Introduction

Sustainable Finance And Impact Investing Via Banks’ Statistics: The time when climate change, inequality, and social justice were pointed out as global challenges has come, and thus, finance is not only about returns anymore, but it is about impact. Sustainable finance and impact investing are responsible for the change taking place in the banking sector, directing trillions of dollars toward social and environmental benefits.

For the future, success is not only for profit; in 2025, banks are going to be very important in the process of making capital available that will not only generate financial returns but also help in achieving the United Nations’ Sustainable Development Goals (SDGs), promoting equal growth, and reducing the risks posed by the environment. Industry reports predict a market for Environmental, Social, and Governance (ESG)-aligned assets that has grown to tens of trillions worldwide, a considerable portion of which is enabled or led by banks.

Let us examine recent data on 2025 Sustainable Finance and Impact Investing via Banks, supported by global studies and financial metrics, to assess the current state and future trajectory.

Editor’s Choice

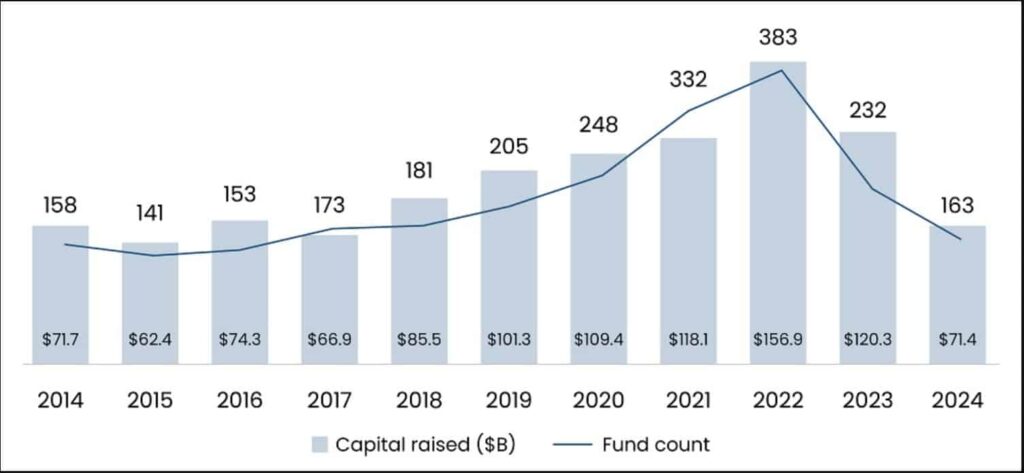

- Global impact fundraising experienced strong growth from 2014 through 2022, reaching a peak of approximately US$156.9 billion across 383 funds, before sharply declining to US$71.4 billion and 163 funds by 2024, driven by tighter financial conditions and shifting political attitudes toward ESG issues.

- The private equity market is a poster child of the ESG trend: 64% of private equity investors continue to consider ESG factors when making investment decisions. Thus, although fundraising has slowed, ESG remains central to the private equity market.

- 43% of the total assets of the world’s largest technology companies are located in extremely water-stressed areas, although the degree of exposure varies substantially across firms.

- 85% of banks are committed to net-zero by 2050, and 91% of executives consider integrating sustainability into the business the most important factor for future growth.

- The setting of high targets is not matched by operational execution, as only 10% of total banking assets are valued using highly detailed climate risk models.

- 60% of banks have already incorporated ESG into their risk management frameworks.

- A transition in portfolio is underway: 25% of banks’ investments are now socially responsible, 47% are restricting fossil fuel financing, and 65% plan to completely stop it by 2030.

