Introduction

Youth and Student Banking Behaviour Statistics: Youth and student banking behaviour is changing rapidly as the world becomes increasingly technologically advanced. Phones and social media influence how they handle money, and many now expect services to be fast and simple. Statistics on youth banking help show how they get money, spend it, save it, borrow it, and pick banks or apps. Many start using digital services earlier than older generations and usually prefer online or mobile banking. Statistics on bank accounts, debit and credit cards, online payments, budgeting, and loan use also indicate some problems.

These include limited financial literacy, unequal income distribution, and a higher risk of overspending or falling victim to scams. Banks, colleges, governments, and fintech companies can use this information to develop safer products, better financial education, and fairer access to credit. This article shares the main trends that shape student money management today.

Editor’s Choice

- According to savethestudent.org, Banco Santander S.A. remains the most-used bank among the students we surveyed, but its share declined to 18%, down from 21% in 2024.

- A report from Wooclap further states that total student loan debt in the United States is USD 1.81 trillion.

- From 2020 to 2025, the number of federal student loan borrowers declined from 48.6 million to 45.8 million.

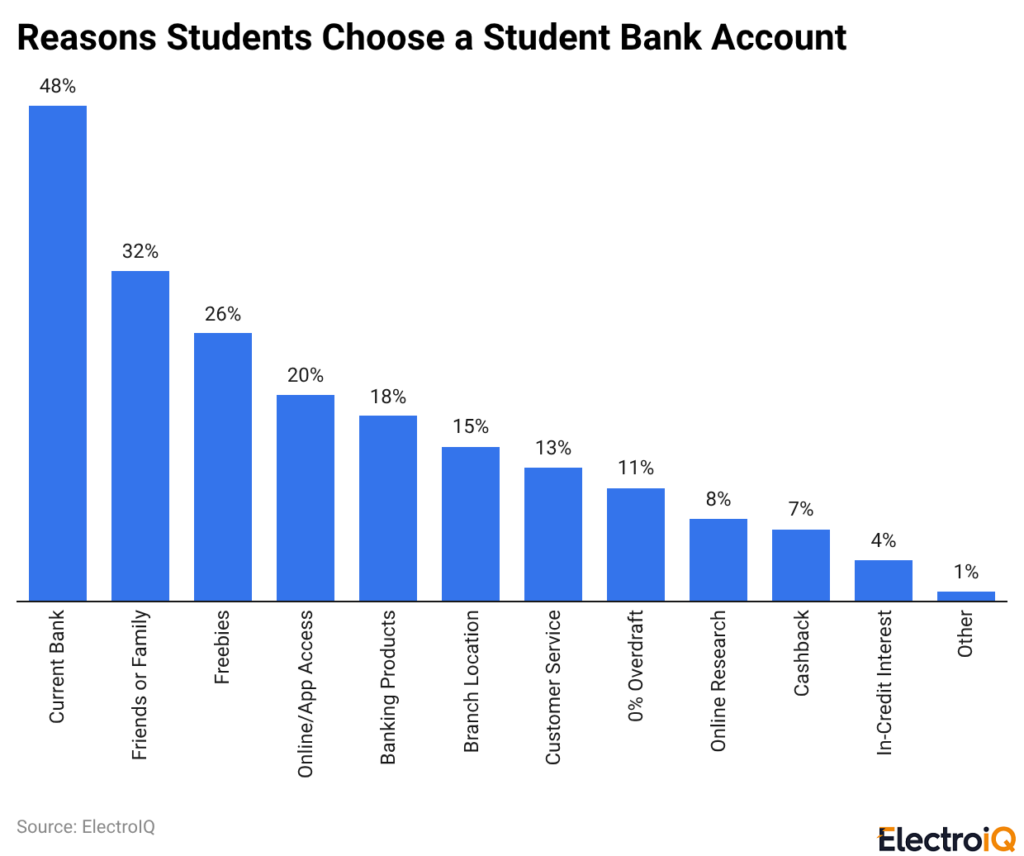

- In the Student Banking Survey 2025, the top reason students selected their current bank was that it was their current bank (48%), while around 32% of friends or family use it.

