example, the lending platforms leveraging open banking data have reported a 22% reduction in default rates attributed to enhanced risk assessment and more comprehensive borrower profiles.

- Wealth management companies make use of consolidated account data to provide personalized investment advice to more than 15 million people.

- The insurance sector has also seen a change, with 35% of the insurtech companies now utilizing income and expenditure data APIs for more accurate and efficient premium pricing.

- Real estate and mortgage companies are also using open banking, as the process for pre-approvals has become faster through the direct integration of banking data into applications.

- B2B payment companies like Stripe and Adyen have adopted open banking, enabling them to offer instant bank transfers to their clients and reducing transaction fees by half.

- Companies in the gig economy, such as Uber and DoorDash, utilize real-time income APIs to facilitate the calculation of loans and benefits.

- In the U.S., student finance is about to take a step forward by leveraging open banking services to assess loan eligibility without relying on traditional credit history.

- Additionally, healthcare finance startups have started to play with the idea of sharing the patient’s spending habits with the doctor to provide the patient with an installment payment option at the time of treatment.

- The travel and ticketing industry has shifted to incorporating payment initiation services to eliminate reliance on card networks, while small and medium enterprises using ERP-integrated open banking solutions have increased the accuracy of their accounts receivable and payable reconciliation by 31%.

Open Banking API Usage

- The metrics for open banking APIs usage reflect the development of open banking ecosystems and their maturity in 2025.

- In the first quarter of 2025, more than 72 billion open banking API calls were made globally, up from 44 billion in the same period the previous year.

- A financial institution typically provides 16 APIs for third-party developer access.

- The leading category in API usage was Account Information Services, with a 63% share of global API traffic, followed by Payment Initiation Services at 28%.

- API uptime among the top banks has surpassed 99.98%, thus consumer trust and quality have been hardly broken.

- The use of token-based authentication has increased significantly and is now the standard, with 91% of open banking frameworks employing it for issuing secure and revocable customer consent.

- In addition, the decline is also seen in technical issues; for instance, the number of API failures due to throttling or schema inconsistencies has been reduced by 41% each year.

- The API gateway market is getting dominated more and more by Banking-as-a-Service platforms, which is making it easier for the smaller banks to the large ones to scale the open banking adoption quickly.

- In the Indian scenario, the Account Aggregator (AA) framework processed more than 150 million data-sharing consents in the January-March 2025 period alone.

- In the EU, call volumes for PSD2-compliant APIs increased by 18% year-on-year, with the Netherlands and Germany the strongest contributors.

- The report from API analytics platforms like Tink and TrueLayer mentions that the provision of detailed usage insights is being utilized by banks for endpoint performance optimization and improving the overall developer experience.

Conclusion

Open Banking and API Usage Statistics: Open banking has indeed solidified its position as the most important component of the global financial ecosystem by the end of 2025. This results from strong regulatory backing, rapid consumer adoption, and advances in API technology. In the various regions where it is implemented, the use of APIs has resulted in significant improvements in terms of efficiency, cost savings, personalization, and speed for both the financial institutions and their customers.

Among the many areas, such as real-time payments, lending, and cross-industry use cases, open banking has been the factor that has transformed the financial services industry into a customer-centric model. As API reliability, security, and scalability continue to improve rapidly, open banking has shifted from a nice-to-have to a must-have. This is the main reason it will be a long-term source of competition, inclusion, and digital transformation worldwide.

Open banking is a system that allows banks to share customer data with third-party providers, but only if the customers have given their permission and only through APIs that are secure APIs. In 2025, APIs are the components that form the foundation of open banking as they support the cross-institutional data exchange, the quicker innovation process, and the secure data exchange without the need for rebuilding the core systems of the institutions involved.

Open banking’s presence is now felt in every corner of the world and has become standard practice in the financial industry. In 2025, more than half of consumers that are worldwide (51%) would have availed at least one open banking-enabled service, while the percentage of Tier-1 banks in the world that have already made their open banking capabilities available has reached 87%.

There is a clear-cut divide where banks and consumers reap the benefits from the utilization of APIs in the open banking scenario. The banks themselves estimate a cut in their operating costs of 33% due to resorting to automation.

In short, APIs are the ones that are at the center of the banks adopting the new model of open banking that encompasses Banking-as-a-Service (BaaS), embedded finance, and API-first product design. Research predicting 2025 states that BaaS platforms would be responsible for over US$30 billion of API-based revenue, which would be the result of a 15-18% CAGR growth.

The APIs used in the open banking scenario are providing benefits to numerous sectors outside the traditional banking sphere. For instance, lending platforms report a decrease of 22% in default rates, insurers requesting financial data via APIs find their pricing more accurate, and wealth management companies give personalized advice to more than 15 million customers.