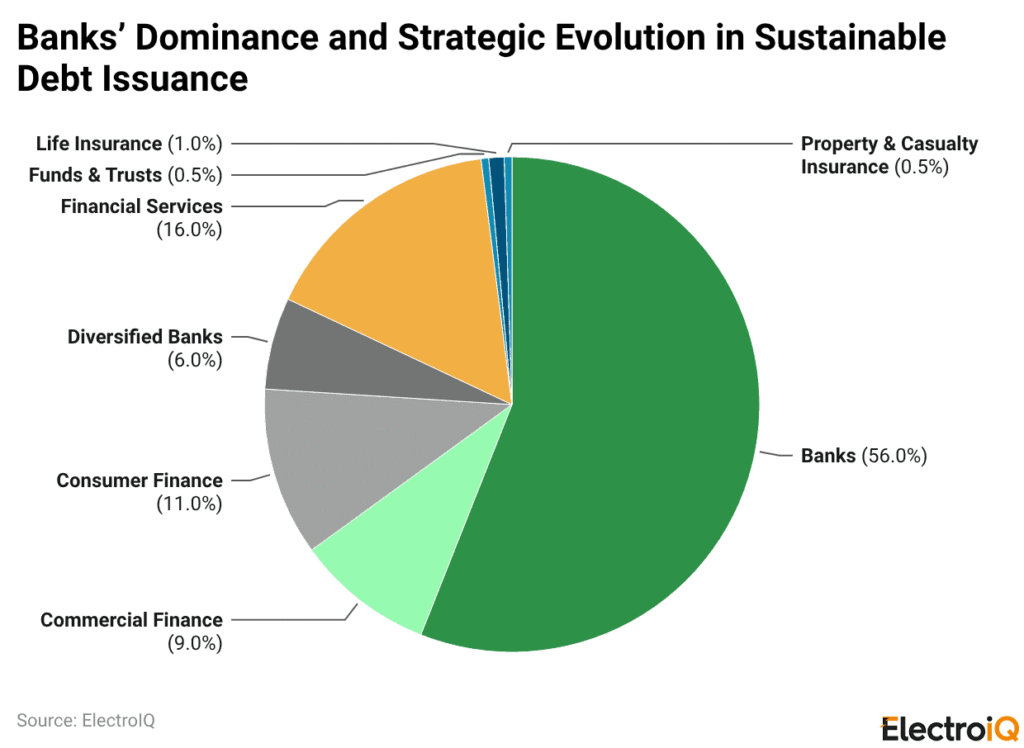

- Banks’ share of the sustainable debt market is 56%, representing the total amount they have issued, which is very high relative to other financial sectors.

- In 2024, global sustainable debt issuance declined by 6%, with bank-led issuance accounting for the largest share of the decline (19%).

Global Impact Fundraising Trends And The Evolving Role Of ESG In Private Equity

(Source: sganalytics.com)

- The global impact fundraising activity has been analyzed from 2014 to 2024, and at the same time, the total amount of capital raised (in billions of dollars) and the number of impact-focused funds launched each year have been brought to the forefront.

- The period from 2014 to 2022 shows a clear increase in the market. The capital raised increased steadily from about US$71.7 billion in 2014 to a peak of US$156.9 billion in 2022, while the fund count also rose sharply, reaching a high of 383 funds in 2022.

- This phase indicates investors’ strong preference for ESG- and impact-driven strategies, which were favoured by favourable market conditions and increasing institutional demand.

- Nonetheless, the graph shows a clear deceleration after 2022. By 2023, capital raised declined sharply to US$120.3 billion, and then fell further to approximately US$71.4 billion in 2024.

- The number of funds declined significantly, reflecting the manner in which capital was raised; thus, 383 funds in 2022 decreased to 232 in 2023 and to only 163 in 2024. Such shrinking is consistent with the changing political climate regarding ESG, stricter financial conditions, and the broader challenges the private market faced in raising funds.

- Yet, the decline is there, but the content that goes along with it emphasizes the fact that ESG is still a major factor in private equity decision-making.

- For example, PitchBook reports that in its 2024 survey, 64% of respondents still consider ESG factors in investment appraisal.

- Although public commitment to ESG may have waned, institutional investors have not only continued but also increased the embedding of ESG considerations in their fundamental investment processes; thus, they are very likely to signal that ESG has become more structural than cyclical within private equity.

Trends In Global Sustainable Finance And Impact Investing

- The data indicate that, in 2025, sustainable finance is more affected by rising risk than by linear progress.

- The financial centers like Europe and North America, which have been following the ESG norms for years, are already giving hints of overall sustainability performance decline.

- Although greenhouse-gas intensity has declined slightly, the reductions are insufficient to meet emissions targets, increasing transition risk for investors in carbon-intensive asset classes and in countries that are slow to implement policies.

- The state of climate pledges at the governmental level also strengthens this concern.

- The largest emitters of greenhouse gases globally are unlikely to meet their 2030 Nationally Determined Contributions (NDCs).