- As of 2025, students most often research bank accounts on money-advice sites (60%), followed by the bank itself (53%) and parents (43%).

- Savethestudent.org reports that Santander, with 18%, is the most popular bank among students.

- 63% of students hold an account with a bank, building society, post office, or credit union, and 62% have a payment or debit card.

- In September 2025, borrowers aged 24 and younger totalled about 6 million.

- In the 2025 federal student loan portfolio chart, California ranks first with USD 154.5 billion in student debt.

- According to cuinsight.com, interest in chore and allowance apps is rising fast, with searches up 65% year over year.

- A Forbes report also states that Gen Z contributed to a significant sales spike in the 2024 holiday season, particularly through buy now, pay later (BNPL).

- Meanwhile, 62% reported not having received formal financial education, whereas only 38% reported having received it.

Student Banking Analyses

- According to savethestudent.org, Banco Santander S.A. remains the most-used bank among the students we surveyed, but its share declined to 18%, down from 21% in 2024.

- In the 2025 ratings, NatWest and RBS ranked highest, scoring 4.34 and 4.32 out of 5, while the overall average across banks was 4.04.

- Only 15% of students report wanting to switch banks.

- Among those with overdrafts, 27% have exceeded their agreed limit at least once.

- Approximately 27% use buy now, pay later services sometimes, including 6% who use them often.

- 23% have a Lifetime ISA (LISA), yet 22% are unaware of what a LISA is.

- Also, 54% use cash once a month or less.

Key Facts On U.S. Student Loan Debt Statistics

- A report from Wooclap further states that total student loan debt in the United States is USD 1.81 trillion.

- Private loans account for 8.02% (USD 144.86 billion), whereas federal loans account for 91.98% (USD 1.67 trillion).

- On average, each borrower owes around USD 37,400.

- Women hold 63.6% of all student loan debt, compared with 36.4% held by men, primarily because parents of male students are more likely to borrow on their behalf.

- Millennials are the largest group, with 14 million borrowers, but Generation X has the largest total outstanding balance, at nearly USD 600 billion.

- California has the most debt (USD 154.5 billion), and Wyoming has the least (USD 1.7 billion).

- The U.S. has the highest student debt worldwide, followed by the UK, which has surpassed £200 billion in total student debt.

Federal Student Loan Debt Sizes Analyses

(Source: wooclap.com)

- From 2020 to 2025, the number of federal student loan borrowers declined from 48.6 million to 45.8 million, but total debt still increased by 10%, from USD 1.56 trillion to USD 1.67 trillion.

- Average debt per borrower also increased by 11%, from USD 33,600 in 2020 to USD 37,400 in 2025.

- Debt-shifting trend in 2020: 35% of borrowers owed USD 5k-USD 20k, and 6.7% owed USD 100k; by 2025, 31% owed USD 5k-USD 20k, while 8.1% owed USD 100k.

- The largest group of borrowers still owed USD 10k-USD 40k, making up 42% of all borrowers.

- Within the USD 100k debt group, the share grew from 6.7% of borrowers holding 36.1% of total debt to 8.1% of borrowers holding 40.9% of total debt.

- The sharpest warning sign was the increase in borrowers by more than USD 200k, up nearly 40% in five years.

Reasons Students Choose A Student Bank Account

(Reference: savethestudent.org)

- In the Student Banking Survey 2025, the top reason students selected their current bank was that it was their current bank (48%), while around 32% of friends or family use it.

- Followed by freebies (26%), online/app access (20%), banking products (18%), branch location (15%), customer service (13%), 0% overdraft (11%), online research (8%), cashback (7%), in-credit interest (4%), and others (1%).

Student Bank Account Research Sources Statistics

- As of 2025, students most often research bank accounts on money-advice sites (60%), followed by the bank itself (53%) and parents (43%).

Furthermore, other research sources are stated in the table below:

| Source | Student Share |

| Friends | 26% |

| University/SU | 9% |

| 9% | |

| 6% | |

| TikTok | 6% |

| YouTube | 5% |

| School | 4% |

| 2% | |

| Other | 2% |

Most Popular Banks Among Students

- Savethestudent.org reports that Santander, with 18%, is the most popular bank among students.

- Followed by HSBC (14%), Nationwide (13%), NatWest (11%), Lloyds (11%), Barclays (11%), Halifax (6%), TSB (2%), RBS (2%), Co-op (1%), and BoS (1%).

- The remaining share comprises other banks accounted for 10%.

Students’ Use Of Financial Services

(Source: oecd.org)

- 63% of students hold an account with a bank, building society, post office, or credit union, and 62% have a payment or debit card.

- In the previous 12 months, 66% made a payment using a mobile phone, and 86% bought something online (either alone or with a family member).

Student Loan Debt Statistics By Age

- In September 2025, borrowers aged 24 and younger totalled about 6 million, according to wooclap.com.

- Meanwhile, the total outstanding balance accounted for USD 90 billion, averaging approximately USD 15,000 per borrower.

| Age group (Year) | Borrowers | Total outstanding balance (USD billion) | Average debt per borrower (USD) |

| 25-34 | 14 million | 476 | 34,000 |

| 35-49 | 12 million | 586 | 48,000 |

| 50-61 | 5 million | 247 | 49,000 |

| 62 and older | 1.9 million | 98 | 51,000 |

| Gen X | – | 600 | 48,000 |

| Baby Boomers | – | 150-180 | 50,000+ |

| Gen Z | – | 90 | 15,000 |

By State

- In the 2025 federal student loan portfolio chart, California ranks first with USD 154.5 billion in student debt, while Michigan ranks tenth, and Wyoming has the smallest balance at USD 1.7 billion.

| Metrics | Valuation |

| Next highest totals | USD 134.7 billion (Texas); USD 110.5 billion (Florida) |

| Highest borrower counts | 3.9 million (California); 3.8 million (Texas); 2.7 million (Florida); 2.4 million (New York) |

| Smallest borrower counts | 54,800 (Wyoming); 75,200 (Vermont); 65,800 (Alaska) |

| Highest average debt per borrower | USD 56,083 (Washington, D.C.) |

| Lowest average debt per borrower | USD 29,545 (North Dakota) |

Highest and Lowest Student Loan Debt Statistics by Degree Level

| Degree level | Highest-debt field | Lowest-debt field |

| Doctorate | Pharmacy and Pharmaceutical Sciences (USD 310,330) | Area Studies (USD 29,644) |

| Professional | Osteopathic Medicine and Osteopathy (USD 287,817) | Theological and Ministerial Studies (USD 46,796) |

| Master’s | Advanced Dentistry and Oral Sciences (USD 158,155) | Romance Languages (USD 13,664) |

| Bachelor’s | Behavioural Sciences (USD 42,822) | Science Technologies/Technicians (USD 9,529) |

| Associate’s | Alternative and Complementary Medicine (USD 38,533) | Biological and Physical Sciences (USD 7,591) |

Minimum Age And ID Needed To Open Youth/Student Bank Accounts Statistics

- According to sftreasurer.org, Bank of America’s Advantage SafeBalance account can be opened at age 16.

- For identification, it accepts a student ID, a work ID, a debit card, or a credit card as primary identification and is Bank On SF-certified.

| Financial institution | Product | Minimum age | Primary ID accepted | Secondary ID accepted | Key details |

| JPMorgan Chase | College Checking | 17 | Birth certificate (minors only), driver’s license, Social Security card (minors/disabled), tribal ID, armed forces ID | Bank statement, debit card, work ID, pay stub/letter from employer, student ID, utility bill | For college, vocational, technical, or trade students |

| Wells Fargo | Clear Access Banking | 17 | Tribal ID, armed forces ID, permanent resident card, employment authorisation | Student ID, work ID, credit card | Bank On SF certified |

| Excite Credit Union | Jump Start Checking and Savings | 13 | Photo ID or school ID | Birth certificate, proof of address | Through select nonprofit partnerships, open in person or by PDF application. |

| San Francisco Federal Credit Union | Membership Savings and Basic Checking | 13 | School ID | Youth Intern ID | For Summer Jobs Connect participants, open in person or by PDF application |

| Golden1 Credit Union | Student Checking Account | 16 | Other governmental ID | School ID | Bank On SF is certified for high school, college, university, or trade students. |

Youth Bank Account Trends

- According to cuinsight.com, interest in chore and allowance apps is rising fast, with searches up 65% year over year.