- The gap caused by this non-fulfilment necessitates accelerating emissions cuts to a significant extent, raising the possibility of sudden regulatory changes, increased compliance costs, and the risk of becoming an unproductive asset for companies and countries that are reluctant to move.

- Approximately half of the assets owned by the world’s largest tech companies are located in areas of severe water scarcity, indicating that even “low-carbon” industries face considerable physical climate risks.

- The range of differences between companies, from 23% to 71% of their assets in water-stressed areas, clearly indicates that environmental risk management is not only of low standard but also increasingly necessary for investment analysis when comparing companies.

Sustainable Banking Practices And Commitments

- Data indicate that sustainability has become a major component of modern banking strategy; however, its overall development remains at different stages.

- A significant long-term commitment is evident: 85% of the largest banks are committed to net-zero emissions by 2050, and among banking CEOs, 68% consider climate risk management a key strategy.

- Confidence in the strategic focus is bolstered by the finding that 91% of banking executives believe that integrating sustainability into core operations is essential for future growth.

- 77% predict sustainability will be a major factor in profitability over the next decade.

- The operational integration of ESG is developing, with 60% of banks using ESG criteria in their risk management processes.

- 72% conduct environmental risk monitoring across their entire portfolios.

- Still, only 10% of banking assets have been evaluated using full climate risk models, indicating a gap between high-level commitments and detailed execution.

- Instead of addressing the issue by establishing 30% of banks with their own sustainability departments and 55% with internal training programs on climate and sustainability,

- 58% engage in climate-related scenario planning as part of the big-picture approach, whereas others opt for a one-size-fits-all solution.

- Banks have made over US$2 trillion in commitments to sustainable finance since 2019, and lending to clean energy projects has increased by 160% over the past five years.

- The share of socially responsible investment (SRI) in bank portfolios was estimated at approximately 25% in 2023, whereas about 50% of banks report plans to reduce financing of fossil fuels, and 65% expect to stop doing so altogether by 2030.

- The situation regarding transparency and accountability is improving as well, as 90% of the largest banks disclose their sustainability reports annually and 83% make their environmental disclosures more comprehensive.

- Together, these trends show a banking sector moving decisively toward sustainability, though deeper and more consistent risk assessment remains a key challenge.

Banks’ Dominance And Strategic Evolution In Sustainable Debt Issuance

(Reference: tdsecurities.com)

- The financial sector is primarily where banks issue sustainable debt; they account for 56% of total activity, which is only a segment of the sector.

- The rest, like the financial services (16%), consumer finance (11%), commercial finance (9%), and diversified banks (6%), only account for smaller portions.

- The insurance-related categories combined also have a marginal share. Thus, this partition gives an overview of the extent to which sustainable finance issuance is concentrated among banks compared to other financial institutions.

- Nonetheless, the 6% decline in sustainable debt issuance across the financial sector is primarily due to the 19% drop in bank-led activities.

- This deceleration reflects tough market conditions, high interest rates, and more cautious issuance strategies, rather than banks abandoning their commitments to sustainability.

- Banks still consider sustainable finance an important strategy, particularly given changes in regulatory frameworks.

- The requirement to disclose Green Asset Ratios under EU regulations is making climate-related financing even more important within banks’ balance sheets.

- The disclosure obligations are compelling banks to maintain, measure, and expand their sustainable lending and investment activities even during periods of low issuance.

- In the near future, banks will seek to expand sustainable finance beyond traditional green bonds.

- Financial institutions are gradually adopting new instruments, such as sustainability-linked loan bonds (SLLBs), green repos, and sustainable deposit products.

- The diversity of products indicates that, although short-term issuance volumes may vary, banks’ commitment to long-term sustainable finance targets and the innovation of climate-aligned financial solutions will remain strong.

Conclusion

Sustainable Finance and Impact Investing via Banks Statistics: In 2025, banks’ sustainable finance and impact investing through them are at a major maturity stage. Market volatility and political shifts have led to a short-term slowdown in fundraising and debt issuance, but commitment to ESG remains strong and deeply embedded in banking strategies and investment decision-making.

Banks are the powerhouse of sustainable finance flows, supported by regulatory pressure, long-term net-zero commitments, and recognition of climate and social risks as financial risks. The major challenge is to bridge the gap between ambition and execution while the global risk landscape is changing and momentum is building.