- Many families use technology for money lessons: 64% of millennial parents report actively using digital tools to build their children’s financial skills.

- Following the pandemic, children’s offline time with friends increased by 12%, while weekly screen time decreased by an average of 6%.

- As of 2024, approximately 86% of parents are concerned about apps collecting excessive data on children.

- 91% trust products more when they prioritise security and transparency.

- 72% think schools should help teach about money, and 95% of children stay loyal to brands that provide good early experiences.

Gen Z Pushes Banks To Upgrade Digital Services

- A Forbes report also states that Gen Z contributed to a significant sales spike in the 2024 holiday season, particularly through buy now, pay later (BNPL).

- The U.S.’s gross merchandise value at USD 0.9 billion over the Black Friday-Cyber Monday weekend.

- A survey of 60% of U.S. banks found that nearly 1/3 of Gen Z report that their bank is not meeting service expectations.

- Banks are urged to improve digital tools in 2025 to win Gen Z’s loyalty, as reports suggest they are getting wealthier faster than older generations.

- Around 35% of Gen Z planned to increase holiday budgets.

- Afterwards, BNPL accounted for USD 18.2 billion in online holiday spending, up 9.6% year over year.

- As of Q4 2024, only 15% of Gen Z use BNPL “regularly,” compared with 9.9% of U.S. adults aged 18 years and older.

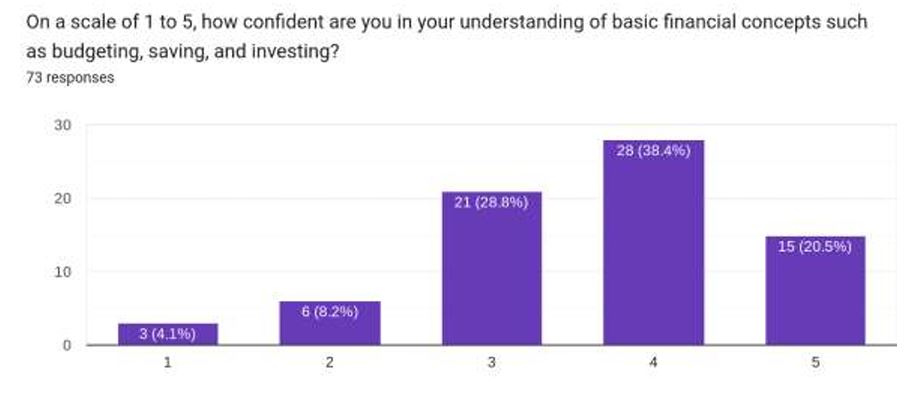

Key Findings On Financial Confidence, Education, And Spending Tracking

(Source: ijfmr.com)

- The ijfmr.com report further states that, among 73 survey responses, 3 people (4.1%) selected a confidence level of 1, and 6 people (8.2%) selected 2.

- The largest groups were in the middle-to-high range: 21 respondents (28.8%) rated themselves 3, 28 respondents (38.4%) chose 4, and 15 respondents (20.5%) picked the highest score of 5 for understanding budgeting, saving, and investing.

- Meanwhile, 62% reported not having received formal financial education, whereas only 38% reported having received it.

- When it comes to tracking spending, the most common habit is checking expenses monthly (33%).

- Some do it more frequently: 20% track weekly and 13% track daily.

- Others are less consistent: 24% track their expenses only occasionally, and 9% never track them.

Conclusion

Young people and students manage money mainly on their phones via various online applications. Nowadays, as they are making numerous transactions regularly, and expect banking services to be faster, simpler, and more honest. In recent years, UPI, cards, and instant app alerts have become the norm, and branch visits are made only when necessary. Besides, many others choose person-to-person banking services that offer spending trackers, rewards, and small, safe credit.

The article concludes with several statistical analyses that elaborate on banking behaviour among the young generation, and on building trust by providing robust security, teaching financial skills early, and offering flexible products that meet evolving needs.